Business

How your money transfer narration becomes tax audit compass

…But not every naira is taxable

The fear is widespread that if you transfer N500,000 to your mother, will the tax authority automatically tax it? With Nigerian banks now mandated to report monthly high-value transactions of N5 million or more for individuals to the tax authorities, many citizens believe every bank transfer is a taxable event.

Experts have said this belief is false, but the risk of misclassification is very high. The new tax law, through the Tax Identification number, uses bank transaction data primarily to identify potential income sources that were not reported in your Personal Income Tax (PIT) filings.

Marvis Oduogu, head of taxation at Stren & Blan Partners, said that it’s necessary to put narrations in bank transfers, especially for transactions in business or salary accounts.

“However, the taxman does not limit itself to narrations, as this can be deceitful. He extends his search to how frequent some transactions are, any other agreement or contract papers to back some transactions, and the underlying conversations leading to some transactions (in deserving cases),” Oduogu said.

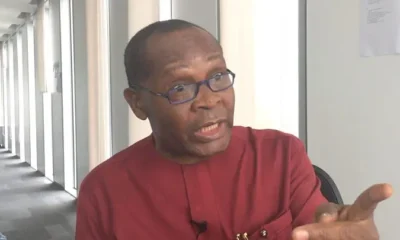

Taiwo Oyedele, chairman of the Presidential Fiscal and Tax Committee, recently announced a push to expand Nigeria’s tax net and drive compliance through advanced data monitoring.

The system aims to flag significant discrepancies between the income an individual declares and their observable lifestyle expenditure.

Oyedele explained, “The system will validate your spending against your declared income. For instance, if an individual declares an annual income of only N1 million but their lifestyle, evidenced by the purchase of a new car, multiple international trips, and frequent high-value purchases, which suggests expenditures closer to N50 million, a substantial discrepancy is triggered.”

The simple, often-neglected transaction description is the primary tool the individual taxpayer has to instantly differentiate taxable income from non-taxable personal transfers.

This focus on tracking is crucial, especially following Oyedele’s previous caution that once a tax liability is established, the government could enforce collection directly from bank accounts. “If you cannot explain yourself and your tax is N1 million, under this new tax law from next year. The government can substitute what you have to collect the taxes you owe,” he said.

This mention of direct bank debit caused significant public concern that the government could unilaterally withdraw money or monitor all private inflows.

However, tax experts insist this enforcement power is not new and is strictly regulated by due process. The primary role of the Tax Identification Number (TIN) on bank transfers is to establish traceability for every taxable person and transaction.

Olamide Olaniran, a Senior Tax Associate at KPMG, explained that the system is an administrative tool, not an enforcement weapon. This administrative goal is the sole justification for the transfer requirement.

Non-Taxable Transfers

Your Shield Against FIRS Scrutiny transactions involve money you already earned and paid tax on, or funds that are not considered statutory income under the Personal Income Tax Act (PITA).

This statement, particularly the mention of direct bank debit, has caused significant public concern that the government could unilaterally withdraw money or monitor all citizens’ private inflows.

Clearly narrating these transfers is your strongest defence against an audit query

Gifts and Personal Contributions. Generally, Nigerian tax law does not have a “Gift Tax” for the recipient. If you send money to a family member, friend, or religious body, describing it explicitly as a gift or contribution is crucial. Use phrases like “Bday Gift for Mum,” “Wedding Contribution,” or “Family Support.” This communicates that the transfer is gratuitous and not a payment for services rendered.

Loans and Principal Repayments

If you lend money or receive repayment of a principal loan, that money is not taxable income. For the N500,000 transfer to be treated as a loan, the description must be specific, such as “Loan Repayment: Balance NGN X” or “Personal Loan to Peter.”

Critically, you must keep a simple written loan agreement or memo to provide as evidence should the FIRS ever ask, confirming that the money was debt, not revenue. Only the interest earned on a commercial loan may be taxed, but the principal is exempt.

Personal Fund Movement

Moving your own money is never a taxable event. Whether you are transferring funds between your own accounts or sending money to a spouse for household expenses, these are non-taxable.

Use descriptions like “Transfer to Savings Account” or “Inter-Account Movement – Joint Bills.” Similarly, a reimbursement, where you are simply being paid back for money you previously spent on someone else’s behalf, should be clearly labelled “Reimbursement: Lagos Trip Expenses.

Taxable Transactions

The FIRS targets transactions that represent an inflow of income, which should be captured in your annual PIT returns. An unclear description here is a strong indicator of unrecorded tax liability.

Employment and Service Income

If you are a freelancer, consultant, or receive secondary employment income, every payment is a taxable event. The description must be precise: “Consulting Fee: Project Alpha Invoice 001” or “Nov Salary Balance.”

This payment must match the total income declared in your PIT return. If the transfer is large and vague, FIRS may assume it is business income that has not been properly documented.

Rent Received and Investment Income

Rental income is taxable, and FIRS expects it to be declared. If you receive a payment from a tenant, describe it as “12 Months Rent: Flat 3B, Ref: Tenant J. T.”

This also applies to income from investments. Dividends or interest on fixed deposits are typically subject to 10 percent Withholding Tax (WHT) at source, which serves as the final tax. A clear description like “Dividend Payment: Zenith Bank” helps you claim this crucial WHT credit during your annual tax filing.

(BusinessDay)

-

News13 hours ago

News13 hours agoFG Files Criminal Charges Against Ozekhome Over UK Property Saga

-

Business13 hours ago

Business13 hours agoPetrol war: Importers outpace domestic refineries with 62% supply in 2025

-

News13 hours ago

News13 hours agoN30bn relief: Oyo cries politics as HEDA drags Makinde to EFCC

-

Business13 hours ago

Business13 hours agoMDAs Allocate Billions For Stationeries Despite Paperless Operation

-

Politics12 hours ago

Politics12 hours ago‘Gear Up, Not Give Up’ Amidst Rivers State Turmoil – Jonathan Tells Fubara

-

Opinion8 hours ago

Opinion8 hours agoPolitics behind failed impeachment attempt of Gov. Fubara

-

Sports13 hours ago

Sports13 hours agoDrama as Senegal beat Morocco to claim AFCON title

-

Politics13 hours ago

Politics13 hours ago‘We Don’t Want A Mole’ – Igbokwe Speaks On Atiku’s Son’s Move To APC