Business

Flutterwave ties Mono acquisition to profitability push, IPO plans

Flutterwave Inc. says its acquisition of open-banking startup Mono Technologies Nigeria Ltd. will boost its profitability drive and strengthen its position for a potential initial public offering (IPO).

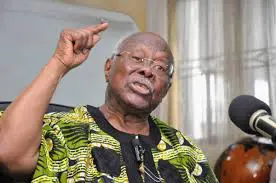

This is according to comments by Flutterwave’s Chief Executive Officer, Olugbenga Agboola, following the company’s purchase of Mono, a fintech it has partnered with since 2021.

The acquisition signals a renewed strategic push by Africa’s most valuable fintech unicorn to deepen infrastructure, lower costs, and build a more resilient business ahead of any future listing.

The Lagos- and San Francisco-based payments company did not disclose the financial terms of the acquisition, but confirmed that Mono’s technology is expected to play a critical role in Flutterwave’s long-term growth strategy.

What Agboola is saying

Speaking in an interview with Bloomberg, Agboola said Flutterwave’s current focus is firmly on profitability and infrastructure rather than rapid expansion.

“Right now, our focus is profitability, resilience and better infrastructure, and that is why we acquired Mono,” he said, adding that the acquisition makes Flutterwave “a better candidate for everything,” including a possible IPO.

Flutterwave had previously announced plans to list on the Nasdaq in 2022, but later delayed and eventually paused the move to address internal challenges and focus on building a sustainable and profitable business.

More insights

Flutterwave has expanded its operations to about 35 African countries, supports payments in more than 30 currencies, and processes roughly 500,000 transactions daily, according to its website.

- The company was last valued at $3 billion following a funding round in January 2022 that tripled its valuation.

- Before the acquisition, Flutterwave paid Mono on a per-transaction basis for account-to-account payment services.

- According to Agboola, owning Mono outright will significantly lower these costs, improving profit margins on those processes to at least 10%.

Mono has grown into a key player in Nigeria’s fintech ecosystem, enabling businesses to securely access customer financial data for credit assessment, faster onboarding, fraud reduction, and seamless payments.

Agboola also said Mono’s technology will help Flutterwave tap into broader payment opportunities expected from the ongoing recapitalization of Nigeria’s banking sector, which could accelerate lending, trade, and e-commerce activity.

What you should know

Last year, Agboola said Flutterwave’s much-anticipated initial public offering (IPO) would only happen when the company becomes profitable.

- Flutterwave initially disclosed plans to list on the Nasdaq stock exchange in 2022 but later deffered the plans.

- Despite postponing its IPO, Flutterwave has significantly expanded its market presence. Since its launch in 2016, the company has extended its services to 35 African countries and processed more than 630 million transactions worth $31 billion.

- While the company has not provided a timeline for a potential listing, Agboola suggested that strengthening its payments “rail” across Nigeria and Africa through acquisitions like Mono could make any future IPO easier to execute.

(Nairametrics)

-

World News3 hours ago

World News3 hours agoIran Confirms Supreme Leader’s Death As Attacks Continue

-

World News3 hours ago

World News3 hours agoAyatollah Ali Khamenei: The Leader Who Shaped Iran’s Defiance

-

Metro3 hours ago

Metro3 hours ago‘I won’t be bullied’ – Seyi Tinubu addresses VDM’s claim of secretly funding King Mitchy’s charity work

-

Politics3 hours ago

Politics3 hours agoNigerians Are Hungry, Will Shock You In 2027 – Bode George Tells APC

-

News3 hours ago

News3 hours agoFG Issues Advisory To Nigerians In Middle East

-

News3 hours ago

News3 hours agoLassa Fever Kills 10 Health Workers In Benue

-

News3 hours ago

News3 hours agoTinubu Renews Tenure Of Audi, NSCDC CG

-

Opinion2 hours ago

Opinion2 hours agoReflections on FCT polls and voter apathy