Business

Stakeholders welcome easing inflation, worry about cost-of-living crisis

Notwithstanding the easing inflationary trend as reported in the September inflation report, stakeholders have expressed concerns about the cost-of-living crisis, noting that the situation remains acute, particularly for low- and middle-income households.

Indeed, major reductions in food prices have forced the headline inflation figure downward from 20.12 per cent it was in August to 18.02 per cent in September 2025.

The September inflation figure, which was released yesterday by the National Bureau of Statistics (NBS), marked the 6th consecutive monthly reduction since April 2025.

Specifically, the Centre for the Promotion of Private Enterprise (CPPE) noted that while the sustained disinflation trend is a welcome development and a sign of improving macroeconomic fundamentals, the next phase of reform must therefore prioritise welfare-focused and cost-reduction measures that deliver tangible relief to citizens.

Chief Executive Officer of the CPPE, Dr Muda Yusuf, noted that with consistency, coordination, and structural reforms, Nigeria can achieve a stable single-digit inflation rate over the medium term — anchoring growth, improving welfare, and restoring confidence in the economy.

“Business confidence is rising, but consumer confidence remains fragile. Policies that enhance productivity, stabilize prices, and reduce the structural cost of doing business will not only strengthen the disinflation trajectory but also foster inclusive and sustainable economic recovery”, he recommended.

Commenting, Senior Research Analyst, FXTM, Lukman Otunuga, attributed the drop to softer food prices and the strengthening of the naira against major currencies in recent weeks. The development, if sustained, could signal relief for millions of Nigerians grappling with the high cost of living.

He noted that further evidence of cooling price pressures may encourage the Central Bank of Nigeria (CBN) to implement additional interest rate cuts at its November Monetary Policy Committee meeting, aimed at stimulating economic growth in Africa’s largest economy.

The NBS report said: “This shows that the Headline inflation rate (year-on-year basis) decreased in September 2025 compared to the same month in the preceding year (i.e., September 2024), though with a different base year, November 2009 = 100.”

On the movement of prices between the rural areas and urban centres, the report said in September 2025, the urban inflation rate was 17.50 per cent, which is 17.63 percentage points lower compared to the 35.13 per cent recorded in September 2024.

Conversely, the rural inflation rate stood at 18.26 per cent in September 2025 on a year-on-year basis, representing a decrease of 12.23 per cent from 30.49 per cent recorded in September 2024.

On a month-on-month basis, rural inflation was 0.67 per cent in September 2025, reflecting a decline of 0.71 from 1.38 per cent recorded in August 2025. Also, the 12-month average for rural inflation was 22.08 per cent in September 2025, 7.68 percentage points lower than the 29.76 per cent recorded in September 2024.

On the food prices movements, which formed the major factor driving inflation, the figures on food inflation were 16.87 per cent in September 2025 on a year-on-year basis, representing a sharp decline of 20.9 percentage points from 37.77 per cent recorded in September 2024. The significant drop in the annual food inflation figure is largely attributed to a change in the base year, which has adjusted comparative estimates.

Indeed, the decline was driven by a reduction in the average prices of key food items such as yams, maize, guinea corn, garri, beans, millet, potatoes, onions, eggs, tomatoes, and fresh pepper.

On a month-on-month (MoM) basis, the food inflation rate also showed a notable improvement, sliding by -1.57 per cent, indicating that average food prices fell in September compared to the previous month.

Another finding of the report is that the average yearly rate of food inflation within the last 12 months was 24.06 per cent, which is 13.47 per cent lower than the 37.53 per cent recorded in September 2024.

The core inflation rate, which excludes the prices of volatile agricultural products and energy, stood at 19.53 per cent in September 2025 on a year-on-year basis, representing a decline of 7.9 percentage points from 27.43 per cent recorded in September 2024.

On a month-on-month basis, the core inflation rate was 1.42 per cent in September 2025, slightly lower by 0.01 percentage points compared to 1.43 per cent recorded in August 2025. (Guardian)

-

Politics10 hours ago

Politics10 hours agoAPC Congress: Ogun, Lagos Retain Chairmen, Ondo, Oyo Elect Babatunde, Adeyemo

-

News10 hours ago

News10 hours agoDSS Arrests Police, Immigration Officials ‘Implicated’ In El-Rufai’s Return To Nigeria

-

News22 hours ago

News22 hours agoBREAKING: Tinubu nominates Oyedele as finance minister

-

Sports10 hours ago

Sports10 hours agoRonaldo ‘Flees’ Saudi Arabia Amid Bombardment From Iran

-

News10 hours ago

News10 hours agoRivers Assembly unveils Fubara’s commissioner nominees

-

News9 hours ago

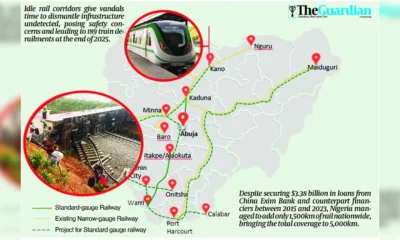

News9 hours agoFaulty design, vandalism, neglect endanger $3.4b rail overhaul

-

News9 hours ago

News9 hours agoFG suspends pilgrimages to Israel over Middle East security situation

-

Business10 hours ago

Business10 hours agoBusinesses Bleed As Blackout Worsens