Opinion

Nigeria’s Capital Market At Risk Of Overregulation

Nigeria is entering a phase of overregulation that risks undermining the capital market it seeks to strengthen. The Securities and Exchange Commission’s January 2026 circular revising minimum capital requirements reflects good intentions but its structure is misaligned with commercial reality, risk, logic and global best practice.

The most problematic element is the treatment of asset managers. The framework links capital requirements directly to assets under management (AUM) including a requirement that managers with over ₦100 billion in AUM hold capital equal to 10 percent of those assets. This is conceptually flawed. Client assets are held in trust segregated with custodians and do not sit on an asset manager’s balance sheet. Treating AUM as balance sheet risk confuses fiduciary responsibility with principal risk.

Asset managers are not banks. They do not lend, take proprietary risk or deploy client assets on their own balance sheets. Applying bank style capital logic to a fee based agency business does not enhance resilience, it immobilizes capital without addressing real operational risk.

The structure also discourages growth. Sharp capital thresholds penalize scale and push firms to limit expansion or restructure artificially. Over time this will reduce competition and concentrate the industry in the hands of a few large players. Even large players might be discouraged to expand as their efficiency ratios such as return on equity may deteriorate with marginal increases in income compared to the increased capital requirement.

This also has direct implications for one of the regulator’s stated pillars, investment literacy and market deepening. Smaller and mid-sized fund managers are typically the primary drivers of retail engagement product, innovation and investor education. If the surviving licensed firms are those with the largest balance sheets their focus will naturally shift toward maximizing return on equity rather than expanding access, educating new investors or developing low-margin retail products. Investment literacy initiatives will weaken as firms prioritize capital efficiency over market outreach.

Global best practice shows a better path. Proportional capital, overhead based buffers, strong governance and client asset protection should be the priority. If Nigeria’s goal is a deeper and more inclusive capital market regulation must support sustainable growth and broad participation but not unintentionally narrow the market and erode previous capital market gains.

Akintunde Odeyemi writes in from Lagos

-

News6 hours ago

News6 hours agoOnly N60m released from N858bn budgeted to bridge electricity tariff gap – NBET tells senate

-

Politics5 hours ago

Politics5 hours ago‘Beer-parlour tales’ – Atiku dismisses Fayose’s claims of ADC VP talks during Minna visit

-

News5 hours ago

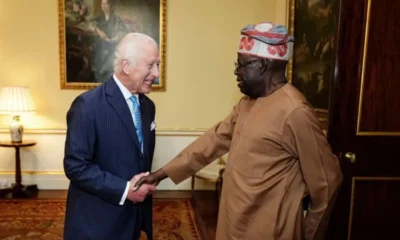

News5 hours agoTinubu’s planned UK visit signals Nigeria’s rising global profile – Lanre Adebayo

-

Business5 hours ago

Business5 hours agoSubmit tax identification details by Feb 20 to avoid service suspension – IKEDC tells customers

-

News5 hours ago

News5 hours agoFubara dissolves cabinet days after Tinubu intervened in Rivers political crisis

-

News5 hours ago

News5 hours agoTinubu’s administration revived dormant Siemens power deal, says German envoy

-

World News5 hours ago

World News5 hours agoNorth Korea’s Kim Jong Un picks 13-year-old daughter as successor

-

News4 hours ago

News4 hours agoVandalism causing flooding on Lagos-Calabar Coastal Highway – Umahi