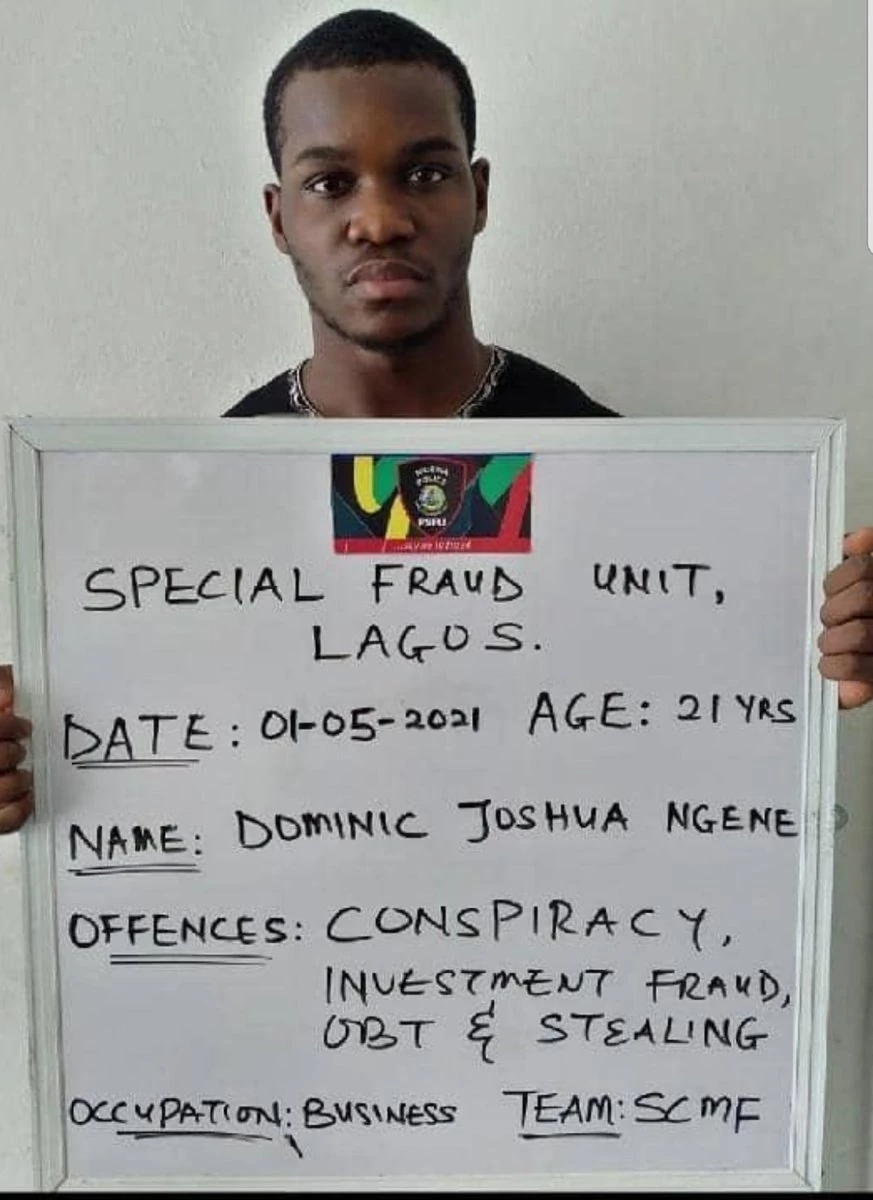

Victims of Brisk Capital share stories of how a 21-year-old scammed them all

He also had little difficulties convincing people to part with huge sums of money, before they even had a chance to think straight.

“He allegedly stole over N2 billion from investors,” says security expert and founder of Chive GPS, Nnamdi Anekwe Chive, whose firm led the police to arrest Joshua. “The 21-year-old promised investors 60% return on investments in real estate, forex, oil and gas etc,” he adds.

Police say Joshua promised investors huge Return On Investments (ROI), went off the radar on pay days and splashed the cash on luxury wrist watches, fast cars and real estate instead.

The smooth talking, good looking, suave, urbane and starry-eyed CEO was arrested in May, after investors waited to no end for the huge payments they had been promised.

Chioma, an online vendor in Owerri, says she discovered Brisk Capital on Instagram and made her first investment of “N500, 000 in November 2020; with a promise of 30% return every month.

Chioma pressured the agent who introduced her to Brisk Capital, to no avail.

She was later told that her money had been used to trade in cryptocurrency, forex and real estate.

Port Harcourt-born Samuel who resides in London, threw in N500,000 into Brisk Capital in March.

He is yet to be paid a dime in monthly returns as promised by Joshua and his team.

“I am also having problems with receiving payments from two other companies,” Samuel says with a sigh of resignation.

He is certain that with Joshua’s arrest, his fate is sealed–he knows he may never get back his money.

Enugu-based Richard who deals in real estate, also fell for Joshua’s silky moves and packaging, investing N500,000 into Brisk Capital in March.

When Richard confronted an agent in Abia who introduced him to Brisk and Joshua, after he was certain that the deal had gone south, he was told there was nothing that could be done and that refunds were no longer possible.

Cursing their luck

Oboe from Asaba says his younger brother had been investing in Brisk for four months and “they paid him every month end, so I joined with N1 million in January.”

The rest has become history. “I never received any payment and nobody told me anything. I spoke to Joshua before I invested and could not reach him when I didn’t receive my profits,” Oboe says.

However, Solomon from Uyo still doesn’t think that Joshua had the intention to defraud people of their hard-earned money ab initio.

He thinks Joshua’s business model and strategy simply sailed into turbulent territory.

“His business model was not sustainable. I have invested with them since November 2020 and they paid regularly until March,” Solomon says.

“They deal in forex and the rate of 30% is not sustainable, given the volatile nature of the forex business,” he adds.

On how his company blew the lid on Joshua’s operations, Chive says “some investors requested the services of Chive GPS to track and collect their trapped funds. So, after we issued him a demand notice and he was not responsive, we then filed a petition to Force Criminal Investigation Department which led SFU (Special Fraud Unit) to arrest him.”

For now, Joshua continues to cool his heels in a police detention facility.

He will soon have his day in court after judicial workers suspended a month-long strike last week, according to Commissioner of Police in charge of the fraud unit, Anderson Bankole.