Business

Naira: Depreciation not necessarily bad — IMF

The International Monetary Fund (IMF) said, yesterday, that the depreciation of the Naira was not necessarily a bad thing.

The Financial Counsellor and Director of Monetary and Capital Markets of the Fund, Mr. Tobias Adrian, stated this while fielding questions at the Global Fiscal Sustainability Report press briefing at the ongoing Annual Meetings of the World Bank and the IMF in Washington DC, USA.

Asked what policy measures the Fund would advise the Nigerian to adopt to shore up the value of the Naira that has suffered a major devaluation in the last two years, the Director said, “In terms of the Nigerian economy, of course, you know exchange rates are important, are important buffers to adjust the domestic economy relative to shocks.

”So, you know, a depreciating exchange rate is not necessarily a bad thing. It may actually be a good thing to restore equilibrium.

“And we have indeed seen in Nigeria, you know, many steps to strengthen policy frameworks, such as on the monetary policy side. And you know, we generally do recommend moving towards more flexible exchange rates.

“And yeah, in addition to monetary policy actions, revenue collection has strengthened in Nigeria, and transparency in terms of FX reserve positions have improved.

”I think all of this has contributed to lower inflation from more than 30% last year to 23% this year, as well as improved FX reserve positions in Nigeria.

”So the direction of travel appears to be positive.”

Mr. Adrian noted however, that Sub-Saharan Africa in general was facing and continue to face headwinds.

He said, “While growth has been pretty strong during this period where financial conditions are easy, capital flows are resuming, it is also possible that the previous capital flow surge and then retracement cycles that we have seen before could happen, and when that happens, it would expose some of these economies with vulnerabilities, particularly when foreign investments were to retrace.

”So, it is important for countries to continue to improve the fundamentals on the fiscal and monetary policy side, but also in terms of developing more structural policies like revenue mobilization, as Nigeria is trying to do- debt management and hopefully also support from the international community.”

Welcomes Stable Coins regulations

The director expressed the Fund’s satisfaction with the regulations of stable coins by various member countries.

He said, “When we look at the picture of stable coins today, they are about 400 billion (dollars) outstanding globally. The vast majority are indeed denominated in US dollars, though they are being used around the world.

They are stable coins denominated in other currencies as well, such as the Euro, the Yen or the pound, but it’s largely a Dollar phenomenon to date.

“What has happened in the US is that a law was passed which provides a legal basis and the pathway to a regulatory approach for Stable Coins.

”Similar initiatives had already been taken in other jurisdictions, such as the Euro Area or the European Union rather, and Japan, where regulation of Stable Coins already passed back in 2023 and there are some other countries with Stable Coins regulations and laws.

”So we certainly welcome the steps towards regulations, and we actually have a policy framework for crypto assets that we published back in February, 2023 that really lays out broad policies perspective, as well as, from a regulatory perspective, what our recommendations are for countries.

“And you know, broadly, what we are seeing is that there are differences, of course, across countries in terms of the specific implementation of regulatory approaches and broader policy approaches relative to Stable Coins. But broadly, you know, the pathway is aligned with our framework.”

-

News19 hours ago

News19 hours agoMajor, 3 Soldiers, Hunter Killed In Borno

-

News19 hours ago

News19 hours agoUmrah Suffers Setback As Airlines Suspend Flights To S/Arabia

-

Politics20 hours ago

Politics20 hours agoAtiku’s son resigns from Fintiri’s cabinet

-

News20 hours ago

News20 hours agoRevised Executive Order: FG adjusts oil revenue remittance framework

-

Politics19 hours ago

Politics19 hours agoDSS arrests social media user who ‘threatened’ Peter Obi after Edo attack

-

News19 hours ago

News19 hours agoPolice Council Confirms Disu As IG, To Be Sworn In Wednesday

-

Business19 hours ago

Business19 hours agoPrivate jet flight from Riyadh to Europe now cost N479m as elites flee Middle East tensions – Report

-

News19 hours ago

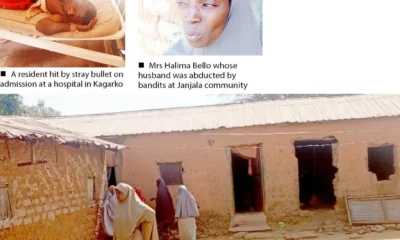

News19 hours agoVigilante, Wife, 12 Others Abducted In Kaduna