Business

Banks Recapitalisation Watch for the Week Ended February 12, 2026

Bank recapitalisation activity remained relatively sober this week as banks continue preparations ahead of the March 31, 2026, regulatory deadline. Market attention is currently focused on institutions progressing through validation and capital confirmation processes with the Central Bank of Nigeria (CBN).

FCMB Group is reportedly undergoing CBN validation to confirm whether it has met its recapitalisation target. Should the verified capital fall short of regulatory requirements, the Group may consider a private placement to a strategic investor(s). Conversely, a successful validation outcome would likely prompt a formal announcement confirming compliance with the minimum capital requirement threshold.

Meanwhile, analysts are awaiting further clarity from Sterling Bank regarding its recapitalisation plans. Market expectations suggest the bank could pursue a rights issue or a private placement to meet the N200bn minimum capital requirement, given its current capital of N167bn.

Last week, GTCO Plc proceeded with a N10.0 billion private placement, issuing 125.0 million ordinary shares at N80.00 per share, which a single investor fully subscribed. Analysts interpret the transaction as a proactive capital optimisation strategy rather than a regulatory necessity, designed to enhance balance-sheet flexibility, reinforce capital buffers, and support medium-term growth initiatives. The successful placement underscores sustained investor confidence and suggests that GTCO is positioning itself ahead of evolving regulatory, macroeconomic, and competitive pressures in the banking sector.

First HoldCo Plc’s FY 2025 unaudited results, released over the weekend, highlight the strain that asset quality challenges can impose on the bottom line. The reporting period was marked by significant balance-sheet pressure, driven by an impairment charge that weighed on earnings. While the move reflects a deliberate effort to reset the loan book and address underlying credit risks, it came at the cost of near-term profitability. The results reinforce the sensitivity of capital buffers to abrupt risk crystallisation and underline the importance of early capital planning, strong governance, and timely balance-sheet remediation as regulatory expectations tighten.

Beyond individual balance-sheet actions, market intelligence during the week pointed to unconfirmed speculation about a potential strategic merger between two tier-1 banks and possible bank-led investments in Nigeria’s refinery and broader energy infrastructure. While these developments remain speculative, they signal growing interest among banks in diversification strategies.

The recapitalisation momentum was further broadened by the CBN’s latest Fintech Report, which highlights the expanding role of digital finance in Nigeria’s financial system. The report underscores the fintech sector’s contribution to financial inclusion, payment efficiency, and innovation, while also identifying funding constraints and the need for regulatory alignment to support sustainable growth. For banks, the findings reinforce the strategic importance of balancing competitive pressures from fintechs with partnership opportunities that can enhance operational efficiency and product reach.

Progress and Challenges Across the Banking Spectrum from Previous Weeks

- Union Bank: Prospective foreign investment interest, particularly from the United Arab Emirates (UAE), has been reported. A lingering legal dispute involving a former core investor, the TGI Group, is expected to be resolved soon, leaving a tight window to complete capital restructuring.

- Keystone Bank: Competing investor interest includes a local consortium seeking preferred-bidder status. While local investors’ capacity to raise capital independently remains questionable, market awareness of foreign investors’ interest suggests a possible joint acquisition, though the move appears less likely.

- Polaris Bank: Expected to pursue investor-led recapitalisation or merge with another Tier-2 bank, which market intelligence suggests is Wema Bank, a move analysts view as supportive of broader industry consolidation and institutional strengthening.

Proshare’s Economic & Market Intelligence Unit (EMIU) notes that the CBN appears receptive to mergers and acquisitions involving banks with marginal or negative shareholder funds as a strategic pathway to build larger, more resilient institutions. While domestic investors continue to express interest in distressed banks, capacity constraints for meeting unencumbered capital requirements independently suggest that strategic foreign partnerships may be necessary.

For banks listed on the Nigerian Exchange Limited (NGX), capital-raising outcomes have varied. With less than two months to the deadline, most Tier-1 and Tier-2 banks have met revised capital buffers. However, Tier-3 banks are in a race to avoid forced combinations and remain relevant in the post-recapitalisation landscape.

Other Updates Include:

- FirstHoldco announced that its commercial banking subsidiary, FirstBank of Nigeria (FirstBank), has successfully met the Central Bank of Nigeria’s (CBN) minimum capital requirement of N500bn. This milestone was achieved following the completion of a series of strategic capital initiatives, including a Rights Issue, a Private Placement, and the injection of proceeds from the divestment of the Group’s merchant banking subsidiary.

- Access Holdings Plc has successfully raised N594.90bn in its ongoing recapitalisation exercise.

- Sterling Financial Holdings Company successfully raised a total of N88.07bn in the Public Offer as of September 30, 2025. Proceeds from the offer are expected to bolster Sterling Bank Limited’s capital adequacy, provide capital for SterlingFi Wealth Management, and fund the Group’s broader strategic expansion plans.

- UBA recently raised about N157.84bn in additional capital, pending approval from the Securities and Exchange Commission (SEC) and the Central Bank of Nigeria (CBN). The Rights Issue will strengthen UBA’s capital position ahead of the CBN’s recapitalisation deadline.

- Meanwhile, Standard Chartered Bank Nigeria Limited and other unlisted banks have similarly announced compliance with the N200bn minimum capital requirement for national commercial banks, ahead of the March 31, 2026, deadline.

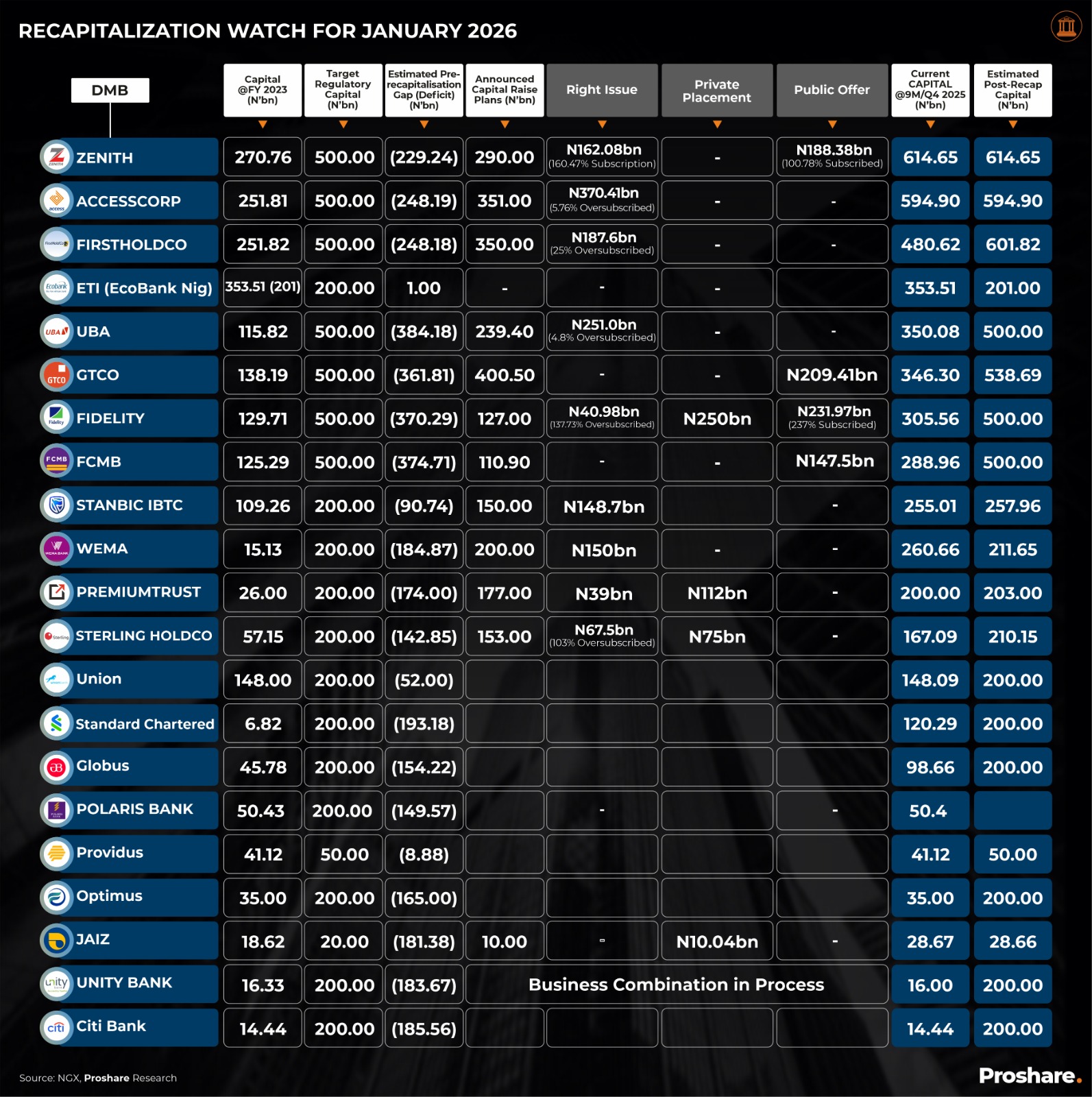

We maintain that investors evaluating banking-sector stocks consider each bank’s new equity capital, earnings growth potential, and the likely twelve-month forward earnings per share (EPS) and price-to-earnings ratio (P/E). Proshare’s EMIU expects earnings per share (EPS) of several banks to fall in the short term. It is also likely that price-to-earnings (P/E) ratios may rise significantly as EPS takes a soft or hard tumble, depending on future earnings growth (see the Table below)

Table 1

(Proshare)

-

News21 hours ago

News21 hours ago‘It was cross-examination’ — Charles Aniagolu says Mehdi Hasan didn’t interview Bwala

-

News21 hours ago

News21 hours agoHardship: How FCT Women Are Converting Their Private Cars To Commercial Use

-

Business21 hours ago

Business21 hours agoMiddle-East War Pushes Up Petrol, Food Prices

-

World News21 hours ago

World News21 hours agoMojtaba, Khamenei’s son, appointed as Iran’s new supreme leader

-

News21 hours ago

News21 hours agoCharge Or Release El-Rufai – Lawyers, ADC Tell ICPC

-

News19 hours ago

News19 hours agoFiscal strain shadows Nigeria’s reforms despite revenue gains- Senator Musa

-

Politics21 hours ago

Politics21 hours agoAbsence from congress, meetings with opposition figures, is Badaru on his way out of APC?

-

Business20 hours ago

Business20 hours agoIraqi oil production falls 70% as Strait of Hormuz disruptions hit exports