Business

Experts warn informal sector may derail tax reforms

Economic watchers have said that the largely informal nature of the Nigerian economy may pose a roadblock to the implementation of the new tax reforms, which came into effect this January.

This was one of the highlights of a panel discussion at the 2026 Economic Summit organised by the Empowerment Team of the Lagos Province 35 of the Redeemed Christian Church of God on Saturday in Lagos.

The PUNCH reports that the Moniepoint Informal Economy Report 2025 indicated that Nigeria is home to over 39 million Micro, Small and Medium Enterprises, accounting for about 96 per cent of all businesses, contributing 50 per cent to GDP, and employing over 84 per cent of the workforce. Despite their significant contributions to the economy, the businesses remain informal.

This very characteristic of informality is what experts have noted stands in the way of the implementation of the tax reforms, which went into full force this January.

Highlighting the barrier, the Chief Executive Officer of the Centre for the Promotion of Private Enterprises, Dr Muda Yusuf, noted, “One of the things I worry about is that it (tax reforms) looks a bit elitist, and it also does not appear to take into account the huge informal economy that we have and the level of literacy that we have, and that is why there is so much anxiety, despite all the efforts to assure people that it is for their good. Not many people believe, and the communication is also very technical, and now you have imposed a burden on people to go and look for consultants, tax consultants, and people to help them keep books; that is an additional burden, and that is the reality.

“I’m saying that because there’s already a reform fatigue. We are just coming from fuel subsidy reform, we have foreign exchange reform, and we have power sector reform. We have not recovered from that. So, there are issues, because no matter what you say, most of our people who are in Oke-Arin (market on Lagos Island) or even people who are selling cattle in Kara Market, if you check their turnover annually, it will be above the threshold of N100m.

You know how much a head of cattle is. So that is, even the man selling cattle in Kara Market has to pay Company Income Tax. This is not something that is part of our culture of doing business. So, it’s a major cultural transition. It may be necessary, but whether this is the time to go through it is a different matter.”

Lending voice to the issue of reform fatigue, an economist and the CEO of Financial Derivatives, Bismarck Rewane, likened it to constipation, saying, “If you eat too many things at the same time, you end up constipated. Reform fatigue is the same thing as having images. You’re going to have to pace the reforms and sequence them properly so that you don’t end up with nothing at the end of the day. You have got to prioritise. You cannot do all of the same things at the same time. The removal of fuel subsidy is an increase in tax. That is one item at the end of the day that I pointed out: all of these money moves from people to the government. If the money is stranded in the government. It has a negative multiplier. So, you must recirculate. I want you to remember that there was a time when we carried out some reforms, and all the money went to what they called SURE-P. SURE-P was static; nothing happened. The money was stranded. And that same year, the next year, we had a recession because the money didn’t come back into the system.

“So, it’s important that one, taxes are paid; two, that the government recycles it possibly; and three, minimises leakages, but doing too much in too little a time frame will give us fatigue, indigestion and negative outcomes.”

Acknowledging the informality barrier, the Tax Partner at KPMG, Elizabeth Olaghere, said the tax reforms have taken it into consideration, with the domestication of the law by state governments expected to drive compliance further.

She said, “The ecosystem in Nigeria’s informal sector plays a critical role in the GDP. It’s just that measuring and capturing the informal sector has its constraints. That constraint is within the tax system. The reforms recognise this and create a special tax framework for companies operating in the informal sector, which is called the presumptive tax regime. And under the presumptive tax regime, there are going to be simplified tax returns for companies that would be operating in the informal sector. So, the essence is to create that enabling compliance framework to help small businesses, even medium and large businesses that Dr Muda mentioned that are still within that ecosystem of the informal sector, but easing their compliance warning so they will not necessarily have to have an audited financial statement to file their tax returns. It’s just a way to capture them within that tax net.

“This presumptive tax system will be simplified. It will not require your normal run-of-the-mill financial statements. The government is still working on guidelines on how this will be implemented, but there’s going to be an office of the tax ombuds, and this office is going to act as a safeguard to protect the rights. There’s also the domestication of the tax reforms by the state government. About nine states have domesticated this. The essence is to eliminate multiple taxes that a lot of informal companies, or companies in the informal sector, are experiencing. So this should help with the tax compliance framework for companies in the informal sector.”

Yusuf added that a risk with the presumptive tax framework for the informal sector is the transfer to the final customers, because for the businesses, the taxes would be seen as an additional cost, and, invariably, they will pass it on to consumers.

In his closing remarks, the pastor in charge of the province and former Director-General of the Budget Office, Ben Akabueze, called for careful calibration of the tax reforms to ensure they achieve their objectives.

Akabueze said, “It is evident that these reforms are well-intentioned. However, it is often said that the road to hell is paved with good intentions, and this means that even with the best of motives, our actions can still have unintended and sometimes disastrous consequences. That’s what we intend: that sessions like this can help us provide from both the standpoint of, you know, the drivers of the reform and those who are the objects, the targets of the reform. To avail the benefits of the reform incentives will clearly entail some measure of formalisation, and that’s something that we all have to come to terms with, lest the benefits of the formalisation outweigh the cost of the formalisation, which includes the cost of registering businesses just to become visible to the system.

“Unless the benefits outweigh the increased cost. These incentives will simply be ignored by those who are supposed to benefit from them. There are apprehensions about the possible resort to bank statements as a basis for taxation. This is something we need to be very careful about so that we will not reverse some of the gains we have made in financial inclusion.”

On the reforms generally, the former Budget Office DG said, “The reality is that the reform train has left the station, you know, so we must rise to the challenges of compliance. We must also now become poised for what I call fiscal activism, and that means we must all take a keener interest in how our tax money is spent. Generally, you know, become more active in holding, you know, public funds accountable.”(Punch)

-

News19 hours ago

News19 hours agoOgoni leaders petition Tinubu, accuse Wike of sabotaging peace talks

-

Politics18 hours ago

Politics18 hours agoMore Commissioners Quit Gov Yusuf’s Cabinet

-

News18 hours ago

News18 hours agoOver 400,000 jostle for 50,000 police jobs

-

Politics18 hours ago

Politics18 hours agoShettima To Visit Plateau Today For Gov Mutfwang’s Reception Into APC

-

Politics19 hours ago

Politics19 hours agoKwankwaso’s Son Resigns From Gov Yusuf’s Cabinet

-

News18 hours ago

News18 hours agoIPOB directs Onitsha traders to open shops despite Soludo’s order

-

Business16 hours ago

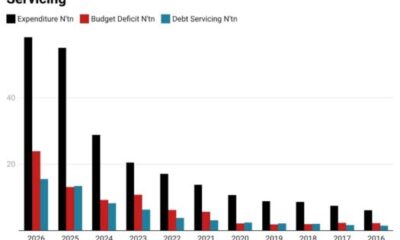

Business16 hours agoNigeria caught in borrowing web as deficit surges 984% in 11 years

-

News18 hours ago

News18 hours agoStrike: Court decides today as FCT workers demand Wike’s removal