Business

The $20 Billion Bet: What Shell’s mega-investment says about Nigeria’s new reality

In the world of global investing, confidence is usually expressed in cautious, incremental sums. A few hundred million dollars here, a phased commitment there. That is why Shell’s newly announced $20 billion investment in Nigeria’s energy sector stands out so sharply. This is not just another corporate expansion. It is a bold statement about how one of the world’s largest energy companies now sees Nigeria’s future.

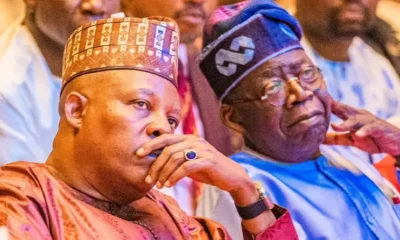

For years, international investors have approached Nigeria with a mix of interest and hesitation. The opportunities were obvious, but so were the risks. Shell’s decision suggests that something fundamental has shifted. It reflects a belief that the country’s ongoing reforms, difficult as they have been, are beginning to produce a more stable and investable environment under President Bola Ahmed Tinubu’s administration. This announcement does not exist in isolation. It comes on the back of renewed foreign interest across technology, manufacturing, and infrastructure. Still, Shell’s scale and long history in Nigeria give this move special weight. When a company with decades of experience in the country commits this level of capital, it is making a judgment not just about resources, but about governance, policy direction, and long-term economic credibility.

More Than Oil: What Shell Is Really Betting On

It would be easy to interpret this investment as a simple vote of confidence in Nigeria’s oil and gas reserves. That would miss the bigger picture. Shell’s decision is tied to a broader assessment of Nigeria’s evolving economic foundations. A key part of that assessment is the long-awaited Petroleum Industry Act. For years, uncertainty around regulation and fiscal terms discouraged major investments in the sector. While the PIA is far from perfect, it has brought a level of clarity that investors value. It sets clearer rules for governance, taxation, and host community engagement, making long-term planning more feasible. For energy majors, reduced uncertainty often matters as much as headline returns.

Macroeconomic reform has also played a role. The removal of fuel subsidies and the move toward a market-driven exchange rate were painful decisions, both economically and socially. They triggered short-term instability and real hardship. Yet from an investor’s perspective, these reforms tackled two long-standing distortions that made Nigeria difficult to price and plan for. The fact that international institutions have begun revising growth forecasts upward reflects growing confidence that these changes, however tough, are pointing in the right direction. Then there is the sheer pull of Nigeria’s market. With a population exceeding 220 million, the country offers scale that few others can match. But it is not just about size. Nigeria’s youthful population is driving changes in consumption, energy use, and technology adoption. Shell’s investment, with its strong gas and downstream components, is a bet on rising domestic energy demand from households, industries, and a growing services sector.

There is also a regional dimension. As the African Continental Free Trade Area takes shape, Nigeria is increasingly seen as a natural base for companies looking to serve the wider African market. An integrated energy strategy in Nigeria supports industrialisation not just locally, but across borders. From that perspective, Shell’s move is as much about Africa’s future as it is about Nigeria’s present.

What This Means Beyond the Energy Sector

An investment of this scale sends ripples far beyond oil and gas. For the government, it is a strong validation of its reform agenda. It strengthens Nigeria’s credibility in conversations with other investors and international financial institutions. At the same time, it raises expectations. Security in the Niger Delta, regulatory consistency, and infrastructure delivery will now be under even closer scrutiny. Confidence, once earned, must be sustained. For the domestic private sector, the signal is powerful. Large investments tend to unlock activity across the value chain, from banking and logistics to engineering and local services. More importantly, they help reset perceptions. When global capital takes a long-term view on Nigeria, it reduces the sense of isolation many local entrepreneurs feel and may gradually lower the risk premium attached to doing business in the country.

For ordinary Nigerians, the real question is impact. Big numbers do not automatically translate into better lives. The true measure of success will be whether this investment leads to jobs, reliable energy supply, and increased public revenue that can be channelled into social services. That outcome depends less on Shell and more on how effectively institutions manage and govern the process. For global investors watching from the sidelines, Shell has effectively made the first move. As one former bank chief executive recently put it, capital flows to places where it is treated with respect and predictability. This decision suggests that Nigeria is beginning to meet that test again, at least in the eyes of serious, long-term investors.

A Moment for Measured Optimism

None of this is to suggest that Nigeria’s challenges have disappeared. Security concerns persist in parts of the country, and infrastructure gaps are still significant. The path to macroeconomic stability is uneven, and setbacks are inevitable. Still, Shell’s announcement feels like a turning point. It suggests that Nigeria is slowly being re-priced in global markets, moving away from the category of a risky gamble toward that of a strategic, long-term opportunity. The reforms of the past year have opened a window of credibility, and Shell has chosen to step through it. The rest of the world is watching closely. If this investment is executed successfully and supported by consistent policy and improved governance, it may come to be seen as the moment Nigeria firmly re-established itself on the global investment map. For now, it stands as the clearest signal yet that the country is not only open for business, but determined to reclaim its place as an economic heavyweight in Africa. (BusinessDay)

-

Politics8 hours ago

Politics8 hours agoJanuary 23 Is ‘World Betrayal Day’ – Kwankwaso

-

Politics8 hours ago

Politics8 hours agoDon’t Insult Kwankwaso – Kano Govt Warns

-

Politics1 hour ago

Politics1 hour ago2027: Storm as Shettima’s fate divides APC

-

Metro22 hours ago

Metro22 hours agoAustralia Revokes Licence Of Nigerian Nurse Caught Sleeping On Duty

-

Politics8 hours ago

Politics8 hours ago‘Obi or nothing’ not helpful – ADC warns supporters against divisive politics

-

News8 hours ago

News8 hours agoMilitary Air Strikes, Ground Troops Hit Terrorist Hideouts In Kwara

-

Politics22 hours ago

Politics22 hours ago‘It’s Betrayal Of Kano’ – Kwankwasiyya Movement’, NNPP Slams Governor Yusuf Over Defection

-

Opinion8 hours ago

Opinion8 hours agoA case for special anti-corruption courts