30 States Risk Bankruptcy As Lagos, Rivers Set For New VAT Regime

Many states in Nigeria may not be able to meet their financial commitments as the federal government could lose revenue from taxes amidst dwindling revenue in recent times with a court ruling assigning the collection of Value Added Tax (VAT) and two other taxes to states.

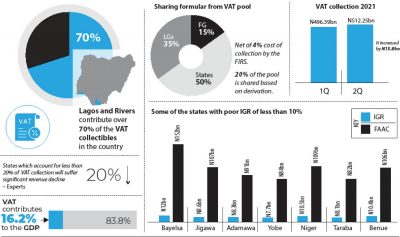

VAT contributes significantly to the total revenue generated by the government, accounting for over 16.2% of the Gross Domestic Product (GDP) in 2019.

Most states depend on funding from the Federal Allocation Account Committee (FAAC) due to their poor Internally Generated Revenue (IGR).

Lagos and Rivers states, which contribute over 70 per cent of the VAT collectibles in the country, have decided to enact a law that will empower them and not FG, to collect VAT in their states.

Their action is based on the judgement of August 11 by a Federal High Court in Port Harcourt, which held that VAT collection was for the states and not for the federal government through the Federal Inland Revenue Service (FIRS).

VAT was introduced via Decree No.102 of 1993. It replaced sales tax operated under Decree No.7 of 1986, which was administered by states and the Federal Capital Territory (FCT).

Until now, the FIRS had the responsibility of collecting VAT on behalf of the 36 states and the FCT. Section 40 of the VAT Act requires that the VAT pool be shared 15% to the FG; 50% to states; and 35% to LGs (net of 4% cost of collection by the FIRS). Twenty per cent of the pool is shared based on derivation.

The Federal Government generated over N2.5 trillion from VAT alone in the last 18 months as outlined in the 2020 Finance Act.

According to data filed by the Federal Inland Revenue Service (FIRS) from the National Bureau of Statistics (NBS), Nigeria may have earned about N2.5 trillion from January 2020 to June 2021 at a 7.5 per cent VAT rate.

The breakdown shows that FIRS collected about N1.53tr in 2020 with import VAT being N348 billion (or 22.7%) while foreign non-import VAT was N420bn (or 27.4%) and local VAT amounted to N763bn (or 49.8%).

In the first quarter of 2021, VAT collection was N496.39bn while it increased by N15.8bn in the second quarter to N512.25bn.

The breakdown of VAT generation for Q2 shows that N187.4bn was from non-import VAT locally, N207.7bn from non-import VAT for foreign goods. The balance of N117.1bn VAT was from the Nigeria Customs Service (NCS) VAT on imports.

Lagos holds public hearing on VAT bill

Taking a cue from Rivers State, a public hearing on the Lagos VAT bill titled, ‘Bill for a Law to Impose and Charge Value Added Tax on Certain Goods and Services, Provide for the Administration of the Tax and for Related Matters,” was held on Wednesday. The bill had passed through first and second reading on Monday.

According to the bill, the tax which shall be charged and payable on the supply of all taxable goods and services other than goods and services listed in the schedule of the law shall be computed at the rate of 6 per cent on the value of goods and services as prescribed under sections 5 and 6 of the Law, except the goods and services listed under Part III of the Schedule which shall be taxed at zero rates.

Section 5 of the bill provides that the value of taxable goods and services shall be determined in the following ways: (a) where the supply is for money consideration, its value shall be deemed to be an amount, which with the addition of the tax chargeable is equal to the consideration; (b) where the supply is for a consideration not consisting of money, the value of the supply shall be deemed to be its market value; and (c) where the supply of taxable goods and services is not the only matter to which consideration in money relates, the supply shall be deemed to be part of the consideration as is properly attributed to it.

Also, the open market value of supply of taxable goods and services shall be the amount that would be taken as its value under subsection (1)(b) of this Section where the supply was for a consideration in money that could be payable by a person in an arm’s length transaction.

Prepare to pay your next VAT to Rivers, Wike tells business owners

Meanwhile, Governor Nyesom Wike of Rivers State has told companies and business owners operating in the state to be ready to pay VAT for September and subsequent months to the Rivers State Internal Revenue Service.

Speaking at an interactive session with representatives of corporate organisations, the governor said it was necessary to explain the position of the law to the business community in the state.

Wike warned corporate organisations not to feign ignorance of the state VAT law, adding that the state government would not hesitate to seal up the premises of any company that defaults.

He said, “We are going to inaugurate the Tax Appeal Commission by Friday which will be headed by a retired judge of the state.

“Let me tell you the injustice in this country. In June 2021, which we shared in July, VAT collected in Rivers State was N15.1billion. What they gave us was N4.7 billion. See the gross injustice and this money includes contracts awarded by the Rivers State Government.

“This is not an issue of a party; it is the issues of infraction of the constitution, issues of illegality. Look at Lagos; it is not the same party as me. In June 2021, the VAT collected in Lagos was N46.4 billion but see what Lagos got, N9.3 billion. Have you seen the injustice in the country? VAT collected in Kano was N2. 8billion and they gave them N2. 8billion. Is there any justice in this country?” he asked.

FIRS writes National Assembly, wants VAT in exclusive list

Meanwhile, the FIRS in a bid to retain VAT collection has written the National Assembly, seeking the inclusion of the tax in the exclusive legislative list.

The federal tax agency is also requesting the federal lawmakers to approve the establishment of the federal revenue court of Nigeria.

The Executive Chairman of the FIRS, Muhammad Nami, requested these in a July 1 letter addressed to the Chairman of the Constitution Review who is also the Deputy Speaker of the House of Representatives, Idris Wase.

The agency specifically pleaded with the nation’s apex legislative institution, to vest, exclusively, all adjudication of tax disputes, including federal tax laws, companies income tax, petroleum tax, income tax, capital gain tax, stamp duty, VAT, taxes, levies and other laws, regulations, proclamations, government notices and rules on it.

Also, Mathew Gbonjubola, Group Lead, Special Operations Group, FIRS, told reporters yesterday in Abuja that if VAT was ceded to the states to administer, it would breed confusion.

“VAT cannot work at the subnational level and there is no country in the world where VAT works at the subnational level and the reason is that VAT depends on the input-output mechanism,” he said.

Experts back states to collect VAT

Fiscal Policy Partner and Africa Tax Leader at the PriceWaterCoopers (PwC), Taiwo Oyedele, said at least 30 states, which account for less than 20% of VAT collection would suffer significant revenue decline.

Oyedele explained that the federal government might be better off given that FCT generates the second-highest VAT (after Lagos) in addition to import and non-import foreign VAT.

He further clarified that the judgment may also have implications for taxes collectible by local governments, which are currently administered by states as well as the amendment via Finance Act 2020, which introduced Electronic Money Transfer levy in place of stamp duties, among others.

Also commenting, Prof Uche Uwaleke, a former Commissioner for Finance in Imo State and financial expert, said, “The judgement is in line with true fiscal federalism as it returns taxing powers concerning VAT to the state governments.”

If implemented, Uwaleke said, “It will boost the IGR of many states since they will now be in a stronger position to collect VAT. As you know, VAT collection efficiency in Nigeria is low partly because it is centrally collected. So, I think it will reduce the incidence of non-remittance of VAT collections by companies.”

An economist, Dr Muda Yusuf, said that the controversy over the jurisdiction of VAT between the states and federal government was for the judiciary to settle; noting that it was a question of law and the interpretation of the law.

According to the former Director-General of Lagos Chamber of Commerce and Industry (LCCI), VAT is essentially domiciled with the sub-nationals in many jurisdictions around the world, adding that in some instances, it is imposed as a consumption tax.

He stated that there was a strong correlation between the volume and scale of economic activities VAT revenue generated and negative externalities to the host states.

He listed the externalities to include the impact on the environment, pressure on economic infrastructures such as roads, pressure on social infrastructure such as schools and hospitals, social problems such as heightened criminality, waste management as well as urbanisation challenges such as the proliferation of slums and traffic congestion among others.

These externalities, he said, put enormous pressures on the finances of the states that provide the bulk of the VAT revenue.

Court order must be respected – Lawyers

A Senior Advocate of Nigeria (SAN) based in Abuja, Adegboyega Awomolo, said all the parties were bound by the judgement of the court.

According to him, the VAT collection by FIRS could be stopped with the ruling unless the appeal court quickly sits to decide the case as there is currently no stay of execution on the Federal High Court’s ruling.

Jude Okey Ugwuanyi Esq, another lawyer, said, “The powers, as provided in the constitution’s concurrent list does not extend the power of the federal government interfering with the state government to generate tax.

“Value-added revenues ought to belong to states where those activities exist as distinct from mining revenues, he noted in his interpretation of the constitution.”

(Daily Trust)