Business

Lagos State returns to capital market with N200 billion bond offer

The Lagos State Government has returned to Nigeria’s domestic debt market with plans to raise up to N200 billion (through book building process) under its N1 trillion Debt and Hybrid Instruments Issuance Programme, intended for infrastructure financing.

The 10-year issuance, which opened for subscription on Thursday, November 6, 2025, is priced between 16.15% and 16.25%, according to offer documents circulated by lead issuing house, Chapel Hill Denham Advisory Services Limited.

According to the lead issuing house and bookrunner (that is, the financial company helping Lagos State sell its bonds to investors) investors have until Thursday, November 13, 2025, to show how much they are willing to buy and at what price.

Book building is a process used by investment firms to determine the price of a bond issuance by collecting bids from potential investors over a specific period. An underwriter, or bookrunner manages this process, and the final price is set after the bidding period closes, reflecting the true market demand.

Proceeds from the bond will be channelled toward financing priority physical and social infrastructure projects across the State—ranging from transportation and housing to healthcare and education—aligning with Governor Babajide Sanwo-Olu’s THEMES+ development agenda.

Lagos, Nigeria’s commercial and financial hub, contributes around 20% of the nation’s GDP and boasts one of the most diversified and resilient subnational economies in Africa.

Strong fiscal profile underpins investor confidence

The latest issuance builds on Lagos State’s well-established reputation in Nigeria’s capital market, underpinned by strong internally generated revenue (IGR) performance.

The State’s IGR surged by 105% to nearly N2 trillion in the year ended December 31, 2024, demonstrating a sustained capacity to fund operations and service debt obligations with limited dependence on federal allocations.

Lagos is rated Aa- by Agusto & Co. and AA- by GCR Ratings, reflecting its solid revenue base, well-diversified economy, and effective expenditure management. Analysts say these strong fundamentals make the bond attractive to institutional investors seeking stable, high-yielding assets.

“Lagos has demonstrated financial resilience, maintaining access to domestic funding lines even in challenging macroeconomic environments,” one investment firm said in a note to clients. “This issuance further consolidates its reputation as Nigeria’s benchmark subnational borrower.”

Track record of market access and timely repayment

This latest offering continues Lagos State’s long-standing engagement with the capital market. Since its debut N15 billion floating-rate bond in 2002—the first by any subnational government in Nigeria—the State has consistently accessed the market to finance major infrastructure initiatives.

Key issuances include the N80 billion bond in 2012, the N87.5 billion Series II bond in 2017, and the N137.3 billion issuance in 2020—all part of larger multi-series programmes aimed at deepening infrastructure investment and bridging the State’s funding gaps.

Each prior issuance was successfully repaid or remains performing, reinforcing Lagos’ credibility among domestic investors and institutions.

Sustaining growth through capital market access

With rapid urbanisation and a population exceeding 20 million, Lagos continues to face significant infrastructure demands. The new N200 billion bond is expected to fund ongoing projects in transportation networks, housing schemes, renewable energy, and social infrastructure.

Financial experts believe the offer’s competitive pricing and the State’s proven strong fiscal base will ensure oversubscriptions. The transaction also underscores the growing sophistication of Nigeria’s subnational debt market, which increasingly serves as a key driver of development financing.(Nairametrics)

-

News22 hours ago

News22 hours agoMajor, 3 Soldiers, Hunter Killed In Borno

-

News22 hours ago

News22 hours agoUmrah Suffers Setback As Airlines Suspend Flights To S/Arabia

-

Politics22 hours ago

Politics22 hours agoAtiku’s son resigns from Fintiri’s cabinet

-

News22 hours ago

News22 hours agoRevised Executive Order: FG adjusts oil revenue remittance framework

-

Politics21 hours ago

Politics21 hours agoDSS arrests social media user who ‘threatened’ Peter Obi after Edo attack

-

News22 hours ago

News22 hours agoPolice Council Confirms Disu As IG, To Be Sworn In Wednesday

-

Business22 hours ago

Business22 hours agoPrivate jet flight from Riyadh to Europe now cost N479m as elites flee Middle East tensions – Report

-

News22 hours ago

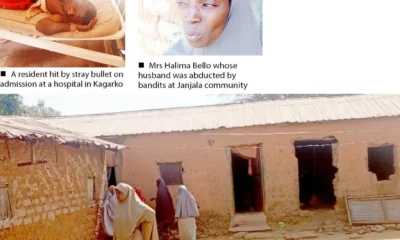

News22 hours agoVigilante, Wife, 12 Others Abducted In Kaduna