Business

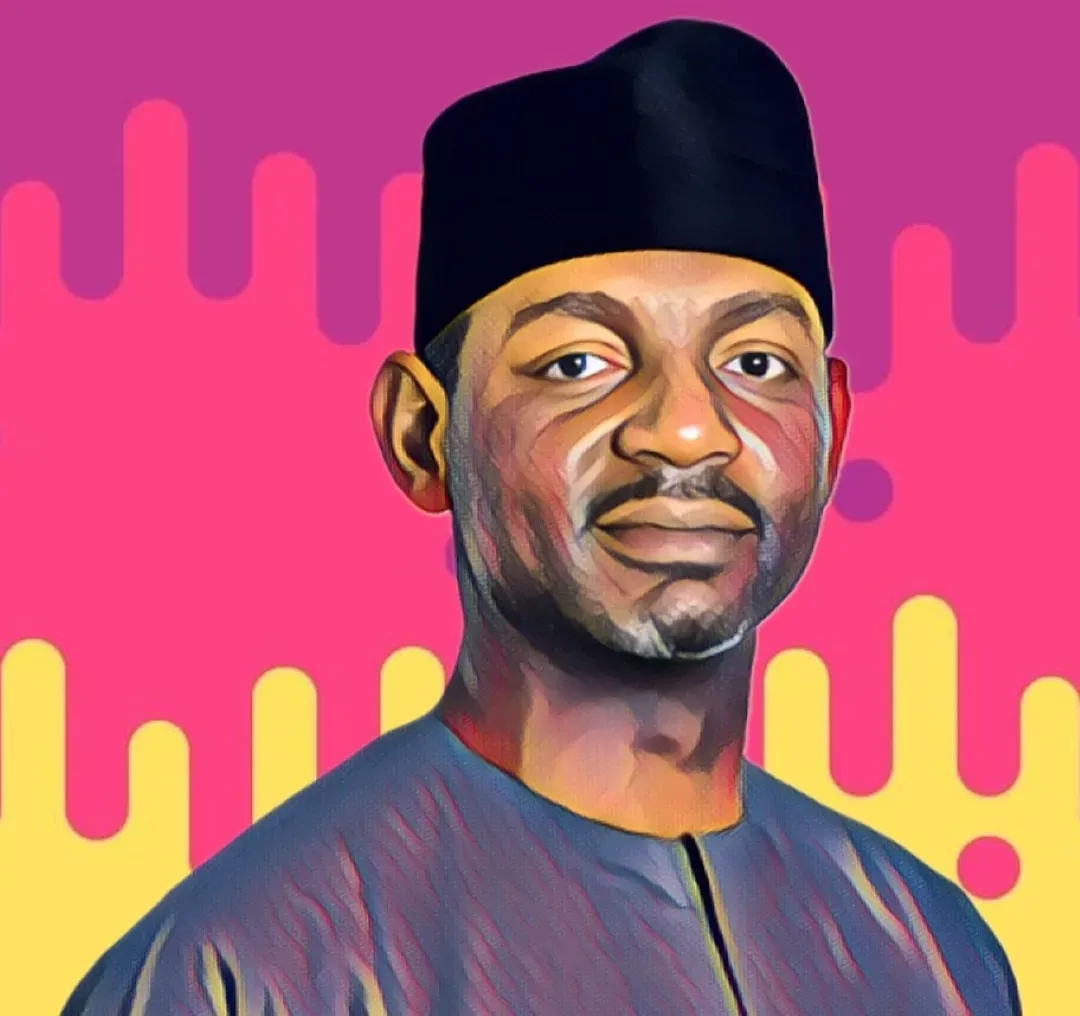

Nigerian billionaire Sayyu Dantata emerges as biggest winner from Dangote Refinery’s fuel boom

Sayyu Dantata, the soft-spoken half-brother of Africa’s richest man, Aliko Dangote, has stepped out of the shadows to become Nigeria’s most dominant private fuel distributor. Through his company MRS Holdings, Dantata has built a network of more than 800 retail outlets, surpassing rivals and positioning himself as the single largest downstream beneficiary of the $20-billion Dangote Petroleum Refinery.

Industry executives say Dantata’s rise has transformed the balance of power in Nigeria’s downstream sector. For decades, the state-owned Nigerian National Petroleum Company (NNPC) controlled both supply and pricing. But since the Dangote refinery began producing petrol in September last year, MRS has leveraged its retail reach — and its long relationship with Dangote — to capture a bigger slice of the market than any private competitor.

Building a fuel empire from humble transport roots

Dantata’s career began far from the boardrooms of today’s oil giants. A former director at Dangote Transport, he set up MRS in 1995 as a modest haulage business moving petroleum products to end-users. The company gained prominence in 2008 when it bought Chevron’s downstream business in West Africa, expanding into Nigeria, Cameroon, Benin, Togo and Côte d’Ivoire.

That acquisition turned MRS into a major player, but its biggest break came in 2023, when it became the first marketing company to strike a formal partnership with the Dangote Refinery. The alliance guaranteed MRS a steady supply of fuel at competitive rates and, in return, helped Dangote ensure that price cuts at the refinery’s gates reached consumers at the pump.

MRS has since grown its footprint rapidly. According to company data, it had 140 company-owned stations and 264 dealer-operated outlets at the end of 2023, up from 81 and 97 a year earlier. By mid-2025, industry sources say, that figure had surpassed 800 outlets, thanks to a wave of franchising and investment in retail networks.

Dangote alliance triggers price war and reshapes market

The partnership coincided with the start of a fierce price war in Nigeria’s fuel market. As Dangote and NNPC jostled for control of supply, other marketers — including Ardova, Heyden Petroleum, Optima Energy, Techno Oil and Hyde — signed bulk purchase agreements with the refinery.

MRS, as Dangote’s earliest and most entrenched partner, quickly emerged as a major beneficiary. Its share of retail sales grew sharply, with some industry veterans speculating that at times it has sold more petrol than the NNPC.

The alliance extends beyond fuel supply. When Dangote launched his fleet of CNG-powered trucks to cut transport costs and improve distribution efficiency, MRS acted as the logistics partner, deploying its licences and nationwide network to move products.

“Dangote doesn’t hold a licence to truck petroleum products,” one industry insider said. “MRS does — which effectively makes it the distribution arm of the refinery.”

Positioned for downstream dominance amid changing rules

The growth of MRS highlights a broader shift in Nigeria’s energy sector since the Petroleum Industry Act of 2021 separated the upstream, midstream and downstream segments. While Dangote has stressed he does not plan to go into retail — saying he could have bought former Mobil, Forte Oil or Oando stations but chose not to — his remarks hint at the tensions surrounding his refinery’s growing sway.

For Dantata, who has represented Dangote in several high-level meetings with the government, marketers and unions, the transformation of MRS from a regional transporter into the refinery’s primary retail partner marks a personal milestone.

“MRS is essentially the downstream face of Dangote,” said Lagos-based oil analyst Ademola Adigun in a recent conversation with The Africa Report. “They’ve become indispensable in getting refinery-produced fuel to the end user.”

The company’s CEO, Patrice Alberti, wrote in the 2024 annual report that the refinery alliance and market expansion strategy had “helped bridge supply gaps, reduce reliance on imports, and ensure competitive pricing.”

Industry observers say MRS’s position could strengthen further as more imported fuel is replaced by locally refined products. With NNPC’s equity in the refinery reduced to 7.25% from 20% last year, Dantata’s company now stands as the refinery’s most important private-sector partner.

As Nigeria’s fuel market undergoes its biggest shake-up in decades, the low-profile entrepreneur from Kano is emerging as the quiet counterweight to both the state-run giant and his more famous billionaire half-brother — and perhaps the clearest symbol of the country’s shifting energy landscape.(Billionaires Africa)

-

Metro16 hours ago

Metro16 hours agoKidnappers threaten Edo victims over N40m ransom

-

News16 hours ago

News16 hours ago$9m lobbying deal: SANs, bishop urge probe

-

Metro17 hours ago

Metro17 hours agoRoyal Rumble: Alaafin weighs litigation over Oyo council leadership

-

Politics15 hours ago

Politics15 hours agoRemoving Tinubu in 2027 only way to reclaim Nigeria – ADC

-

News17 hours ago

News17 hours agoNigerians sleep in waste bins amid UK deportation threat

-

Social Media News16 hours ago

Social Media News16 hours ago‘God called him, Flavour recalled him’ – Fans react to Odumeje’s new video

-

News17 hours ago

News17 hours agoPolice Rescue 7 Kidnap Victims, Arrest 12 Suspects In Nasarawa

-

Metro17 hours ago

Metro17 hours agoTwo Nigerians kill friend over woman in India