Business

Nigeria’s bank chiefs: Big salaries, luxury homes, but tiny stakes

When Roosevelt Ogbonna, chief executive of Access Bank, reportedly bought a $20 million home in London, it raised eyebrows — not for the purchase itself, but because the market value of his personal stake in Access Holdings, the listed parent of the bank, is less than the price of the house.

That contrast has reignited debate about whether Nigeria’s bank chiefs have enough “skin in the game” — the personal financial stake that ties their fortunes to the shareholders they serve.

In developed markets, from Wall Street to Hong Kong, it is not uncommon for a big-bank CEO to have tens or hundreds of millions of dollars in their own institution’s stock.

In Nigeria, by comparison, the numbers look modest.

What Nigeria’s top bank CEOs’ stakes look like

A review of 2024 annual reports, updated with 2025 insider purchases and valued at today’s NGX closing prices (2 Oct 2025), shows the following:

| # | Bank | CEO | Shares owned | Value at today’s price (USD) | % of bank owned |

|---|---|---|---|---|---|

| 1 | Zenith Bank | Adaora Umeoji | 160,460,000 | $7.5 million | 0.39% |

| 2 | UBA | Oliver Alawuba | 124,322,930 | $3.6 million | 0.36% |

| 3 | Sterling Financial Holdings | Abubakar Suleiman | 599,984,442 | $3.14 million | 1.15% |

| 4 | Access Holdings | Roosevelt Ogbonna | 158,494,589 | $2.78 million | 0.30% |

| 5 | GTCO | Segun Agbaje | 32,146,651 | $2.05 million | 0.68% |

| 6 | Fidelity Bank | Nneka Onyeali-Ikpe | 94,644,260 | $1.3 million | 0.19% |

| 7 | First HoldCo | Wale Oyedeji | 34,847 | $0.0007 million | 0.00008% |

A signal investors watch closely

To many institutional investors, a CEO’s personal stake is a gauge of alignment: the bigger it is, the more the boss gains and suffers with ordinary shareholders.

In countries such as the US, Britain or South Africa, it is common to see CEOs retain or build holdings worth tens or even hundreds of millions of dollars — even when they receive large cash pay.

In Nigeria, by contrast, most bank chiefs still hold shares worth just a few million dollars — often less than a year’s bonus or, as in Ogbonna’s case, less than the cost of a personal real-estate acquisition.

Some analysts say the gap reflects the sector’s history: many Nigerian banks were recapitalised or restructured over the past two decades; today’s leaders often inherited rather than founded their institutions and have had only a few years to accumulate stock.

Others argue it reveals a cultural tilt toward property over equity and the limited long-term stock-based pay in Nigerian banking.

Why the gap matters

As the Central Bank of Nigeria pushes a fresh recapitalisation drive, boards and investors will be watching whether more insiders increase their holdings.

Some — notably Umeoji at Zenith and Alawuba at UBA — have bought shares on the open market this year, which market watchers see as a confidence signal.

Still, the overall picture contrasts sharply with global norms.

Where a Wall Street bank chief may have hundreds of millions of dollars of personal stock at risk, Nigeria’s bank bosses mostly hold less than $10 million — in some cases less than the value of a single overseas property.

For now, the gulf between the price of a London mansion and the size of a Nigerian CEO’s personal stake in their bank stands as a vivid symbol of how far executive ownership traditions in the sector still have to go. (Billionaires Africa)

-

News3 hours ago

News3 hours agoDIG Mba, others retire, seven AIGs for promotion

-

News3 hours ago

News3 hours agoBorno: Hundreds still missing after Boko Haram attack

-

News3 hours ago

News3 hours agoDetention: El-Rufai Petitions ICPC, Demands N15.6bn Damages

-

World News22 hours ago

World News22 hours agoHow Iran Strikes Have Damaged US Military Sites – CNN

-

Politics3 hours ago

Politics3 hours agoTinubu Elevates Masari To Special Adviser

-

Sports3 hours ago

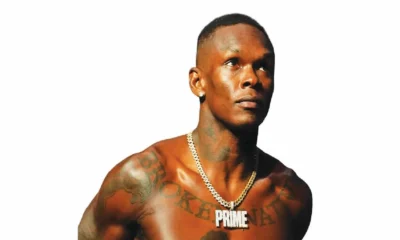

Sports3 hours agoAdesanya demands $15m per fight from UFC boss White

-

Politics4 hours ago

Politics4 hours agoWe Will Adopt Tinubu As 2027 Presidential Candidate – APGA

-

Business3 hours ago

Business3 hours agoMiddle East Crisis: We’ll Ensure There Is No Fuel Scarcity In Nigeria, Says Dangote Refinery