Business

Doctors say official data cloud medical tourism spend

..As patients ditch official channel after rates convergence

Nigeria’s medical tourism spending has come under renewed scrutiny after Central Bank of Nigeria (CBN) figures showed a sharp year-on-year collapse, a decline doctors and healthcare leaders say reflects changes in foreign exchange (FX) payment channels rather than a genuine halt in overseas medical travel.

The CBN data covering January to June 2025 show spending on medical tourism fell 96.2 percent to just $0.09 million, down from $2.38 million in the same period of 2024. While policymakers have pointed to the drop as evidence that Nigerians are increasingly seeking treatment at home, industry experts argue the data significantly understates actual patient outflows.

According to healthcare professionals, most Nigerians travelling abroad for medical care are no longer sourcing FX through official channels following the convergence of the official and parallel market rates, opting instead for private arrangements that fall outside the CBN’s reporting framework.

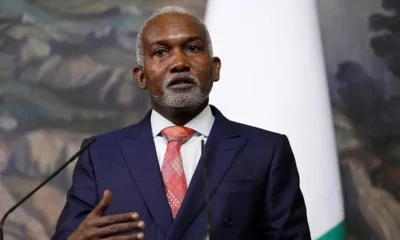

“The data only captures transactions routed through the official FX window. Once rates converged, people stopped seeing any benefit in accessing dollars through the CBN. Most medical travel payments are now happening outside that system,” Njide Ndili, president of the Healthcare Federation of Nigeria, told BusinessDay.

Ndili said patients increasingly rely on the parallel market, offshore facilitators, employer-funded schemes and private insurance arrangements to settle overseas medical bills, making official figures a poor proxy for the true scale of outbound healthcare spending.

Still, she said the direction of travel is changing, with Nigeria laying the foundations for a real and lasting reduction in medical tourism over the next few years, driven by private-sector investment and public hospital reform.

“We can reverse medical tourism in a few years’ time. People travel mainly because of trust. Once confidence in quality, safety and outcomes is restored locally, the incentive to go abroad disappears,” Ndili said.

She said private hospitals are expanding capacity and investing in advanced technology and specialist skills that now allow complex procedures once available only overseas to be performed in Nigeria. These include cardiac surgery, robotic oncology, non-invasive fibroid treatment using High-Intensity Focused Ultrasound (HIFU) and AI-assisted urology care.

Consolidation is also reshaping the sector, with larger hospital groups acquiring smaller facilities to standardise care, improve clinical governance and spread the high cost of specialised equipment and talent.

Beyond private hospitals, public-sector reform is beginning to alter long-held perceptions of Nigeria’s healthcare system. At the Federal Medical Centre (FMC), Ebute Metta, a quality improvement programme implemented in partnership with PharmAccess has focused on digitisation, clinical protocols, workforce training and infrastructure optimisation.

The reforms have delivered measurable results. According to Ndili, FMC Ebute Metta’s internally generated revenue has risen by more than 1,000 percent, while patient visits have surged, reflecting growing confidence in public healthcare delivery.

Following visits by federal health officials, the government has moved to replicate the model nationwide. In November, PharmAccess signed a memorandum of understanding with the Federal Ministry of Health to support quality improvement programmes across 48 tertiary hospitals.

Another structural shift is the growing use of short-term diaspora doctor missions. Under this model, Nigerian specialists based abroad return home for defined periods to carry out high-volume complex procedures in partnership with local hospitals, reducing costs for patients while retaining access to global expertise.

“For many patients, you are seeing the same doctor you would meet overseas, but without the additional costs of travel, accommodation and visas,” Ndili said.

Policy reforms in the FX market may also reinforce the trend. In January 2025, the CBN launched the Nigerian Foreign Exchange Code and an electronic FX matching system, tightening access to discretionary FX for non-essential spending, including overseas medical travel.

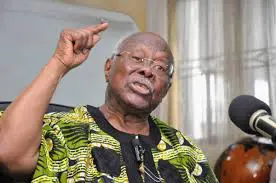

However, some doctors caution against reading too much into the official data. Tunji Akintade, former chairman of the Association of General and Private Medical Practitioners of Nigeria, said affordability remains a major barrier to fully reversing medical tourism.

“Yes, private hospitals are improving, but many Nigerians still travel abroad if they can afford it,” Akintade said, noting that smaller private facilities continue to struggle with high operating costs and limited access to finance.

He urged the government to establish long-tenor, low-interest loan schemes for private hospitals to support facility upgrades and equipment acquisition, arguing that financing is critical to expanding domestic treatment capacity and reducing FX losses linked to medical travel.

For now, Nigeria’s medical tourism debate reflects both progress and uncertainty. While data gaps cloud the true scale of outbound care, healthcare leaders agree that capacity is expanding and that, for the first time in decades, the country has a credible path to keeping more patients at home. (BusinessDay)

-

World News10 hours ago

World News10 hours agoIran Confirms Supreme Leader’s Death As Attacks Continue

-

Politics10 hours ago

Politics10 hours agoNigerians Are Hungry, Will Shock You In 2027 – Bode George Tells APC

-

News10 hours ago

News10 hours agoFG Issues Advisory To Nigerians In Middle East

-

World News10 hours ago

World News10 hours agoAyatollah Ali Khamenei: The Leader Who Shaped Iran’s Defiance

-

Opinion9 hours ago

Opinion9 hours agoReflections on FCT polls and voter apathy

-

Metro10 hours ago

Metro10 hours ago‘I won’t be bullied’ – Seyi Tinubu addresses VDM’s claim of secretly funding King Mitchy’s charity work

-

News10 hours ago

News10 hours agoTinubu Renews Tenure Of Audi, NSCDC CG

-

News10 hours ago

News10 hours agoLassa Fever Kills 10 Health Workers In Benue