Oil market outlook: What Trump or Biden presidency means for Nigeria

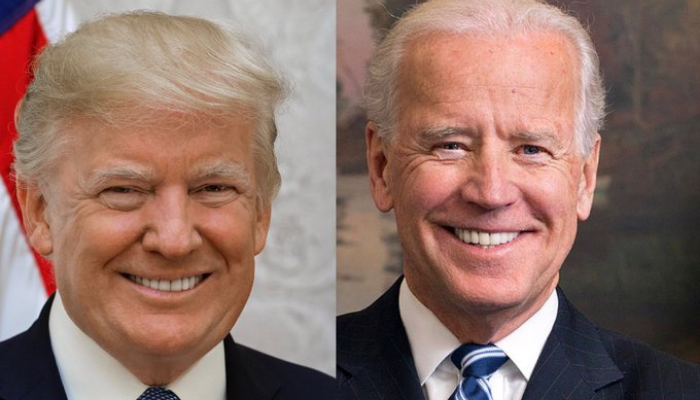

Whether it’s the Republican candidate Donald Trump or Democratic candidate Joe Biden, the winner of the forthcoming United States presidential elections in November would play a big role in influencing the global oil market which Nigeria is still heavily reliant on.

Events from the White House have increasingly had an influence on oil supply, demand, and prices, especially after higher oil prices helped boost President Jimmy Carter’s chances at a second term in 1980.

In effect, the next four years of US oil policy could shape supply/demand dynamics domestically and abroad, with implications for shale, sanctions, trade relations with China, and the Organisation of Petroleum Exporting Countries (OPEC) relations.

President Trump’s tight enforcement of sanctions against Iran and Venezuela has seen their oil exports fall by a combined 3 million bpd. Issues around both OPEC producers would be among the top concerns for the next US president.

And a petro-dollar economy like Nigeria had better take note.

“We do see Biden being a bearish signal to the oil markets because we see a greater likelihood of the return of Iraqi oil, maybe some Venezuelan oil – it can’t get any lower,” said Chris Midgley, Platts global head of analytics.

“And of course, US shale, although it will continue to struggle based on the current economics, I don’t think it will be his first priority to focus on,” Midgley said.

Iran’s oil supply

The next US president’s approach to Iran could have the biggest global supply impact if up to 2 million bpd of Iranian oil returns, either through Biden re-joining the nuclear deal or unpredictable direct talks by President Trump.

Rapidan Energy Group predicts 1.8 million bpd of Iranian exports could return by end-2021 under a Biden White House, a year earlier than under Trump negotiating scenarios.

“Saudi Arabia and Russia would be unlikely to make disproportionate cuts to make way for 1 million-2 million bpd from Iran, which could accelerate the next shift back to a market-share strategy,” Platts Analytics said.

Venezuela’s sanctions

On Venezuelan sanctions, Democratic candidate Joe Biden is seen as more likely to grant relief on humanitarian grounds, while Republican candidate Trump might be more willing to meet directly with President Nicolas Maduro.

President Maduro’s victory in the 2018 Venezuelan presidential election led to oil sanctions from President Trump, a development which had a positive effect on the oil price.

Any easing of restrictions on Venezuela’s state-owned PDVSA would potentially increase the country’s export to 500,000 bpd and return to 2019 levels, but the country’s oil sector would remain hobbled without a change in government, debt relief, and foreign investment.

OPEC

After taking credit for helping to negotiate an end to the oil price war between Saudi Arabia and Russia earlier in March this year, President Trump would likely continue practicing Twitter oil diplomacy, which he started in his first term, to urge OPEC+ producers to increase or cut supply during their meetings in Vienna.

During Trump’s current term in office, there have been situations where the US president would protest the rise of oil prices above $70-$80 because of how it’s increased gasoline prices for his citizens which are his priority.

Trump also uses his influence as the world leader to reduce OPEC supply while still maintaining his country’s supply in the market.

Under Biden, any US diplomacy toward OPEC might return behind the scenes, just like under former President Barack Obama, while any antitrust legislation against OPEC would only see renewed interest if gasoline prices soar, which is not expected through 2021.

US-China trade war

President Trump’s recent warning on raising taxes on Chinese goods as “certainly an option” to retaliate for the spread of the novel coronavirus out of China has led to fears of trade tensions, which could hit economic recovery, thereby putting a cap on gains in oil prices.

Under Trump, tensions with Beijing have flared to the point that some analysts expect a decoupling of US-China ties, which could have massive trade impacts.

The two world superpowers account for about 34 percent of the global crude oil.

For most experts, Biden is expected to tone down the rhetoric against China. Analysts do not expect any major warming of ties that could lead to revived trade.

US crude exports to China jumped to 1.5 million bpd in May, a record high, after languishing for nearly two years. China imported 906,000 bpd in June, according to the Energy Information Administration.

Implications for Nigeria

For most experts, a Joe Biden presidency might alleviate the political tensions between the US and China which might see China buy oil elsewhere, including Nigeria’s Bonny light, while a return of President Trump means a world of shale oil.

Also, a world less of shale oil signifies higher oil prices for Africa’s biggest oil-producing country and other petro-dollar economies. This would lead to an improvement in Nigeria’s economy as the country relies on crude oil for over 90 percent of foreign exchange and two-thirds of government revenue.

The World Bank has already estimated that Nigeria will lose up to 70 percent of its earnings from crude oil sales in 2020 due to the devastating impact of Covid-19.

(BusinessDay)