News

How to retrieve your Tax ID using NIN, CAC number from January 2026

The Joint Revenue Board (JRB), formally known as the Joint Tax Board and the Nigerian Revenue Services (NRS), formerly known as the Federal Inland Revenue Service, have announced the launch of the Nigerian Tax ID Portal.

According to the organizations, the portal which goes live from January 1, 2026.

The platform will allow individual Nigerians and businesses to retrieve their tax identification number (Tax ID) using either the National Identification Number (NIN) for individuals and the Corporate Affairs Commission (CAC) registration number for businesses.

The FIRS had earlier announced that the NIN issued by the National Identity Management Commission (NIMC) has now automatically become a Tax ID for individual Nigerians, while CAC registration number is used for businesses.

How to retrieve your Tax ID on the portal

The use of NIN and CAC erased the concerns that many Nigerians would have to go through another tedious process of acquiring a tax ID from next year in order to open bank accounts.

The Tax ldentification (Tax ID) is a unique, system-generated number assigned to all taxable persons in Nigeria for the purpose of tax administration.

According to the JRB and NRS, Nigerians will need to follow these steps to retrieve their Tax ID using NIN and CAC number:

For Individuals:

- Visit www.taxidjtb.gov.ng or www.taxidnrs.govng

- Click on the “Individual” tab on the homepage.

- -Select National Identification Number (NIN).

- Enter your 11-digit NIN

- Click on Retrieve Tax ID”

- Enter “First Name, “Last Name” and ‘Date of Birth exactly as captured by NIMC.

- Click “Continue”

- 13-digit Tax ID will be displayed.

For Non-Individuals (Registered Entities)

- Visit www.taxidjtb.gov.ng or www.taxidnrs.govng

- Click on the “Corporate” tab

- Select the appropriate organisation type

- Enter your CAC registration number, as applicable

- Click”Retrieve Tax ID”

- 13-digit Tax ID will be displayed

What you should know

Four tax reform laws have been enacted under the Tinubu administration. Two of the laws took effect in June 2025, while two are scheduled for January 1, 2026.

Despite the controversies surrounding the two laws, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, told journalists on Friday that the implementation will proceed as planned from January 1.

According to Oyedele, the new laws will deliver significant tax relief across the economy.

- He said about 98% of Nigerian workers will either pay no PAYE tax or pay lower taxes under the new framework.

- He also noted that approximately 97% of small businesses will be exempt from corporate income tax, VAT, and withholding tax, while large companies will benefit from reduced tax liabilities.

- The laws, he said, are intended to promote economic growth, inclusivity, and shared prosperity.

(Nairametrics)

-

Business14 hours ago

Business14 hours agoOil Industry Contracting: NCDMB Issues NCEC Guidance Notes, Rules Out Transfer of Certificate

-

News13 hours ago

News13 hours agoKnocks For Tinubu For Attending Wedding Without Visiting Kwara Massacre Victims

-

Politics14 hours ago

Politics14 hours agoMakinde, Wike camps set for showdown at PDP HQ today

-

News14 hours ago

News14 hours agoElectoral Act standoff: Senate calls emergency plenary as protests loom

-

Business13 hours ago

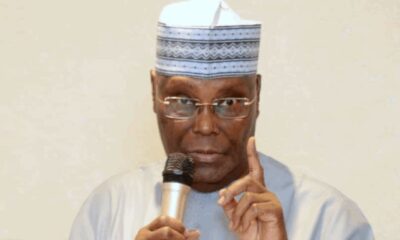

Business13 hours ago‘Should have been sold before rehabilitation’ — Atiku asks NNPC to discontinue proposed refinery deal

-

News13 hours ago

News13 hours agoInsecurity: ADC Spokesman Taunts Tinubu, Says Nigeria Has No Gov’t

-

News13 hours ago

News13 hours agoAbia blames typo after allocating N210m for photocopier in 2026 budget

-

News13 hours ago

News13 hours agoIdle refineries gulp N13tn as NNPC admits waste