News

No 25% levy on building materials in Tax Act – FG counters Amaechi

The Federal Government has refuted claims that the Nigeria Tax Act 2025 imposes a 25 per cent levy on building materials, construction funds, or bank balances.

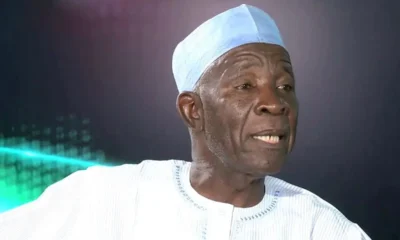

Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, made the clarification in a statement issued on Sunday via X, in response to a viral video of former Minister of Transportation, Rotimi Amaechi.

Amaechi, while addressing crowd during a gathering, warned of impending economic hardships if the All Progressives Congress retains power in the 2027 elections.

“The tax law is if I pay you 100 million Naira for your building materials, automatically 25 million will leave your account.

“If you are a landlord and building a house, you will charge 25% extra because you won’t bear it alone; you will transfer it to the person who buys or rents,” the former minister stated.

But Oyedele said both claims that the new tax laws would commence in 2027 and that it would introduce a 25 per cent tax on funds for building materials and other transactions were incorrect.

“We are aware of a recent video claiming that the new tax laws will commence in 2027 and alleging the imposition of a 25% tax on funds for building materials and other transactions.

“Both claims are incorrect. Contrary to the misinformation seeking to create fear, panic and disaffection, the Nigeria Tax Act 2025 has already commenced and does not impose a 25% tax on construction funds, bank balances, or business expenses.

“Instead, it contains provisions specifically designed to reduce the cost of housing, rent and real estate development,” he said.

Oyedele outlined key provisions of the Act aimed at lowering housing costs and encouraging real estate development.

According to him, land and buildings are exempt from Value Added Tax under Section 185(l), while contractors can recover input VAT on materials, assets, and overhead costs where VAT is applicable.

He added that a reduced Withholding Tax rate of 2 per cent now applies to construction contracts, while mortgage interest is tax-deductible for individuals developing owner-occupied residential houses under Section 30(2)(iv).

Property owners earning rental income, he said, can deduct related expenses such as repairs, insurance, and agency fees under Section 20 of the Act.

On reliefs for renters and tenants, Oyedele stated that individuals can claim rent relief of up to ₦500,000, representing 20 per cent of annual rent, under Section 30(2)(vi).

He further noted that rent is exempt from VAT and that lease agreements with an annual value below ₦10m, or 10 times the annual minimum wage, are exempt from stamp duty under Section 134.

The committee chairman also listed incentives for investors and developers.

“𝘊𝘢𝘱𝘪𝘵𝘢𝘭 𝘎𝘢𝘪𝘯𝘴 𝘛𝘢𝘹 𝘌𝘹𝘦𝘮𝘱𝘵𝘪𝘰𝘯 (𝘚.51(1)): Individuals pay no Capital Gains Tax (CGT) when disposing of a dwelling house or an interest in one.

“𝘙𝘌𝘐𝘛 𝘐𝘯𝘤𝘦𝘯𝘵𝘪𝘷𝘦𝘴 (𝘚.162(𝘤)): Real Estate Investment Trusts (REITs) are exempt from Companies Income Tax (CIT) when distributing at least 75% of their dividend or rental income within 12 months after the financial year-end.

“𝘗𝘳𝘪𝘰𝘳𝘪𝘵𝘺 𝘚𝘦𝘤𝘵𝘰𝘳 𝘐𝘯𝘤𝘦𝘯𝘵𝘪𝘷𝘦𝘴: Manufacturing of building materials such as iron, steel, and domestic appliances qualifies for specific tax exemption under the economic development incentive scheme for up to 10 years.

“𝘙𝘦𝘥𝘶𝘤𝘦𝘥 𝘊𝘰𝘳𝘱𝘰𝘳𝘢𝘵𝘦 𝘛𝘢𝘹 𝘙𝘢𝘵𝘦 (𝘚.56): Scope for the reduction of companies’ income tax rate for large businesses from 30% to 25%,” he said.

He noted the Act provides priority sector incentives for manufacturers of building materials such as iron, steel, and domestic appliances for up to 10 years, as well as scope for reducing Companies Income Tax for large businesses from 30 per cent to 25 per cent under Section 56.

Oyedele added that small companies would benefit from zero per cent Companies Income Tax, exemption from charging VAT, and no deduction of Withholding Tax from their invoices and payments.

He stressed that the Act does not tax money in bank accounts, transfers for buying building materials, or introduce any 25 per cent construction or business cost tax.

“The Act does not tax money in bank accounts or bank balances. It does not tax transfers for buying building materials. It does not introduce a 25% construction or business cost tax. It does not delay implementation until 2027,” he said.

Dismissing the viral claims as false, Oyedele concluded: “Fact Not Fear, evidence beats emotion. If anyone makes an alarming claim or tries to misinform you, ask them ‘Where is it in the law?’

“With the new tax laws, housing should become more affordable, and rent should go down, NOT up!”

-

Opinion15 hours ago

Opinion15 hours agoA vote for electronic transmission

-

News15 hours ago

News15 hours agoRibadu’s bugged phone: El-Rufai under fire as probe calls rise

-

News15 hours ago

News15 hours agoGov Yusuf Removes Buba Galadima As Kano Poly Governing Council Chair

-

News15 hours ago

News15 hours agoUS military aircraft drops ammo in Borno

-

News7 hours ago

News7 hours agoPresidency refutes Amaechi’s allegations on tax law

-

News15 hours ago

News15 hours agoHow 36 Nigerian youths ended up in Russia-Ukraine war

-

Business14 hours ago

Business14 hours agoOver 115,000 MSMEs access $200m funding support – FG

-

Business14 hours ago

Business14 hours agoCapital gains tax hits record N522bn in 2025