Business

Why ‘Nigeria first’ policy remains rich in packaging, lean in impact

For decades, Nigeria’s leaders have spoken about the need to build a competitive industrial economy, yet the manufacturing sector’s performance tells a different story. Despite being central to job creation, economic diversification, and export growth, manufacturing in Nigeria has shown persistent signs of decline, a situation stakeholders see as a reflection of government’s lip service to the sector rather than purposeful action. GBENGA SALAU reports that the Nigeria First policy of the President Bola Tinubu administration and two Executive Orders signed by its predecessor to boost production in the country have had little or no impact on the economy.

Despite being widely recognised as the cornerstone of economic diversification and industrialisation, Nigeria’s manufacturing sector has struggled to reach its potential due to what many stakeholders describe as “insufficient governmental commitment” to sustained growth and policy implementation. According to the Manufacturers Association of Nigeria (MAN), the country’s manufacturing sector continues to operate at below 50 per cent of its installed capacity, a direct reflection of weak policy execution and a lack of prioritisation by successive governments. This under-performance occurs alongside a notable decline in the sector’s contribution to the GDP, with quarterly data showing sharp year-on-year drops in manufacturing’s share of output and value added.

A report in the third quarter of 2025 by KPMG revealed that the growth of Nigeria’s manufacturing sector has been weak and sluggish with a yearly growth of 1.38 per cent in 2024. It added that in the past five years, the sector recorded an average growth of 1.17 per cent, with post-COVID gains in 2021 quickly losing steam. The report further revealed that the sector’s contribution to GDP fell from 9.2 per cent in 2018 to 8.6 per cent in 2024, reflecting structural weaknesses. The sector’s export to total export declined from 10.8 per cent in 2019 to 2.2 per cent in 2023.

The report also stated that despite a 194 per cent year-on-year growth in 2024 export value, from N778.4 billion in 2023 to N2.29 trillion in 2024, the sector’s share of total exports remained modest at three per cent, highlighting stronger growth in other sectors. It further stated that Nigeria’s five-year average manufacturing export of 4.2 per cent lags far behind regional peers like Botswana (92.9 per cent), Egypt (46.8 per cent), South Africa (39 per cent) and Ghana (6.4 per cent).

Many stakeholders and critics attribute the poor showing of the manufacturing sector to inconsistent policy frameworks, limited financial support, and a lack of targeted interventions. They argue that without stronger political will, coherent industrial strategies, and intentional support mechanisms, Nigeria risks perpetuating a cycle in which its manufacturing base remains too weak to drive meaningful economic transformation.

Findings indicate that over the years, the country had made efforts to re-engineer the manufacturing sector but implementation had been weak. For instance, as part of efforts to revamp the sector, the Buhari administration signed two executive orders to promote production – Executive Orders 003 and 005. While Executive Order 003 was signed by Yemi Osinbajo, as an acting President on May 18, 2017, and took immediate effect, Executive Order 005 was signed by Buhari on February 2, 2018.

Executive Order 003 was very emphatic. It states that all Ministries, Departments and Agencies (MDAs) of the Federal Government of Nigeria shall grant preference to local manufacturers of goods and service providers in their procurement of goods and services.

The order also provides that Made-in-Nigeria products shall be given preference in the procurement of listed items and at least 40 per cent of the procurement expenditure on these items in all MDAs of the Federal Government of Nigeria shall be locally manufactured goods or local service providers. Government, through the order, lists items that should be considered to include uniforms and footwear; food and beverages; furniture and fittings; stationery; motor vehicles; pharmaceuticals; construction materials; and information and communication technology. The order also states that within 90 days of the take off, the heads of all MDAs of the Federal Government shall assess the monitoring, enforcement, implementation, and compliance with the Executive Order and local content stipulations in the Public Procurement Act or any other relevant Act within the agencies.

The order further provides for the proposal of policies to ensure that government’s procurement of goods and services maximise the use of goods manufactured in Nigeria and services provided by Nigerian citizens doing business as sole proprietors, firms, or companies held wholly by them or in the majority. The order states that within 180 days of the order, the Minister of Industry, Trade and Investment in consultation with the Director-General of the Bureau for Public Procurement shall submit to the President a report on the Made-in-Nigeria initiative.

Similarly, Executive Order 005 recognises the vital role of science, technology and innovation in national economic development, particularly in the area of promoting Made-in-Nigeria goods and services. Tactically, the Executive Order 005 aims to harness domestic talents and develop indigenous capacity in science and engineering for technological innovation needed to drive national competitiveness, productivity and economic activities.

Despite the availability of these two executive orders, the President Bola Tinubu administration in May 2025 approved a Nigeria First policy to promote Made-in-Nigeria, which it said would be consolidated with an executive order that will prioritise the use of Nigerian-made goods across government agencies.

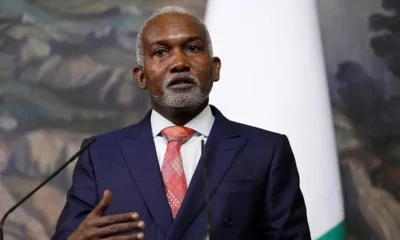

The Minister of Information and National Orientation, Mohammed Idris, speaking after a Federal Executive Council (FEC) meeting in Abuja, said the executive order would be part of the “Renewed Hope Nigeria First” policy aimed at reducing imports and supporting local industries.

“No MDA will be allowed to buy foreign goods when local alternatives exist,” he declared. He added that a waiver must be obtained from the Bureau of Public Procurement (BPP) in exceptional cases. He further said the BPP has been directed to update procurement rules, compile a list of credible local suppliers, and enforce strict compliance, warning that any officer who violates the directive may face disciplinary action. Idris said the policy would help keep public spending within the country and strengthen the local economy.

Commenting on the Tinubu administration’s effort at promoting production, the Director General of the Textile Manufacturers Association of Nigeria, Dr. Gamma Kwajaffa, noted that such an initiative is not new, noting that enforcement has been the bane. He recalled that a similar executive order was issued in 2017 during the Buhari administration with the Ministry of Industry directing civil servants to wear Made-in-Nigeria clothes on Mondays and Wednesdays, but there was no serious enforcement. He added that most of the procurement officers were not cooperating with them on the issue.

“In practice, many procurement officers did not cooperate, and most government agencies did not implement the directive. We also engaged with the military uniform procurement units, secondary schools, and the Ministry of Education, but progress remained slow. The key point is that Nigeria must develop a competitive market for Made-in-Nigeria products,” Kwajaffa stated.

Using the textile industry as an example, Kwajaffa adduced reasons the Nigeria First policy should be strictly implemented. He noted that although Nigeria produces cotton, many of the imported fabrics are made from polyester, derived from crude oil. He noted that while competing countries with large refinery capacities can produce polyester cheaply, Nigeria, despite being an oil-producing nation, struggles with refining crude and producing polyester competitively.

“As a result, polyester fabric floods the Nigerian market at low prices, with little tariff protection, making it difficult for cotton-based local products to compete. For example, a high-quality cotton fabric may cost around N6,000, while imported polyester fabric can be sold for around N1,000. This price disparity has allowed cheap foreign products to dominate the market and displace Nigerian textiles.

“We have also pursued a backward integration programme, encouraging the use of domestically grown cotton to support local farming and production. But at some point, cotton producers started selling internationally because foreign demand and prices were higher, further reducing the supply available for local textile manufacturers. These pressures have contributed to the closure of many textile companies. Even with funding from the Bank of Industry for retooling and improving production capacity, local fabrics remain more expensive than imported alternatives.

“To make the Nigerian First procurement policy effective, the government must implement supporting measures such as tariffs or levies on imports to create a level playing field. Countries like the United States impose tariffs broadly to protect local industries. Nigeria should adopt similar protective mechanisms for its priority sectors. If we do not protect local production, the textile industry will continue to shrink. Historically, Nigeria had over 200 textile mills; today only about 15 are operational. Without deliberate government protection and enforcement, local manufacturers cannot compete with imported goods. To truly promote local products, the Federal Executive Council should demonstrate visible leadership. For example, if ministers and senior officials publicly wear Made-in-Nigeria attire, including state and local council officers, this example will spur the citizens to follow suit,” he said.

Speaking further on support needed by manufacturers outside strict implementation of the executive orders, Kwajaffa said that in many countries, there are textile parks where special considerations are given to businesses in the park, particularly electricity.

“Government does not increase the price of power anyhow, because the price of goods will jump up once electricity price increases. So, government will continue to defray the increase so that it will balance. And they will not also increase for manufacturers and government will continue to protect manufacturers that way until they are able to stabilise with competitors,” he added.

Also speaking, a member of the executive council of the Manufacturers Association of Nigeria (MAN), Mr. John Aluya, said MDAs were not embracing the Nigeria First policy, stressing that most of them still relied on imported goods.

“They are not giving sufficient patronage to made-in-Nigeria products,” he insisted.

He noted that naturally, goods made in Nigeria are a little bit more expensive than imported ones, explaining that the Nigeria First policy is supposed to help bridge the gap by giving a certain percentage gap for MDAs to buy goods made-in-Nigeria. He added that most MDAs argue that imported items are cheaper, hence their preference for them.

“This was why in MAN’s Annual General Meeting (AGM) in October 2025, the theme of the AGM was ‘Made-in-Nigeria First.’ And the government representative at the meeting, the Minister of State for Trade and Investment, acknowledged that and pledged that the government would prioritise promoting ‘Made-in-Nigeria.’ So, we are hoping that this will take off effectively and priority should be given to ‘Made-in-Nigeria’ goods in public procurement. But as of now, it has not been really effective. Most of the MDAs are not following the pronouncement by the administration in May. They still bypass it and still procure from other sources,” he said.

Aluya stated that if the government fully implements the Nigeria First policy, it would have a multiplier effect on manufacturing companies in Nigeria as there will be huge demand, which will give companies the opportunity to expand their production capacity and even do more investments, thereby creating jobs and solving the problem of unemployment the country is facing at the moment.

He maintained that whether there is a new executive order or not, the most important thing is that there should be a penalty for breach of procedures.

“If there are no penalties attached to it, there’s no way the MDAs are going to stick to the rule. So, executive order or no executive order, the most important thing is let there be a sanction for any government agency, MDA or establishment that breaches the Nigeria First policy. Once that happens, everybody will fall in line,” he said.

Asked what other support the manufacturing sector needs to produce optimally besides issuing executive orders and implementing them to the letter, Aluya said: “What we have been crying about over the years is infrastructure deficits. We don’t have good roads. We don’t have power. We don’t have rail. All these things are needed to produce. The typical one is the national grid going down regularly. How can you be producing when the national grid will be going down? You cannot produce like that. So, steady power is what we require. And the only thing we require the government to do is to create the enabling environment, provide infrastructure.

Tariffs for electricity have been raised several times, but yet the supply has not improved. So, it’s the infrastructure that we need.”

To the President, Lagos Chamber of Commerce and Industry (LCCI), Mr. Leye Kupoluyi, the Nigeria First policy and 30 per cent procurement from local manufacturers is a step in the right direction. He, however, said there are so many things needed to improve the manufacturing sector, such as power, access to credit and protecting the local market.

He added: “If we allow the market to continue to be flooded with foreign goods the way it is now, we will continue to weaken our local manufacturing sector. Government must provide better access to funding and at single-digit interest rates to help manufacturers. What is the difference between a developed country and a developing one? It is simply each country’s manufacturing base. It has nothing to do with the mineral resources in that country.

“If you look at the list of developed countries all over the world, their manufacturing sector is very strong. Take China and India for instance; look at their industrial base and compare it with ours. Most drugs we use in Nigeria now are from India. Why can’t we develop our own and start exporting to others? If a country wants to be developed, manufacturing is a major area of interest for that country.

“Our youths have shown that they have the skills. Many of our youths who have left Nigeria and are all over the world, providing the services they are unable to provide back home. What this means is that we must give our youths the necessary environment needed for them to excel within Nigeria. We must make our environment conducive for young people to innovate and the government must live up to its expectations before we can talk about industrialisation,” Kupoluyi said.

Indeed, many countries around the world, including developed nations, have policies to promote local goods preference. The United States of America has the ‘Buy American Act’ which requires federal agencies to prefer U.S. made goods under many procurement contracts; and the Berry Amendment, which requires the U.S. Department of Defence to buy domestically produced food, clothing, fabrics, and specialty metals. Also, China has policies that favour domestically made products in government procurement. Specifically, it has a provision of a 20 per cent price evaluation advantage to qualifying domestic products in public tenders, which means Chinese products can be more expensive yet still win based on adjusted evaluation price.

The Director General of the MAN, Segun Ajayi-Kadir, disclosed that as at 2023, 335 manufacturing companies were ailing in the country and that 767 shut down operations nationwide. He attributed this to a number of issues. According to him, at 30-35 per cent, the prevailing high interest rates and limited access to credit have made it difficult for manufacturers to secure the funding needed for expansion or modernisation.

Ajayi-Kadir also stated that with a staggering N3.04 trillion worth of raw materials imported in 2023 alone, Nigeria’s heavy dependence on imported raw materials exposes many manufacturers to global market fluctuations and foreign exchange risks.

The third quarter of 2025 report by KPMG earlier cited aligns with some of the demands being made by manufacturers. The report lists a number of factors that would drive the growth of the manufacturing sector to include government unlocking access to long-term finance needed for critical long-term projects by strengthening and recapitalising DFIs like BOI, NEXIM, and others, just as government must also work with SEC and NSE to deepen capital markets for large-scale equity funding.

The report also says the reforms in the power sector must continue and be accelerated to drive real industrialisation while other infrastructure such as rail and road transport must remain areas of focus for the government. The report also suggested digitalisation and automation of border clearing processes to reduce the average time to clear goods.

“We need more efficient and cost-effective ports. There is a need to streamline the number of taxes/levies to reduce compliance burden on manufacturers/businesses. Government needs to continue to provide single digit interest loans to SMEs through BOI, Bank of Agriculture, etc. The scope and reach of support services being provided by SMEDAN to SMEs should be expanded,” the report says.

-

World News6 hours ago

World News6 hours agoIran Confirms Supreme Leader’s Death As Attacks Continue

-

News6 hours ago

News6 hours agoFG Issues Advisory To Nigerians In Middle East

-

Politics6 hours ago

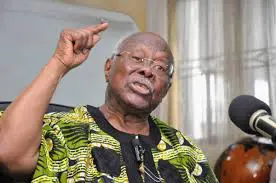

Politics6 hours agoNigerians Are Hungry, Will Shock You In 2027 – Bode George Tells APC

-

World News6 hours ago

World News6 hours agoAyatollah Ali Khamenei: The Leader Who Shaped Iran’s Defiance

-

Metro6 hours ago

Metro6 hours ago‘I won’t be bullied’ – Seyi Tinubu addresses VDM’s claim of secretly funding King Mitchy’s charity work

-

Opinion5 hours ago

Opinion5 hours agoReflections on FCT polls and voter apathy

-

News6 hours ago

News6 hours agoTinubu Renews Tenure Of Audi, NSCDC CG

-

News6 hours ago

News6 hours agoLassa Fever Kills 10 Health Workers In Benue