Business

International investors are frustrated with Taiwo Oyedele – Reports

The mood among international investors following a recent investor call with Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, was one of palpable disappointment and unease.

This, according to feedback gathered from attendees of a virtual call organized by Standard Chartered, was meant to clarify the contentious new Capital Gains Tax (CGT) provisions in Nigeria’s tax reform law.

The call attracted several foreign investors seeking clarity on how the provisions would affect equity investments in Nigeria.

What they are saying

According to multiple sources who listened in, the session was intended to explain Nigeria’s new stance on CGT and broader fiscal reforms.

However, it left many participants questioning both the economic philosophy and investor sensitivity guiding the reforms.

Several investors described Oyedele’s tone as “surprisingly ideological,” suggesting that the country’s top tax reformer appeared more “socialist” than market-oriented.

- “We put a socialist in charge of our tax reform policy. He basically said the bottom 97% cannot pay tax, so the government should focus on the 3% to fund the state,” one investor lamented.

Oyedele, however, has in several engagements insisted that the new regime is not punitive but designed to stimulate investment.

- “Under the old regime, capital gains on shares were taxed at a flat rate of 10%, with no relief for capital losses and limited exemptions,” he explained in an earlier call hosted by the NGX.

- “The new regime introduces progressive taxation, where gains are taxed based on the payer’s income band, similar to practices in the U.S., U.K., South Africa, Ghana, and Brazil.”

Despite these clarifications, many foreign investors appeared unconvinced. Some fund managers said the message sent a troubling signal about Nigeria’s competitiveness, fairness, and policy predictability.

Sources also said Oyedele argued that even if Nigeria did not collect capital gains tax locally, FPIs would still pay equivalent taxes in their home jurisdictions — a point several participants dismissed as inaccurate.

One Africa-focused fund told Nairametrics, “mostly BS! Most institutional investors are zero-rated taxpayers in their home jurisdictions. It’s not the same thing.”

Adding to the frustration, participants could only submit questions via chat, which were filtered by Razia Khan, Chief Economist for Africa at Standard Chartered, who moderated the call.

- “Razia did not push this point about CGT making Nigeria uncompetitive relative to other frontier and emerging markets,” one participant complained.

OMO Bills vs Equities

Another concern was policy inconsistency. Oyedele reportedly noted that holders of Open Market Operations (OMO) instruments would be shielded from additional taxes and that new rules for bondholders would take effect in 2025.

Equity investors, however, were not given the same clarity.

- “If they want to do CGT, then do it properly and uniformly,” one fund manager said.

- “Let everyone pay CGT on gains with a base date of January 1, 2025. The way they’re going about it is absolutely mind-bendingly frustrating.”

While many acknowledged Oyedele’s broader vision for a fairer tax system, several foreign investors viewed his rhetoric as tone-deaf to market realities.

- “He’s focusing on extracting more from the top, not expanding the base,” one global fund manager told Nairametrics. “That’s not how you build investor confidence.”

Balancing Perspectives

Not everyone shares the gloom. Some investors argue that the new CGT could attract more stable capital into Nigeria.

- They note that the market has long relied on “hot money”—foreign portfolio inflows that leave as quickly as they arrive, often destabilizing prices during global shocks.

- By taxing large short-term gains, the reform could tilt incentives toward longer-term foreign direct investment (FDI) and deepen local participation.

- In fact, domestic institutional investors have quietly dominated trading for over five years, sustaining market gains of about 430% between December 2019 and September 2025.

Viewed this way, CGT may not be a deterrent but a filter—discouraging speculative inflows while rewarding investors willing to stay the course.

(Nairametrics)

-

News3 hours ago

News3 hours agoDIG Mba, others retire, seven AIGs for promotion

-

News3 hours ago

News3 hours agoBorno: Hundreds still missing after Boko Haram attack

-

News3 hours ago

News3 hours agoDetention: El-Rufai Petitions ICPC, Demands N15.6bn Damages

-

Politics3 hours ago

Politics3 hours agoTinubu Elevates Masari To Special Adviser

-

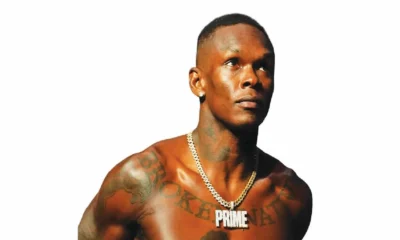

Sports3 hours ago

Sports3 hours agoAdesanya demands $15m per fight from UFC boss White

-

Politics4 hours ago

Politics4 hours agoWe Will Adopt Tinubu As 2027 Presidential Candidate – APGA

-

World News22 hours ago

World News22 hours agoHow Iran Strikes Have Damaged US Military Sites – CNN

-

Business3 hours ago

Business3 hours agoMiddle East Crisis: We’ll Ensure There Is No Fuel Scarcity In Nigeria, Says Dangote Refinery