Business

Nigeria’s $2.3 billion Eurobond costly at 9%, says Nairametrics CEO

Nairametrics Founder and CEO, Ugo Obi-Chukwu, has raised concerns about the high yield rates on Nigeria’s recently issued $2.3 billion Eurobond, describing the pricing as “pretty expensive” and reflective of investor caution toward Nigeria’s macroeconomic outlook.

Speaking on the financial program Moneyline with Nancy, Obi-Chukwu said the bond’s 8% yield for the 10-year tranche and 9% for the 20-year signal that global investors still perceive Nigeria as a high-risk borrower.

“Nine percent over 20 years is high. Unless we’re able to refinance when rates come down, this could become a burden. The pricing reflects investor caution around Nigeria’s risk profile,” he said.

Investor confidence, but at a cost

The Federal Government’s Eurobond offer, announced earlier this week, attracted over 400% oversubscription, indicating strong investor appetite for Nigerian securities.

However, Obi-Chukwu warned that the yields highlight a deeper issue about the country’s macroeconomic stability and cost of debt servicing.

“The oversubscription shows that foreign investors still see value in Nigeria. But the cost of borrowing is something we can’t overlook — it’s a long-term sustainability concern,” he said.

Zenith Bank’s Q3 results show resilience

Turning attention to the domestic financial sector, Obi-Chukwu commended Zenith Bank Plc for delivering strong third-quarter results that surpassed market expectations.

- The bank’s gross earnings rose 16% to N3.4 trillion in Q3 2025, up from N2.9 trillion in the same period last year, driven largely by a 41% increase in interest income to N2.7 trillion.

- Pre-tax profit stood at N917 billion, which Obi-Chukwu described as “mouth-watering for shareholders.”

- He added that even after adjusting for the foreign exchange gains that boosted 2024 results, Zenith’s performance remains robust.

“Stripping out FX gains, this is a lot more impressive than expected,” he said.

Obi-Chukwu dismissed speculation that the bank’s strong performance was a temporary boost. He argued that Zenith’s growth trajectory is sustainable, supported by solid interest income and efficient cost management.

“Net interest margin is still around 12%, which is impressive given the high-rate environment. Even with rising costs of funds, Zenith has managed to maintain healthy margins,” he noted.

He, however, advised that banks must diversify income streams as foreign exchange gains normalize and dollar-based assets face renewed risks. “With the naira strengthening, hedging strategies will be critical,” he said.

On inflationary pressures, Obi-Chukwu acknowledged the strain on banks’ operating costs but praised Zenith’s ability to remain efficient.

“Cost-to-income ratios have risen across the board, with some banks nearing 60%. But Zenith, with N31 trillion in total assets, has managed to keep its cost of funds at 45%. That’s commendable,” he said.

He attributed the slight rise from 39% last year to the inflationary environment and volatile funding costs, but maintained that Zenith remains one of the most operationally efficient lenders in the market.

Outlook: cautious optimism for 2026

Looking ahead, the Nairametrics CEO expressed cautious optimism about the banking sector heading into 2026, predicting that the industry will transition from a year of normalization to one of aggressive growth.

“We’ve seen a mixed bag, some banks are thriving, others are navigating challenges. But overall, banks are posting profits, increasing deposits, and growing total assets. The FUGAZ banks alone now hold over N150 trillion,” he said.

“Banks are profitable, deposits are rising, and total assets are expanding. The FUGAZ banks alone now control over N150 trillion in assets. The next step is deploying that capital efficiently,” he said. (BusinessDay)

-

News18 hours ago

News18 hours agoUmrah Suffers Setback As Airlines Suspend Flights To S/Arabia

-

Politics19 hours ago

Politics19 hours agoAtiku’s son resigns from Fintiri’s cabinet

-

News18 hours ago

News18 hours agoMajor, 3 Soldiers, Hunter Killed In Borno

-

News19 hours ago

News19 hours agoRevised Executive Order: FG adjusts oil revenue remittance framework

-

Politics18 hours ago

Politics18 hours agoDSS arrests social media user who ‘threatened’ Peter Obi after Edo attack

-

News19 hours ago

News19 hours agoPolice Council Confirms Disu As IG, To Be Sworn In Wednesday

-

Business18 hours ago

Business18 hours agoPrivate jet flight from Riyadh to Europe now cost N479m as elites flee Middle East tensions – Report

-

News18 hours ago

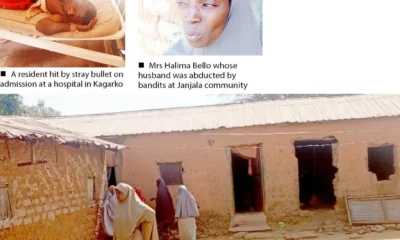

News18 hours agoVigilante, Wife, 12 Others Abducted In Kaduna