Business

Oando faces creditor pressure over unpaid debt

Oando Plc led by Nigerian oil mogul Wale Tinubu is under pressure after Irad Investment Ltd. accused the firm of failing to settle long-overdue payments for completed projects.

Irad, a Port Harcourt–based engineering and services company, said the delayed payments have caused “severe financial strain” and forced it to take out bank loans to finance work done for Oando. The company said it has since accumulated heavy interest payments and is facing pressure from its lenders.

Company says delays threaten stability

In a statement, Irad said it completed all assigned contracts “to Oando’s satisfaction” but has yet to receive full payment despite “repeated assurances and several months of negotiations.”

“We secured facilities from our bankers to execute jobs running into billions of naira and dollars,” the statement read. “These delays have exposed us to enormous interest obligations and threats to our assets.”

Call for corporate responsibility

The company said it staged a peaceful protest on July 15 to draw attention to the issue after “months of unfulfilled promises and missed payment timelines.” Following that protest, Irad said Oando’s management promised to clear all verified invoices within three months.

“Nearly three months later, less than 10 percent of the total outstanding amount has been paid,” Irad said. “This continued delay has put immense pressure on our bankers, suppliers, and subcontractors.”

Irad urged Oando to “demonstrate the corporate responsibility and integrity expected of a leading energy company” and settle its verified debts. The firm also reassured its stakeholders that it is pursuing all legal and administrative steps to recover the payments. But Oando has not publicly commented on the matter.

Oando’s market position

Oando, listed on both the Nigerian Exchange and the Johannesburg Stock Exchange is one of Africa’s largest indigenous energy firms, with operations across the upstream exploration, midstream trading, and renewable energy.

Under Tinubu’s leadership since its transformation from Unipetrol in 2003, the company has expanded its footprint in Nigeria’s energy landscape. Through Ocean and Oil Development Partners, a joint venture with Omamofe Boyo, Tinubu controls about 66.7 percent of the firm.

The dispute comes as Oando grapples with weaker earnings, in the first half of 2025, the company reported a 15 percent drop in revenue to N1.72 trillion ($1.12 billion) citing weaker oil prices and lower trading volumes.

In August the company announced plans for a $1.5 billion multi-instrument issuance program to strengthen its balance sheet and improve liquidity.

(Billionaires Africa)

-

News17 hours ago

News17 hours agoUmrah Suffers Setback As Airlines Suspend Flights To S/Arabia

-

Politics17 hours ago

Politics17 hours agoAtiku’s son resigns from Fintiri’s cabinet

-

News17 hours ago

News17 hours agoMajor, 3 Soldiers, Hunter Killed In Borno

-

News17 hours ago

News17 hours agoRevised Executive Order: FG adjusts oil revenue remittance framework

-

Politics17 hours ago

Politics17 hours agoDSS arrests social media user who ‘threatened’ Peter Obi after Edo attack

-

News17 hours ago

News17 hours agoPolice Council Confirms Disu As IG, To Be Sworn In Wednesday

-

Business17 hours ago

Business17 hours agoPrivate jet flight from Riyadh to Europe now cost N479m as elites flee Middle East tensions – Report

-

News17 hours ago

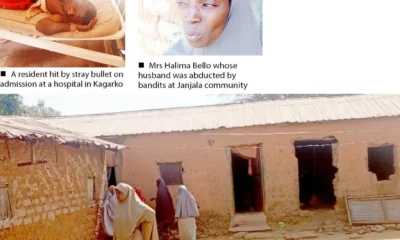

News17 hours agoVigilante, Wife, 12 Others Abducted In Kaduna