Business

CBN raises N15trn via treasury bills to cover 2025 budget deficit

The Central Bank of Nigeria (CBN) raised N15.3 trillion from the Nigerian treasury bills (NTBs) market in 2025 to support the federal government’s effort to bridge its budget deficit, according to data obtained from the apex bank.

According to the apex bank, the amount represents a 15.04 percent increase over the N13.3 trillion raised from investors in 2024.

Treasury bills (T-Bills) are short-term debt securities issued by the government to cover budget shortfalls and finance development projects.

The securities bear no interest and are issued at a discount, with repayment made at par value at maturity.

Data from the CBN also showed that the total amount offered for subscription in 2025 rose to N12.8 trillion, representing a 60.2 percent increase from the N7.99 trillion offered in 2024.

However, despite the higher volume raised, total investor subscriptions declined, reflecting the impact of lower yields.

According to the apex bank, subscriptions in 2025 stood at N36.63 trillion, a 5.47 percent decrease from the N8.75 trillion recorded in 2024.

According to the apex bank, subscriptions in 2025 stood at N36.63 trillion, a 76.11 percent decrease from the N38.75 trillion recorded in 2024.

On November 15, the apex bank took a step in asserting full control over the government securities segment of the fixed-income market.

The CBN said it was activating a new regime that mandates the use of its S4 electronic interface for treasury bills auction submissions, with the directive taking effect with an issuance on November 20.(the Cable)

-

World News21 hours ago

World News21 hours agoIran Confirms Supreme Leader’s Death As Attacks Continue

-

Politics21 hours ago

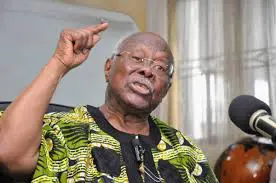

Politics21 hours agoNigerians Are Hungry, Will Shock You In 2027 – Bode George Tells APC

-

News21 hours ago

News21 hours agoFG Issues Advisory To Nigerians In Middle East

-

World News21 hours ago

World News21 hours agoAyatollah Ali Khamenei: The Leader Who Shaped Iran’s Defiance

-

Metro21 hours ago

Metro21 hours ago‘I won’t be bullied’ – Seyi Tinubu addresses VDM’s claim of secretly funding King Mitchy’s charity work

-

Opinion20 hours ago

Opinion20 hours agoReflections on FCT polls and voter apathy

-

News21 hours ago

News21 hours agoLassa Fever Kills 10 Health Workers In Benue

-

News21 hours ago

News21 hours agoTinubu Renews Tenure Of Audi, NSCDC CG