Business

FG writes off $1.42bn, N5.57tn NNPC debt

President Bola Tinubu has approved the cancellation of a substantial portion of the debts owed by the Nigerian National Petroleum Company Limited to the Federation Account, wiping off about $1.42bn and N5.57tn after a reconciliation of records between both parties.

This is contained in a document prepared by the Nigerian Upstream Petroleum Regulatory Commission and presented at the November meeting of the Federation Account Allocation Committee.

The report, titled “Report of October 2025 Revenue Collection Presented at the Federation Account Allocation Committee Meeting Held on 18th November 2025,” was obtained by The PUNCH on Sunday.

In the section headed “Recovery from NNPC Ltd Outstanding Obligations,” the commission said the debts earlier reported at the October 2025 FAAC meeting stood at “$1,480,610,652.58 and N6,332,884,316,237.13 for PSC, DSDP, RA & MCA Liftings and JV & PSC Royalty Receivables respectively.”

It disclosed that the Presidency had now approved that most of those balances be removed from the Federation’s books.

The document stated, “However, the commission recently received a Presidential Approval to nil off the outstanding obligations of NNPC Ltd as at 31st December 2024 as submitted by the Stakeholder Alignment Committee on the Reconciliation of Indebtedness between NNPC Ltd and the Federation.”

Providing a breakdown of the affected balances, the NUPRC added, “Consequently, out of $1,480,610,652.58 and N6,332,884,316,237.13, the affected outstanding obligations that have been nil off are $1,421,727,723.00 N5,573,895,769,388.45. The commission has passed the appropriate accounting entries as approved.”

An analysis of the figures shows that the presidential directive wiped out about 96 per cent of the dollar-denominated debt and about 88 per cent of the naira-denominated obligations previously reported as outstanding.

The document indicates that the approval followed the recommendations of the Stakeholder Alignment Committee on the Reconciliation of Indebtedness between NNPC Ltd and the Federation, which reviewed the company’s royalty and lifting-related liabilities up to December 31, 2024.

Despite the cancellation of the legacy balances, fresh debts built up in 2025 remain. In a separate section titled “NNPC Ltd Outstanding Obligations,” the regulator disclosed that statutory obligations arising between January and October 2025 still stood at “$56,808,752.32 and N1,021,550,672,578.87 for PSC & MCA Liftings and JV Royalty Receivables respectively.”

The commission added that part of the dollar component was recovered in the month under review, stating: “However, the commission received $55,003,997.00 in the month under review from the outstanding, leaving a balance of $1,804,755.32 and N1,021,550,672,578.87. The amount of $55,003,997.00 received is part of the total collection reported above for sharing by the Federation this month.”

The NUPRC confirmed that it had already implemented the directive in the Federation Account, noting that “the Commission has passed the appropriate accounting entries as approved.”

The approval effectively resolves long-running disputes over NNPC’s legacy indebtedness to the Federation, while current liabilities from ongoing operations continue to be tracked for future recovery.

However, the debt cancellation comes at a time when the commission is struggling to meet its revenue projections for the year, The PUNCH learnt. Data from the NUPRC document seen by The PUNCH showed that against a 2025 approved monthly revenue target of N1.204tn, the commission recorded N660.04bn as actual collection for November 2025, leaving a shortfall of N544.76bn for the month.

Royalty payments on oil and gas, which account for the bulk of upstream revenues, fell sharply below target. The approved monthly royalty projection was N1.144tn, compared to N605.26bn actually collected in November, indicating a deficit of N538.92bn.

Cumulatively, as of November 30, 2025, the NUPRC’s total approved revenue stood at N13.25tn, while actual cumulative collections were N7.60tn, representing a revenue gap of N5.65tn. For royalties alone, cumulative approved collections stood at N12.59tn against N6.96tn actually received, leaving a shortfall of N5.63tn.

The document further showed a drop in revenue collections compared to the previous month. While N873.10bn was collected in October 2025, the figure declined to N660.04bn in November.

The PUNCH earlier reported that there was a clash between the Nigerian National Petroleum Company Limited and Periscope Consulting, the audit firm hired by the Nigeria Governors’ Forum to examine an alleged under remittance of oil revenue totalling $42.37bn (about N12.91tn) to the Federation Account between 2011 and 2017.

The dispute, revived by fresh submissions from both sides, forced the Federation Account Allocation Committee to mandate a joint reconciliation session to determine the true state of remittances and resolve the long-running impasse.

According to a document seen by The PUNCH, the FAAC Sub-Committee confirmed that NNPC had formally rejected the audit findings, insisting that no outstanding revenue is owed to the Federation Account for the period under review.

The national oil company maintained that all crude oil proceeds and associated earnings were fully accounted for, disputing Periscope’s claims of significant underpayment.

However, Periscope Consulting flatly disagreed with NNPC Limited’s defence, maintaining that its audit uncovered substantial gaps in remittances and that the alleged $42.37bn shortfall remained unresolved.

The report read, “NNPC Limited submitted their response regarding $42,373,896,555.00 under remittance to the Federation Account as contained in the report of Periscope Consulting. Recall that Periscope Consulting was the Consultant engaged by the Governors’ Forum to examine NNPC Limited under remittance to the Federation Account.

“NNPC Limited responded that all revenues due to the Federation have been properly accounted for and no outstanding amounts for the period under review.”

This disagreement has pushed both sides into a stalemate, with the consultants accusing the oil company of providing explanations that do not reconcile with the audited data.

The FAAC sub-committee, noting the conflicting positions, directed that NNPC Ltd and Periscope Consulting must meet jointly to harmonise records and “close out” the matter. It added that the reconciliation process remains ongoing.

“Responding, Periscope Consulting disagreed with NNPC Ltd’s position; hence, the Sub-Committee directed that there should be a joint meeting with the two parties to close out on the issue. This assignment is a work in progress,” it added.

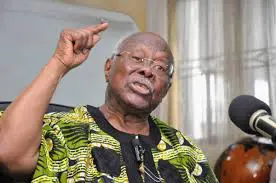

Speaking earlier with The PUNCH, a renowned Prof Emeritus of Petroleum Economics, Wumi Iledare, said the alleged $42.37bn under-remittance recorded between 2011 and 2017 reflects long-standing flaws in Nigeria’s pre–Petroleum Industry Act regime.

According to him, the former Nigerian National Petroleum Corporation operated with overlapping roles that made revenue reconciliation cumbersome and frequently disputed. Iledare described the controversy as a “legacy problem,” stressing that similar discrepancies can be avoided only through disciplined implementation of the PIA, real-time monitoring, and continuous independent audits.

The World Bank earlier accused NNPCL of failing to fully remit oil revenues to the Federation Account, thereby undermining fiscal transparency and macroeconomic stability.

The bank noted that while the company was corporatised in 2021 to operate as a commercial entity, it still retains monopolistic control over crude oil sales and foreign exchange inflows, leading to persistent gaps between reported earnings and actual remittances.

“NNPC Ltd has remained a key source of revenue leakages,” the World Bank stated, urging the government to “strengthen oversight, ensure full disclosure of oil proceeds, and improve transparency in federation revenue management.”

The institution said the state-owned company has only been remitting 50 per cent of revenue gains from the removal of the Premium Motor Spirit subsidy to the Federation Account.

It said out of the N1.1tn revenue from crude sales and other income in 2024, the NNPC Ltd only remitted N600bn, leaving a deficit of N500bn unaccounted for.

“Despite the subsidy being fully removed in October 2024, NNPC Ltd started transferring the revenue gains to the Federation only in January 2025. Since then, it has been remitting only 50 per cent of these gains, using the rest to offset past arrears,” the World Bank stated.

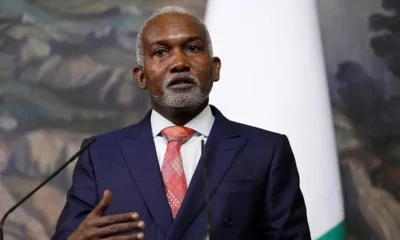

Since assuming office, the NNPC Ltd Group Chief Executive Officer, Bayo Ojulari, has consistently pledged to entrench transparency, efficiency, and accountability in the company’s operations.

He has repeatedly assured Nigerians and the global investment community that the company’s books would be transparent and that its dealings with the Federation Account would be fully compliant with fiscal rules. (Punch)

-

World News20 hours ago

World News20 hours agoIran Confirms Supreme Leader’s Death As Attacks Continue

-

Politics19 hours ago

Politics19 hours agoNigerians Are Hungry, Will Shock You In 2027 – Bode George Tells APC

-

News19 hours ago

News19 hours agoFG Issues Advisory To Nigerians In Middle East

-

World News19 hours ago

World News19 hours agoAyatollah Ali Khamenei: The Leader Who Shaped Iran’s Defiance

-

Metro19 hours ago

Metro19 hours ago‘I won’t be bullied’ – Seyi Tinubu addresses VDM’s claim of secretly funding King Mitchy’s charity work

-

Opinion19 hours ago

Opinion19 hours agoReflections on FCT polls and voter apathy

-

News19 hours ago

News19 hours agoTinubu Renews Tenure Of Audi, NSCDC CG

-

News19 hours ago

News19 hours agoLassa Fever Kills 10 Health Workers In Benue