Business

FCMB Group Presents Facts Behind ₦160bn Public Offer

FCMB Group Plc, one of Nigeria’s leading financial institutions, on Monday, October 13, 2025, presented the Facts Behind the Offer at the Nigerian Exchange (NGX) in Lagos. The session, attended by capital market operators, fund managers, analysts, and other stakeholders, provided insights into the Group’s fundamentals, growth strategy, and rationale for its ongoing public share offer.

The event followed the Analyst and Investor Session held on Thursday, October 9, 2025, where the Group’s leadership discussed performance trends, strategic direction, and progress in delivering long-term value.

FCMB Group launched a ₦160 billion public share offer on October 2, 2025, to enable First City Monument Bank Limited, which has already secured its national banking licence, to meet the Central Bank of Nigeria’s new ₦500 billion capital requirement for international banks. The offer, comprising 16 billion shares at ₦10 each, will close on November 6, 2025.

This capital raise follows a ₦147.5 billion share sale in 2024, the first in 16 years, which was oversubscribed by 33% and attracted over 42,800 investors, 92% of whom participated through digital channels. Analysts expect this strong investor confidence to continue into the second phase of FCMB’s three-stage recapitalisation plan.

After the current share offer, the Group plans to conclude the sale of minority stakes in two subsidiaries, with proceeds to be injected into the bank. This will position the Group’s qualifying core capital well above ₦500 billion, effectively completing its recapitalisation programme and securing its international banking licence.

Subscriptions can be made through:

- Digital Platforms: FCMB Mobile App and Retail/Business Banking Platforms

- Websites: publicoffer.fcmb.com and invest.ngxgroup.com

- In-Branch: FCMB branches nationwide

- Stockbrokers: Licensed stockbrokers nationwide or CSL Stockbrokers (for inquiries, contact 02012777628 or email cslservice@fcmb.com / cslcsu@fcmb.com)

From left: Doyen of the Nigerian Capital Market, Alhaji Rasheed Yusuf; Head, Primary Market, Nigerian Exchange (NGX) Limited, Mr. Tony Ibeziakor; Chief Executive Officer (CEO), NGX Regulation Limited, Mr. Olufemi Shobanjo; Chief Executive Officer, Nigerian Exchange (NGX) Limited, Mr. Jude Chiemeka; Group Chief Executive, FCMB Group Plc, Mr. Ladi Balogun; Executive Director/Chief Operating Officer, Mr. Gbolahan Joshua; and Executive Director, Coverage & Investment Banking, Mr. Femi Badeji, both of FCMB Group Plc.

From left: Doyen of the Nigerian Capital Market, Alhaji Rasheed Yusuf; Head, Primary Market, Nigerian Exchange (NGX) Limited, Mr. Tony Ibeziakor; Chief Executive Officer (CEO), NGX Regulation Limited, Mr. Olufemi Shobanjo; Chief Executive Officer, Nigerian Exchange (NGX) Limited, Mr. Jude Chiemeka; Group Chief Executive, FCMB Group Plc, Mr. Ladi Balogun; Executive Director/Chief Operating Officer, Mr. Gbolahan Joshua; and Executive Director, Coverage & Investment Banking, Mr. Femi Badeji, both of FCMB Group Plc.

From left: Executive Director/Chief Operating Officer, FCMB Group Plc, Mr. Gbolahan Joshua; Managing Director/Chief Executive Officer, First City Monument Bank, Mrs. Yemisi Edun; Group Chief Executive, FCMB Group Plc, Mr. Ladi Balogun; and Executive Director, Coverage & Investment Banking, FCMB Group Plc, Mr. Femi Badeji.

Cross-section of industry stakeholders at the session.

Cross-section of industry stakeholders at the session.

-

Politics10 hours ago

Politics10 hours agoAPC Congress: Ogun, Lagos Retain Chairmen, Ondo, Oyo Elect Babatunde, Adeyemo

-

News10 hours ago

News10 hours agoDSS Arrests Police, Immigration Officials ‘Implicated’ In El-Rufai’s Return To Nigeria

-

News22 hours ago

News22 hours agoBREAKING: Tinubu nominates Oyedele as finance minister

-

Sports10 hours ago

Sports10 hours agoRonaldo ‘Flees’ Saudi Arabia Amid Bombardment From Iran

-

News10 hours ago

News10 hours agoRivers Assembly unveils Fubara’s commissioner nominees

-

News9 hours ago

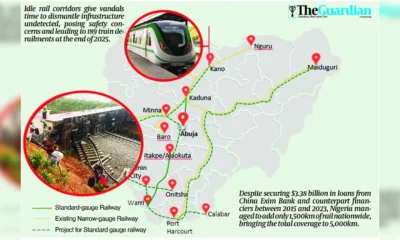

News9 hours agoFaulty design, vandalism, neglect endanger $3.4b rail overhaul

-

Business10 hours ago

Business10 hours agoBusinesses Bleed As Blackout Worsens

-

News9 hours ago

News9 hours agoFG suspends pilgrimages to Israel over Middle East security situation