Business

Nigeria’s billionaires build family offices to cement legacies and expand global reach

Family offices are beginning to take shape in Nigeria, marking a shift in how the country’s wealthiest families manage capital, legacy, and influence. For decades, most founders operated through company structures and informal holdings. That model is evolving. A small but growing group of billionaires is setting up formal investment offices — some single-family, some edging toward multi-family structures — bringing in professional chief investment officers, governance frameworks, and strategic co-investment mandates.

Aliko Dangote is establishing a family office in Dubai with a global investment focus. The initiative signals Africa’s richest entrepreneur is moving to institutionalize wealth management, diversify beyond core industrial holdings and create a platform for international partnerships.

TY Danjuma runs his investment operations separately from his oil business, South Atlantic Petroleum. The structure keeps the family’s upstream energy assets apart from a broader pool of financial investments, a setup that mirrors the way many large family offices overseas manage exposure and preserve wealth.

Femi Otedola uses Calvados Global as his investment vehicle. It holds his controlling interest in Geregu Power and has been steadily building a significant position in FBN Holdings. His approach resembles that of long-term anchor investors who mix operating control with market stakes to consolidate influence and returns.

Tengen, created by former banker Aigboje Aig-Imoukhuede, is one of the clearest examples of a fully fledged Nigerian family office. With a multibillion-dollar balance sheet and a dedicated investment team, it backs financial services, energy, insurance and infrastructure, and takes active roles on the boards of portfolio companies such as Petralon Energy and Coronation.

Tony Elumelu’s Heirs Holdings sits between a private investment office and a holding company. Its headline transactions include a $1.1 billion deal for a 45 per cent interest in OML 17 and a controlling stake in Nigeria’s power sector through Transcorp. Its investment strategy aims to pair returns with development goals across the region.

IHS Towers founder Sam Darwish runs Singularity Investments, which targets technology, media and telecom assets in the U.S. and emerging markets.

The rise of these offices reflects new realities for Nigeria’s top fortunes. Energy, finance and infrastructure deals have generated liquidity that can support professional investment platforms. Succession planning has become more urgent.

Although transparency remains limited, it’s clear that Nigeria’s richest families are adopting more structured investment models, expanding beyond their operating businesses, and taking positions alongside institutional capital in key sectors. Many are expected to play a larger role as anchor investors and partners in the continent’s next wave of private investment. (Billionaires Africa)

-

News18 hours ago

News18 hours agoMajor, 3 Soldiers, Hunter Killed In Borno

-

News18 hours ago

News18 hours agoUmrah Suffers Setback As Airlines Suspend Flights To S/Arabia

-

Politics19 hours ago

Politics19 hours agoAtiku’s son resigns from Fintiri’s cabinet

-

News19 hours ago

News19 hours agoRevised Executive Order: FG adjusts oil revenue remittance framework

-

News18 hours ago

News18 hours agoPolice Council Confirms Disu As IG, To Be Sworn In Wednesday

-

Politics18 hours ago

Politics18 hours agoDSS arrests social media user who ‘threatened’ Peter Obi after Edo attack

-

Business18 hours ago

Business18 hours agoPrivate jet flight from Riyadh to Europe now cost N479m as elites flee Middle East tensions – Report

-

News18 hours ago

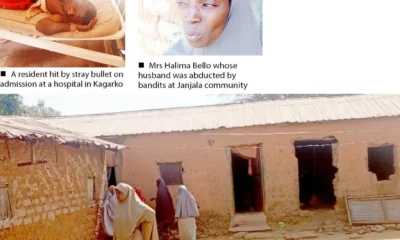

News18 hours agoVigilante, Wife, 12 Others Abducted In Kaduna