Business

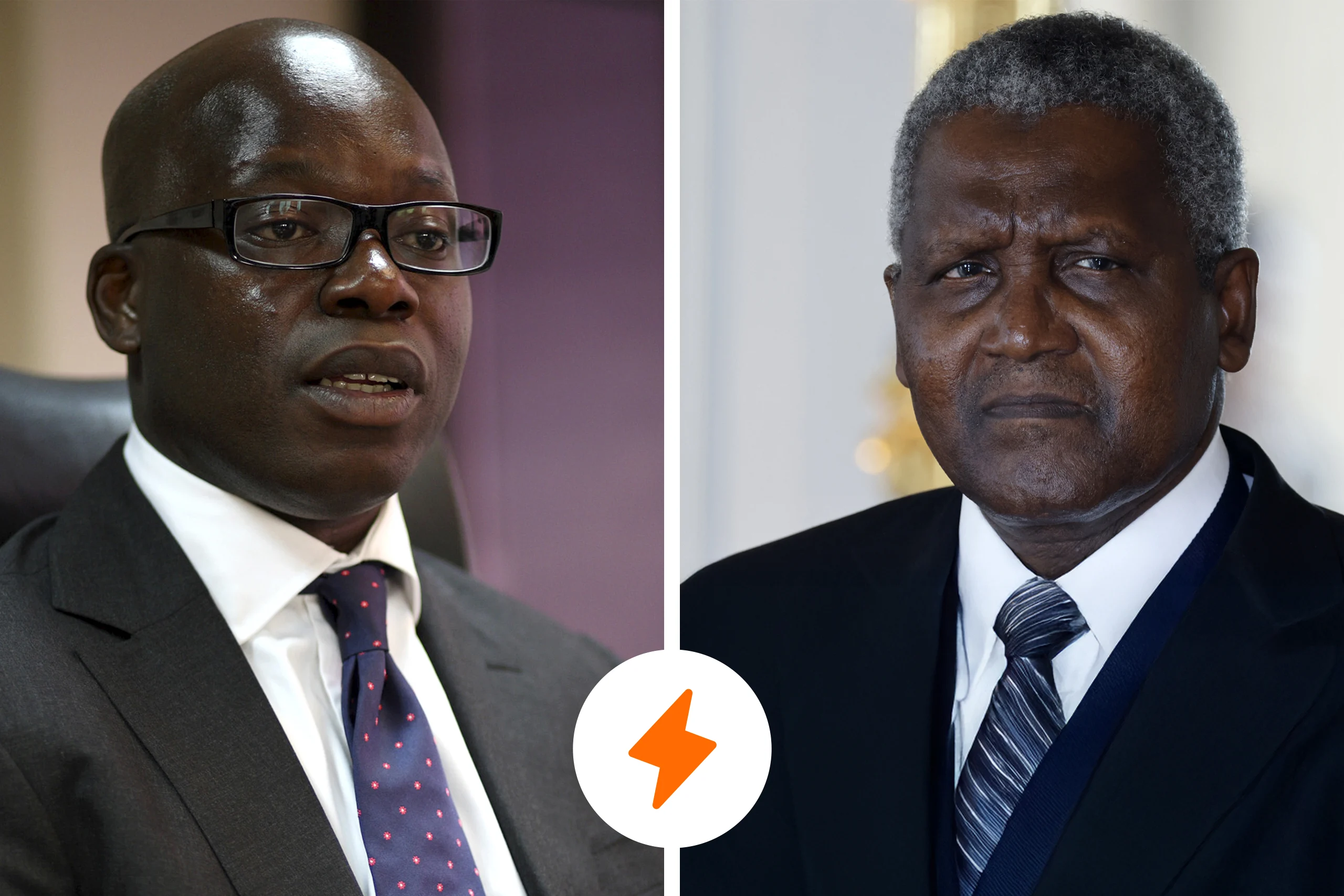

Dangote vs Nigeria’s fuel importers: Who will win?

With the massive Dangote refinery redrawing the Nigerian downstream petroleum landscape, fuel importers that have long held the market’s reins are fighting hard to keep their businesses alive.

The 650,000-barrels-per-day refinery, which started operations last year, is increasingly giving established operators, including retail outlets and depot owners, a run for their money.

Some of the casualties of the market disruption caused by the refinery include TotalEnergies, Oando and Conoil, with their financials showing a further drop in revenues in the third quarter of the year.

Oando, a listed Nigerian energy independent that exited the fuel retail business in 2019, said last month that it had paused the trading of refined products as no petrol cargo was sold in the first nine months of 2025.

Its revenue fell by 20% compared to a year earlier.

“Across our trading business, refined products volumes remained under pressure, largely due to the well-deserved and expected success of the Dangote refinery in meeting Nigeria’s import needs,” the company said, adding that it has “rebalanced its portfolio towards higher-margin crude and gas trading opportunities”.

TotalEnergies Marketing Nigeria, a subsidiary of French energy major TotalEnergies involved in fuel retailing, posted a loss of ₦14.1bn ($9.67m) in the nine months to September compared with a profit of ₦27.42bn in the same period of 2024.

Profit at Conoil, the country’s oldest oil marketer, tumbled 88% to ₦1.46bn.

Conoil and TotalEnergies are among the six operators called major marketers, which have been involved in importation for years.

Other players in the sector include depot owners and thousands of small independent marketers.

Under the importation system, products brought in by vessels are discharged into depots, from which they are transported by trucks to retail outlets.

The clash between Dangote and importers “is going to be an evolving issue”, according to Jide Pratt, a Lagos-based industry analyst and country manager for TradeGrid.

“Importers have every right to import petroleum products into the country. They’ve established businesses; they’ve established tank farms,” he tells The Africa Report.

“The Dangote refinery is a $20bn investment, and it has every right to also sell.”

Before the Dangote refinery came on stream in January 2024 with the production of diesel and jet fuel, Nigeria wholly relied on imports to meet its fuel needs as the four government-owned refineries remained idle since 2019, when they were closed for repairs.

A few weeks after Dangote Petroleum Refinery & Petrochemicals started producing petrol in September last year, its founder Aliko Dangote said marketers were still importing the product and not buying from his refinery.

“I am expecting that the NNPC Ltd and the marketers should stop importing,” he said in October 2024, adding that his refinery had 500 million litres in its tanks.

“The retailers should please come forward and pick… I’m not in the business of retail… We also don’t have trucks to send [products to them].”

Dangote had earlier filed a ₦100bn lawsuit against the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), the Nigerian National Petroleum Company (NNPC) and five major fuel marketers in his bid to have importation banned.

He accused the marketers of importing substandard fuel, which he said allowed them to undercut market prices.

He also argued that the NMDPRA’s continued approval of imports, despite his refinery’s capacity to meet local demand, violated the Petroleum Industry Act.

Although the lawsuit was withdrawn in July with no reason stated, the battle for market share between Dangote and the importers has intensified in recent months.

Dangote refinery’s contribution to national petrol requirement rose from 12.87% or an average daily supply of 6.43 million litres in September 2024 to 44.99% (22.50 million litres) in January but fell to 31.21% (15.60 million litres) in September, according to data from the regulator.

Dangote: ‘I have been fighting all my life’

In September, Dangote began the distribution of fuel directly to retail stations and other large buyers through compressed natural gas-powered trucks as part of measures to further penetrate the market.

While addressing the question of whether he intended to go into fuel retailing at a briefing, Dangote said his company had restricted itself to production because “we didn’t want to be called a monopoly” and the expectation that the retailers “would become our customers, and we will have a very nice party together”.

“If they are looking for a nice party, fine. But if they are looking for a fight, I have been fighting all my life. There is no business that I did that I didn’t fight,” Dangote said.

His remarks came amid the disputes with an oil and gas union as well as an association comprising fuel depot owners and marketers over his company’s foray into fuel distribution, among other issues.

Last month, Africa’s richest man surprised many when he announced a plan to more than double the capacity of his refinery to 1.4 million bpd within three years – surpassing India’s Jamnagar refinery as the world’s largest.

Analysts have said the move could reshape regional fuel markets, threaten entrenched importers and accelerate Nigeria’s push for self-sufficiency.

Controversial 15% import tariff on hold

A new 15% duty on imported fuels approved by the government last month to encourage local refining saw importers sounding the alarm that the cost of the products at the pump would rise as a result.

“Smaller independent importers may be squeezed out of the market,” Clement Isong, CEO of Major Energy Marketers Association of Nigeria, says.

The implementation of the tariff has been postponed for further review in the first quarter of next year.

“I think Dangote has won the fight already. He’s got the government to act on his side, and I think for all intents and purposes, he’s putting too many innovations into the market,” says Ademola Adigun, an oil and gas analyst, adding that the country’s reliance on imports has reduced.

If the 15% import tariff kicks in, many importers would close shop because they’ll be uncompetitive in the Nigerian market, he says.

He argues that there’s still room for importation as “Dangote refinery’s current output can’t take care of the market”.

“We can’t stop importation because it’s a single-train refinery, and we are in danger if anything happens to the refinery or if, for instance, the US stops supplying crude to it.

“But I think we should move away from this conflict situation,” he says.

Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise, says the suspension of the duty exposes domestic refiners to “inequitable competition from importers benefitting from vastly superior international conditions”.

“While domestic refineries are expected to meet national demand within a short horizon, temporary supply gaps should be addressed not by dismantling protective measures but through guided, quota-based importation to supplement domestic output,” he says.

For Pratt, there’s a need for better collaboration between Dangote refinery and importers.

“I think if they collaborate more, we’ll find a middle ground, and that way competition will thrive so that the market is not in one hand,” he says.

(The Africa Report)

-

Metro11 hours ago

Metro11 hours ago‘I Was In The Wilderness For 42 Days After Paying N17Million Ransom’ – Ekiti Farm Manager Narrates Kidnap Ordeal

-

News11 hours ago

News11 hours agoBanditry: Over 300,000 Displaced In Niger – Bago

-

News11 hours ago

News11 hours agoNo attempt to poison Tinubu – Presidency

-

News11 hours ago

News11 hours agoTinubu convenes Police Council today to confirm Disu

-

Politics11 hours ago

Politics11 hours agoINEC Can’t Guarantee Perfect Election In 2027 – Amupitan

-

News11 hours ago

News11 hours agoIran: IGP Orders Heightened Surveillance In North

-

Business11 hours ago

Business11 hours agoAbu Dhabi directs hotels to extend guests’ stay over travel restrictions, says it’ll cover cost

-

Metro11 hours ago

Metro11 hours agoKidnapped Ondo Man Killed, Found Dead In Edo Forest After Ransom Payment