Business

Nigeria caught in borrowing web as deficit surges 984% in 11 years

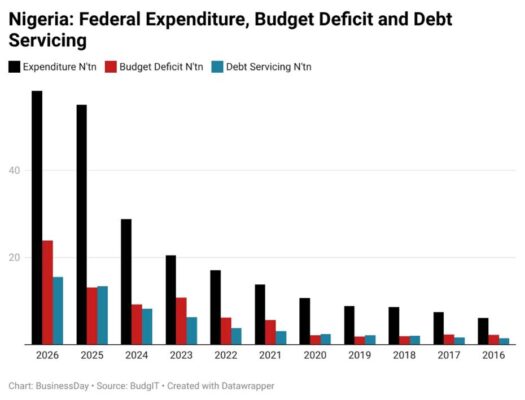

Debt servicing jumped from N1.48 trillion to N15.52 trillion, while federal expenditure surged almost ten-fold to N58.18 trillion from N6.08 trillion over the period, according to a BusinessDay review of BudgIT data.

Wale Edun, minister of Finance, has emphasised domestic resource mobilisation over repeated borrowing, a message aimed at reassuring investors and multilateral lenders increasingly concerned about Nigeria’s fiscal trajectory.

However, debt service now takes up an increasing portion of federal spending. Between 2016 and 2019, interest payments accounted for roughly 24 percent of total expenditure. By 2023, that share had climbed to 31 percent and, in the current 2026 budget, stands at 27 percent, even after aggressive revenue mobilisation. Put simply, more than N1 in every N4 spent by the government goes to servicing debt.

Measured against revenue, the pressure is sharper. In 2023, interest payments consumed nearly 65 percent of federal revenue. In 2026, the figure hovers close to 50 percent. Economists warn that debt service above 20 percent–30 percent of revenue signals crowding out essential spending in developing economies.

“Our fiscal position is not solid enough to accommodate all our expenses,” said Oyekan Idris, a capital market analyst at Quantum Zenith Debt.

“Debt servicing alone gulps a significant share of our revenue. While the rate of increase may slow as revenue improves, public debt is expected to remain high. Nigeria has run deficit budgets consistently for more than a decade, and the outlook suggests this will continue.”

Revenue gains, but deficits persist

Rising revenue has risen but has not kept pace with spending. The 2025 deficit of N13.08 trillion was double the N6.26 trillion recorded in 2022.

In 2026, the shortfall is projected at N23.85 trillion, driven by higher spending ambitions and the structural weight of debt service.

A cursory review shows a projected deficit of N23.85 trillion against revenue of N34.3 trillion, implying a deficit-to-revenue ratio of about 70 percent.

In practical terms, for every N100 the government expects to earn, it plans to borrow about N70, highlighting further pressure on public debt, especially as revenue performance lags projections.

The federal government has shown little willingness to streamline its expenditure profile, according to Oluseun Onigbinde, global director of BudgIT.

Edun maintains that stronger revenue will gradually reduce reliance on borrowing. Speaking at the World Economic Forum (WEF) held recently in Davos, Edun said Nigeria’s priority is domestic resource mobilisation, targeting a tax-to-GDP ratio of about 18 percent within two years.

There are signs of progress. Zaccheus Adedeji, chairman of the Federal Inland Revenue Service, said Nigeria collected N28 trillion in taxes in 2025, exceeding targets, thanks largely to non-oil revenue growth. Gains are attributed to improved compliance, digitalisation, and a broader tax base.

But spending continues to outpace revenue. Federal expenditure more than doubled between 2023 and 2025 and is projected to rise further in 2026. Even with strong revenue, deficits are likely to persist unless spending growth slows or debt service costs fall.

A strategy still in transition

Nigeria’s debt stock is modest by emerging market standards, but its servicing burden remains high relative to revenue. S&P Global Ratings, which revised Nigeria’s outlook to positive in late 2024, acknowledged that fiscal reforms have improved credibility but noted that debt affordability remains a constraint.

“The reforms are directionally positive, but interest payments still absorb a very large share of government revenue,” an S&P analyst said. Fitch Ratings echoed the concern, emphasising that the challenge lies less in the size of the debt than in the cost of carrying it.

Domestic analysts are blunt. Taiwo Oyedele, chair of the Presidential Fiscal Policy and Tax Reforms Committee, argued that revenue growth must be paired with stricter spending discipline and clearer prioritisation to restore fiscal balance. Borrowing, he said, becomes unavoidable when expenditure outpaces sustainable revenue.

Between 2016 and 2026, federal spending increased by about N52 trillion, the deficit expanded by more than N21 trillion, and debt servicing rose by roughly N14 trillion. In this context, borrowing is less a policy choice than a residual outcome of fiscal arithmetic.

Edun’s claim should be seen as aspirational rather than a near-term outcome. Nigeria may reduce borrowing at the margin if revenue reforms continue, but unless expenditure growth slows or debt service costs ease through refinancing or lower interest rates, borrowing will remain embedded in the budget.

The investor perspective

For investors, the signal is mixed but not discouraging. Nigeria is attempting to grow its way out of fiscal stress rather than inflate or default its way out.

The credibility of that strategy will ultimately depend on whether deficits and debt service begin to decline as a share of spending, a point the data suggest has yet to be reached. (BusinessDay)

-

News14 hours ago

News14 hours agoOgoni leaders petition Tinubu, accuse Wike of sabotaging peace talks

-

Politics13 hours ago

Politics13 hours agoMore Commissioners Quit Gov Yusuf’s Cabinet

-

News13 hours ago

News13 hours agoOver 400,000 jostle for 50,000 police jobs

-

Politics13 hours ago

Politics13 hours agoShettima To Visit Plateau Today For Gov Mutfwang’s Reception Into APC

-

Politics14 hours ago

Politics14 hours agoKwankwaso’s Son Resigns From Gov Yusuf’s Cabinet

-

News13 hours ago

News13 hours agoIPOB directs Onitsha traders to open shops despite Soludo’s order

-

Business10 hours ago

Business10 hours agoLawsuit Claims Meta Can See WhatsApp Chats in Breach of Privacy

-

News23 hours ago

News23 hours agoBREAKING: Military finally admits coup plot against Tinubu