Business

Lagos State’s N200bn bond oversubscribed by 55%

The Lagos State Commissioner for Finance, Yomi Oluyomi, says the state has made history with the conclusion of the bookbuild for its landmark bond issuance that has recorded an overwhelming reception from the investment community.

In a statement on Monday, Oluyomi explained that the state offered a N200bn Conventional Bond and a N14.8bn Green Bond, both of which were significantly oversubscribed.

“The Conventional Bond, which is the largest ever issued by a non-corporate sub-national in Nigeria’s history, attracted subscriptions totalling N308bn, representing a 54 per cent oversubscription above the initial offer. Lagos State is the first sub-national government to issue an impact climate bond. The Green bond attracted N28.7bn – 94 per cent more than the target,” Oluyomi said.

The Lagos State Governor, Babajide Sanwo-Olu, was quoted in the statement as saying, ”This is a reflection of the global confidence in Nigeria’s economy, fostered by the bold reforms initiated by President Bola Tinubu as reflected in the recent oversubscription of the Federal Government’s Eurobond.

“In Lagos, ours is a testament to our resilience and the unwavering support of our private sector partners who believe in our vision of building Africa’s model megacity that is safe, secure, and functional,” Sanwo-Olu said.

According to him, the state shall continue to ensure prudent financial management, accountability, and fiscal transparency as it continues to provide a conducive environment for businesses to grow. “Our dream is to make Lagos a global financial hub; we will keep our eyes on the ball,” he added.

The statement pointed out that the proceeds from these Bonds are earmarked to fund critical projects across the state, directly aligned along the line of the THEMES+ Agenda of Governor Babajide Sanwo-Olu.

“These projects will focus on vital areas such as transportation, healthcare, education, and environmental sustainability, all aimed at significantly improving the livelihood and well-being of all Lagosians and securing a more prosperous and resilient future for the state,” it stated.

The “conventional bond” is a fixed-rate, long-term debt instrument issued by the Lagos State Government to raise capital from the domestic capital market.

Proceeds are used to fund infrastructure and social development projects across Lagos. Lagos State has a Debt Issuance Programme that allows it to issue bonds, notes, and other securities under a shelf registration.

-

News21 hours ago

News21 hours ago‘It was cross-examination’ — Charles Aniagolu says Mehdi Hasan didn’t interview Bwala

-

News21 hours ago

News21 hours agoHardship: How FCT Women Are Converting Their Private Cars To Commercial Use

-

Business21 hours ago

Business21 hours agoMiddle-East War Pushes Up Petrol, Food Prices

-

World News21 hours ago

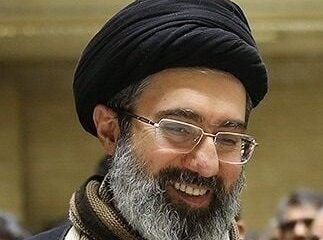

World News21 hours agoMojtaba, Khamenei’s son, appointed as Iran’s new supreme leader

-

News21 hours ago

News21 hours agoCharge Or Release El-Rufai – Lawyers, ADC Tell ICPC

-

News20 hours ago

News20 hours agoFiscal strain shadows Nigeria’s reforms despite revenue gains- Senator Musa

-

Politics21 hours ago

Politics21 hours agoAbsence from congress, meetings with opposition figures, is Badaru on his way out of APC?

-

News21 hours ago

News21 hours agoFashola, Banire lead Lagos pushback against federal bid to control coastlines