Business

A year in the life of the Nigerian naira

Nigeria’s currency has found a measure of stability over the past year after losing about 70% of its value against the dollar in two wrenching devaluations under President Bola Tinubu.

The calm rests on a mix of market reforms, aggressive monetary tightening and a modest improvement in hard-currency inflows.

Tinubu moved quickly after taking office on 29 May 2023, liberalising the foreign-exchange market.

Two step-downs – in June 2023 and January 2024 – left the naira among the world’s worst performers and deepened a cost-of-living crisis as inflation surged.

The currency fell as far as ₦1,900 to the dollar in the first quarter of 2024 from about ₦461/$1 in 2023, triggering large foreign exchange losses across sectors and eroding profits.

Since then, it has clawed back some ground. In the 12 months to 10 October 2025, the naira gained about 13% to close at ₦1,458/$1, Central Bank of Nigeria (CBN) data show.

Kunle Edun, head of research at Ecobank Nigeria, ties the turn to market plumbing: “Naira appreciation has been a journey.

“It started in December 2024 when the CBN introduced the BMatch system, which opened up the market for transparency and true pricing.”

Akpan Ekpo, a former member of the CBN’s Monetary Policy Committee, agrees that better price discovery and access have helped – though only to a point. “The stability is relative … the naira wobbled.”

Market fixes and monetary grip

From 2 December 2024, banks on the interbank foreign exchange market began using Bloomberg BMatch – adopted by the CBN as its Electronic Foreign Exchange Matching System (EFEMS) – to automate and transparently match trades.

The EFEMS, first rolled out in October 2024, formed part of a broader push to deepen liquidity.

In January 2025 the CBN launched a Nigerian foreign exchange code, drawing on the global foreign exchange code, to set common standards and curb abusive practices.

“The foreign exchange code brought discipline and improved liquidity,” says Edun.

“Once the market was comfortable with pricing, foreign portfolio investors came in droves into government securities.”

That was reinforced by tighter policy. The CBN lifted the monetary policy rate to 27.5% to lean against inflation, which peaked at 34.8% in December 2024.

“The entrance of portfolio investors has supported the currency to a large extent,” says Ayokunle Olubunmi, head of financial institutions ratings at Agusto & Co.

“The foreign exchange management strategy seems to be effective.”

Some argue the high policy rate is doing double duty. “If the CBN had cut the MPR the way we saw in Ghana and Kenya, the naira would likely be around ₦1,600–₦1,700,” says Edun.

The bank’s primary mandate, he notes, is price stability across inflation, interest and the exchange rate – and, by that yardstick, tight policy has helped.

Oil, reserves – and Dangote’s refinery

Hydrocarbon inflows have improved. Combined crude and condensate output rose to 1.71m barrels a day in July 2025 from 1.53m b/d, according to the upstream regulator, as efforts to curb pipeline vandalism and theft gained traction.

Higher receipts lifted foreign exchange reserves to $42.58bn on 10 October 2025 from $38.67bn a year earlier, the CBN says.

Stripping out an estimated $13bn of portfolio flows, reserves would still cover roughly seven months of imports, according to Ecobank.

Refined-product dynamics are shifting too. The Dangote refinery began producing petrol in September 2024, reducing dollar outlays for imports and, over time, nudging the trade balance.

Nigeria’s trade surplus rose to ₦7.46trn in Q2 2025 from ₦5.2trn in Q1, official statistics show.

Ekpo argues the refinery will also support manufactured exports.

Businesses exhale – cautiously

Currency steadiness has eased planning for companies hit hardest by the devaluations.

“Stability has been positive – businesses hate volatility,” says Olubunmi.

Firms are resuming expansion and those that booked heavy revaluation losses “are now breathing easier”.

Disinflation has helped. Despite a CPI rebasing in January that complicates year-on-year comparisons, headline inflation eased for a third consecutive month in August to 20.12%.

The CBN cut the MPR last month – its first reduction in five years – after the Monetary Policy Committee highlighted a more stable foreign exchange market and the need to support rapid disinflation.

GDP growth picked up to 4.23% in Q2 2025 from 3.48% a year earlier.

The road ahead

Risks remain. A sharp drop in oil prices, rising government spending and debt service could quickly sap foreign exchange buffers.

“If the government does not have a handle on the fiscal side – the expenditure side – there’ll be a problem,” says Ekpo.

“If you keep increasing the cost of governance and incurring more deficits, it will have an impact [on the exchange rate].”

Still, some policymakers are optimistic. In July, CBN deputy governor Bala Bello said the naira “is likely to keep appreciating” and could reach about ₦1,400/$1 before year-end, citing higher oil production, fresh capital inflows and an improved balance of payments.

To lock in gains, he argued, “fiscal discipline and deliberate effort to stimulate local productivity and employment are non-negotiable”.

Edun sees a year-end rate near ₦1,475/$1. “The fundamentals are quite supportive of an appreciating naira,” he says.

(The Africa Report)

-

Politics18 hours ago

Politics18 hours agoAtiku’s son resigns from Fintiri’s cabinet

-

News18 hours ago

News18 hours agoMajor, 3 Soldiers, Hunter Killed In Borno

-

News18 hours ago

News18 hours agoUmrah Suffers Setback As Airlines Suspend Flights To S/Arabia

-

News18 hours ago

News18 hours agoRevised Executive Order: FG adjusts oil revenue remittance framework

-

Politics18 hours ago

Politics18 hours agoDSS arrests social media user who ‘threatened’ Peter Obi after Edo attack

-

News18 hours ago

News18 hours agoPolice Council Confirms Disu As IG, To Be Sworn In Wednesday

-

Business18 hours ago

Business18 hours agoPrivate jet flight from Riyadh to Europe now cost N479m as elites flee Middle East tensions – Report

-

News18 hours ago

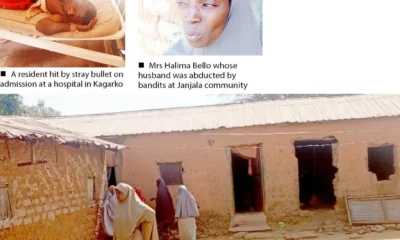

News18 hours agoVigilante, Wife, 12 Others Abducted In Kaduna