News

Pushback As More Lawmakers Reject Gazetted Tax Laws

Concerns have deepened over alleged alterations to tax laws passed by the National Assembly, after two more lawmakers raised objections to the gazetted versions.

Daily Trust had reported how a member of the House of Representatives, Hon. Abdulsammad Dasuki (PDP Sokoto), on Wednesday, raised a matter of privilege on the floor of the House, alleging discrepancies between the tax laws passed by the National Assembly and the versions subsequently gazetted and made available to the public.

Rising under Order Six, Rule Two of the House Rules on a Point of Privilege, Dasuki told the House that his legislative privilege had been breached, insisting that the content of the tax laws as gazetted did not reflect what lawmakers debated, voted on and passed on the floor of the House.

Speaking in a BBC Hausa’s Ra’ayi Riga programme, Hon. Muhammad Bello Fagge (representing Fagge Federal Constituency, Kano) and Hon. Yusuf Shitu Galambi (Gwaram Federal Constituency, Jigawa), also warned that the discrepancies could undermine constitutional order and further erode public trust in government.

Hon. Fagge said the opposition had initially objected to the bills, a move that led to wider consultations across the country before their eventual passage.

“We in the opposition initially objected to the tax bills because of fears that certain provisions could be introduced without proper scrutiny. This led the Speaker of the House of Representatives, Tajudeen Abbas, to constitute a committee that went round the country, met with traditional rulers and governors, and asked them to submit their grievances and suggestions to the National Assembly. After that process, the bills were harmonised and approved,” he said.

Fagge said the controversy arose when the gazetted versions of the laws differed from what lawmakers approved.

“However, when the laws were later gazetted, what appeared was different from what we approved in Parliament. There were discrepancies, meaning that what was signed is not what we at the National Assembly passed,” he said.

He cited the Nigeria Revenue Service Act, noting differences in Section 25 on accounts and audit, as well as Sections 26 and 30, adding that the Joint Revenue Board Act also contains discrepancies, particularly in Sections 9, 14, 30, 40 and 44.

“Even if it is just one part that is different from what we agreed, there is a problem,” he added.

It’s about saving Nigeria

The lawmaker warned that some provisions appear to have transferred powers from the legislature and the judiciary to the Executive, particularly to the Nigeria Revenue Service.

“There is no way the legislature will make a law without giving itself oversight functions. That is the essence of checks and balances. The issue goes beyond party politics. This is not about opposition politics. This is about saving Nigeria.”

Lawmaker demands suspension of implementation

Also speaking in the programme, Hon. Galambi said public opposition to taxation is often driven by mistrust over how government spends public funds.

“We all know that people do not like tax because of the mistrust they have about how government utilises their money. But if people are certain and have trust, nobody will object,” he said.

Galambi described the allegations of alterations as disturbing, though still unproven, and said the National Assembly has set up a committee to investigate the matter.

He urged the government to suspend implementation of the tax laws scheduled for January 2026 pending the committee’s findings.

“If alterations are found, the law should be brought back and corrected in line with what the legislators passed. If nothing is found, then implementation can go ahead,” Galambi said.

He also raised concerns over alleged changes granting the Nigeria Revenue Service enforcement powers without court orders, contrary to what lawmakers approved.

“We said enforcement should only be with a court order. If the court order requirement has been removed, it can create tension in the country and people will not agree with it,” he said.

The lawmakers said the committee has four weeks to review the allegations and make recommendations, stressing that the tax laws were only passed after consultations with Nigerians to ensure they serve the interest of the masses.

Daily Trust had reported that the Speaker of the House of Representatives, Tajudeen Abbas, on Thursday set up a seven-man ad-hoc committee to investigate the allegations of discrepancies between between the tax bills passed by the National Assembly and the versions subsequently assented and gazetted.

Experts warn against alterations, executive interference

Weighing into the discussion, an economic analyst, Prof. Muttaqa Usman, said taxation is not merely about generating revenue but also about ensuring it is used to grow the economy and improve the welfare of Nigerians.

“Tax is not just about getting more money or revenue, but how it should be used to grow the economy and improve the welfare of people in Nigeria,” he said during the programme.

He added that public mistrust arises when government policies or laws differ from what is actually implemented.

“There’s mistrust between government and people because sometimes what is promised or stated is different from what is implemented,” Prof. Usman noted.

Also commenting on the development, Professor Auwalu H. Yadudu said the alleged changes threaten the foundation of constitutional governance.

“For how else can one explain extensive review and alteration of laws that were publicly debated, subjected to public hearings, and duly passed, to now insert entirely new provisions or remove those lawfully adopted?” he asked.

He identified several areas of concern in the Nigeria Tax Administration Act, including provisions relating to petroleum income tax and value added tax, which he said no longer reflected what lawmakers agreed upon.

FG defends new tax laws

Amaid concerns, the federal government had insisted that the new tax laws would enhance fiscal equity, protect taxpayers’ rights and ensure a level playing field for all.

Taiwo Oyedele, Chairman, Presidential Fiscal Policy and Tax Reforms Committee, also explained that contrary to the general perception that the government is introducing new taxes on the masses, many taxes have been repealed, reversed and suspended.

He listed the taxes to include 5% excise tax on airtime & data; Cybersecurity levy on money transfers; Carbon tax on single use plastics; Excise tax on imported vehicles; Import duties on food items, Agric and pharmaceuticals ; 4% import levy; FRCN charge on private companies and Expatriate employment levy.

In a recent presentation on the new tax laws, Oyedele expressed confidence that the new tax laws would stimulate growth without adding to inflation burden.

At the signing ceremony of the bills at the State House, President Tinubu said that the new taxes presented a new lease of life to every Nigerian and future generation.(DailyTrust)

-

Business15 hours ago

Business15 hours agoGas supply crisis cuts power generation to 3,940MW

-

News15 hours ago

News15 hours agoDetention: El-Rufai Petitions ICPC, Demands N15.6bn Damages

-

News15 hours ago

News15 hours agoDIG Mba, others retire, seven AIGs for promotion

-

Politics16 hours ago

Politics16 hours agoWe Will Adopt Tinubu As 2027 Presidential Candidate – APGA

-

News15 hours ago

News15 hours agoBorno: Hundreds still missing after Boko Haram attack

-

Politics15 hours ago

Politics15 hours agoTinubu Elevates Masari To Special Adviser

-

Sports15 hours ago

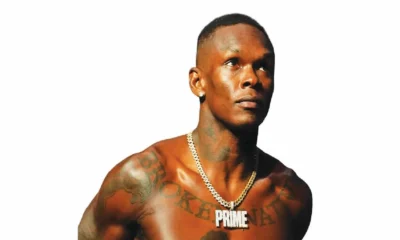

Sports15 hours agoAdesanya demands $15m per fight from UFC boss White

-

World News15 hours ago

World News15 hours ago‘They host US military bases used to attack us’ — Iran defends striking Gulf countries