Business

Best places to park your dollars this year

Nigeria’s local debt market is drawing renewed attention from foreign investors, not because of stronger growth prospects, but because of a wide yield gap that few markets currently offer, according to BusinessDay analysis.

At recent auctions, Nigerian Treasury bills have cleared at annualised rates between 15.3 percent and 17.5 percent, compared with about 3.4 to 3.6 percent on equivalent US Treasury bills.

Under a base-case assumption, according to BusinessDay, that the naira remains broadly stable through 2026, this spread could translate into higher dollar-equivalent returns on Nigerian bills than on US bills over the same holding period.

Dollar returns could outpace us treasuries

This renewed interest follows the return of foreign inflows after several years of withdrawals driven by currency controls, FX illiquidity and repeated devaluations. Unlike earlier cycles, the current investment case is not based on expectations of currency appreciation. Instead, it rests on short-term carry, provided exchange-rate volatility remains limited.

A conservative outlook carried out by BusinessDay, based on a three-month moving average of NAFEX exchange-rate data suggests limited currency movement in 2026, implying relatively low volatility under this scenario.

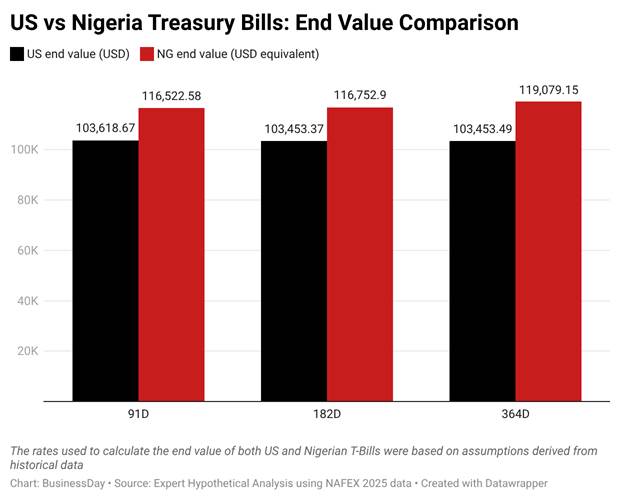

Using the same framework, a hypothetical $100,000 investment in Nigerian Treasury bills would rise to about $116,000 under this illustrative framework, compared with roughly $103,500 if invested in US Treasury bills. Over 12 months, the Nigerian position approaches $119,000, while the US equivalent remains near $103,000. These estimates reflect yield differences rather than expectations of naira appreciation.

Short-term carry over currency bets

“High interest rates have restored the appeal of naira assets, particularly at the short end of the curve,” says Bismarck Rewane, chief executive of Financial Derivatives Company in Lagos. “For investors who can manage FX exposure, Treasury bills now offer positive real returns.”

Shorter tenors account for most of the interest. Ninety-one-day and 182-day bills allow investors to capture elevated yields while reducing exposure to policy shifts, liquidity changes and year-end FX pressures. They also allow investors to reassess conditions more frequently rather than locking in longer-dated exposure.

Central bank credibility and policy discipline

Nigeria’s central bank has maintained that monetary discipline remains its priority. “Our focus is on restoring confidence through price stability and market-based FX reforms,” said Olayemi Cardoso, governor of the Central Bank of Nigeria, in recent remarks. “Sustained credibility is essential for attracting long-term capital.”

That credibility remains under scrutiny. The main risk for foreign investors is FX convertibility. Even if the naira appears stable, the ability to exit positions at prevailing market rates without delays or discounts will determine actual returns. Operational issues such as settlement delays, custody arrangements and repatriation processes can also reduce realised gains.

Risks remain: FX, rates, and operational challenges

There is also rate risk. Nigeria’s carry advantage depends on auction yields staying near current levels. A shift in liquidity conditions, higher issuance or a change in policy stance could compress yields and narrow spreads.

“In a world where safe assets offer limited returns, frontier carry has become relevant again,” says Oyekan Idris, a capital market analyst. “Nigeria stands out because the yield is real, but execution risk remains significant.”

Tactical allocation, not long-term judgment

The trade, therefore, is not a judgment on Nigeria’s long-term fundamentals. It is a tactical allocation to short-dated instruments, based on high nominal yields, tight domestic liquidity and conservative FX assumptions.

For investors with short investment horizons, FX hedges or natural dollar inflows, Nigerian Treasury bills offer a clear but conditional proposition: elevated yields that remain meaningful in dollar terms, as long as currency and exit risks are carefully managed. (BusinessDay)

-

News14 hours ago

News14 hours agoReal-Time Transmission: Hacking Needs To Be Avoided In This Computer Age – Tinubu

-

Sports14 hours ago

Sports14 hours agoSaka Becomes Arsenal’s Highest-Paid Player

-

Politics13 hours ago

Politics13 hours ago2027: Ex-CBN Deputy Governor Tunde Lemo joins Ogun governorship race

-

News14 hours ago

News14 hours ago37 Killed In Gas Leak At Plateau Mine

-

Politics13 hours ago

Politics13 hours agoPDP says electoral bill exposes APC fear of defeat ahead of 2027 polls

-

News14 hours ago

News14 hours agoForgive Me If I Have Sinned Against You – Tinubu Begs Nigerians

-

Politics14 hours ago

Politics14 hours ago“The 2031 Puppet Master”—Amaechi Alleges Ribadu is Plotting Personal Power Grab While Propping Up Tinubu

-

Business14 hours ago

Business14 hours agoTinubu orders direct remittance of oil, gas revenues to Federation Account