Business

Capital Gains Tax on equities triggers investor panic, capital flight fears

Nigeria’s capital market is in turmoil following fresh concerns over the impending 25% Capital Gains Tax (CGT) on share disposals set to take effect in January 2026.

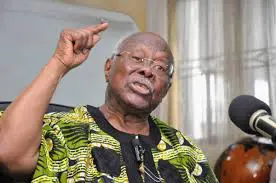

The anxiety stems from new clarifications made by Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, during an engagement organized by the Nigerian Exchange Group (NGX) last month.

Oyedele explained that under the new rule, investors who sell shares and reinvest the proceeds in fixed-income securities or other non-equity assets will be subject to a 25% CGT.

He, however, noted that retail investors will largely be unaffected, as the N150 million annual exemption threshold effectively shields 99.9% of individual players.

“Only very few big investors cross that threshold, mostly institutional players or high-net-worth individuals,” Oyedele said.

Market fears and potential capital flight

Despite the exemption, capital market operators warn that the new tax could disrupt investor sentiment, especially among foreign portfolio investors who have recently shown renewed interest in Nigerian equities.

One market operator, who spoke on condition of anonymity, described the policy as “poorly conceived,” warning that its ambiguities, retroactive computation, and steep rate could deter capital inflows and raise the cost of equity at a critical time when Nigeria is just beginning to recover investor confidence.

- “Its ambiguities, retroactivity, high rates, and exposure to foreign investors could deter capital flows, increase the cost of equity, and ultimately stall the investment cycle just as Nigeria tries to pivot from stability to growth,” the operator said.

The expert added that with clearer rules, moderate rates, and cost-basis adjustments, the tax could still be implemented in a way that supports rather than undermines market growth.

Other analysts say the problem runs deeper and lacks fairness.

Under the current design, capital gains are calculated based on historic cost, not adjusted for inflation or currency depreciation.

“That means investors could be taxed on gains made years before the law even existed,” one analyst explained.

- “South Africa in 2001 and India in 2018 both avoided this trap by resetting the cost basis to the market value at the time of implementation, ensuring only future gains were taxed. Nigeria should do the same.”

This approach, they warn, could lead to double taxation and inflated liabilities, especially in an inflationary environment where the naira’s depreciation distorts real gains.

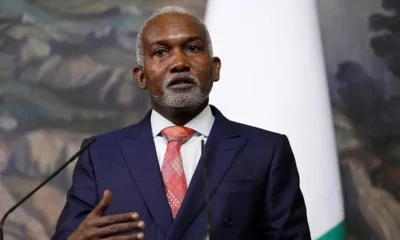

Echoing similar sentiments, Otunba Adetunji Oyebanji, CEO of 11 Plc, described the new regime, which also raises corporate CGT to 30% as potentially punitive for businesses.

- “We are concerned that the economy is now more sensitive to high capital investments because some of the reliefs that existed before are going to be removed,” Oyebanji said, urging the government to engage stakeholders and introduce a transition period to prevent market shocks.

He noted that the combination of higher rates and stricter reporting rules could impose heavy burdens on smaller enterprises while discouraging large-scale investments.

Concerns over capital gains tax on equities are not new.

In 2023, while the proposal was still being debated, Sam Onukwue, Chairman of the Association of Securities Dealing Houses of Nigeria (ASHON), told Nairametrics that the reintroduction of CGT risked stifling the market.

- “Rather than stifling the market with the re-introduction of CGT,” he said, “the government should focus on reversing the waning interest of foreign portfolio investors and attracting FDI by creating a tax-friendly environment.”

Ironically, Taiwo Oyedele, now one of the tax’s chief defenders, once shared similar reservations.

In a 2022 presentation at an RCCG event, he warned that the 10% CGT introduced under the Finance Act could discourage capital market investment, especially given the concurrent expiration of tax exemptions on corporate bonds.

- “The tax may discourage investment in the capital market,” he said at the time, “given the expiration of tax exemption on corporate bonds.”

Market performance and what’s at stake

The timing of the controversy is delicate, with the All-Share Index up 38% year-to-date as of September 2025. This extends a five-year streak of annual gains, the longest since the 2000–2008 boom cycle.

Analysts fear that sudden policy shifts such as the CGT rule could reverse these gains, triggering capital flight and eroding confidence just as Nigeria seeks to attract long-term foreign investment.

While the Federal Government aims to broaden its tax base and curb speculative capital movement, market stakeholders warn that poor design and abrupt implementation could deliver the opposite effect.

They opine that it can reduce liquidity, discouraging participation, and undermining Nigeria’s reputation as a reform-driven investment destination.

As one analyst summed it up:

- “Tax reforms should promote growth, not punish it. Without clarity, fairness, and engagement, this 25% CGT could become a self-inflicted wound.”

(Nairametrics)

-

World News12 hours ago

World News12 hours agoIran Confirms Supreme Leader’s Death As Attacks Continue

-

Politics12 hours ago

Politics12 hours agoNigerians Are Hungry, Will Shock You In 2027 – Bode George Tells APC

-

News12 hours ago

News12 hours agoFG Issues Advisory To Nigerians In Middle East

-

World News12 hours ago

World News12 hours agoAyatollah Ali Khamenei: The Leader Who Shaped Iran’s Defiance

-

Metro12 hours ago

Metro12 hours ago‘I won’t be bullied’ – Seyi Tinubu addresses VDM’s claim of secretly funding King Mitchy’s charity work

-

Opinion11 hours ago

Opinion11 hours agoReflections on FCT polls and voter apathy

-

News12 hours ago

News12 hours agoTinubu Renews Tenure Of Audi, NSCDC CG

-

News12 hours ago

News12 hours agoLassa Fever Kills 10 Health Workers In Benue