Business

Investors gain N1.7tn as banking, industrial shares surge

Investors gained approximately N1.70 trillion at the close of Thursday’s trading, as broad-based sectoral advances lifted equities and pushed the benchmark index to a fresh weekly high on the Nigerian Exchange Limited.

Market capitalisation rose to N123.93 tn from N122.24 tn, while the All-Share Index advanced by 2,645.61 points (+1.39 per cent) to 193,073.57, underscoring strong buying activity across major sectors.

The session’s performance was underpinned by advances across major sectoral gauges, particularly banking, industrial and consumer stocks. The NGX Banking Index strengthened to 1,852.15 from 1,804.68 in the prior session, reflecting positive sentiment toward financial stocks. Key banking tickers recorded gains, including Stanbic IBTC (+9.52 per cent), FirstHoldCo (+6.67 per cent), AccessCorp (+4.00 per cent), United Bank for Africa (+2.13 per cent), Zenith Bank (+1.55 per cent) and Guaranty Trust Holding Company (+0.91 per cent).

However, declines in Fidelity Bank (-1.22 per cent) and Wema Bank (-0.37 per cent) tempered the upside.

The NGX Industrial Index edged higher to 7,200.81 from 7,180.10, sustaining the sector’s upward momentum. Performance was supported by gains in Julius Berger (+2.77 per cent) and Lafarge Africa (+2.11 per cent).

The NGX Insurance Index closed at 1,334.83, up from 1,328.24, indicating modest sector strength. Notable movers included FTG Insurance (+10.00 per cent), Custodian (+9.42 per cent), Lasaco (+6.41 per cent), WAPIC (+4.36 per cent) and Linkage Assurance (+1.74 per cent).

Losses were observed in the stocks of AXA Mansard (-7.92 per cent), Guinea Insurance (-4.11 per cent), Universal Insurance (-2.04 per cent) and Regency Alliance Insurance (-0.79 per cent).

The NGX Consumer Goods Index advanced to 4,472.50 from 4,448.49, reflecting improved investor appetite for defensive stocks. Key gainers included Guinness (+9.38 per cent), NASCON (+6.21 per cent), PZ Cussons (+3.74 per cent), Honeywell Flour (+2.16 per cent), and International Breweries (+1.01 per cent). However, declines were recorded in Cadbury (-6.38 per cent), Dangote Sugar (-1.68 per cent) and Tantalizers (-1.20 per cent).

The NGX Oil & Gas Index eased slightly to 4,076.03 from 4,080.66, indicating mild profit-taking within the sector.

Market breadth remained positive, with multiple equities posting strong gains. Top performers included DEAPCAP, Okomu Oil, and FTG Insurance, each advancing 10 per cent, while MCNichols, Multiverse, and NSL Tech led the laggards with 10 per cent declines.(Punch)

-

News11 hours ago

News11 hours agoGunmen Attack Kebbi Communities, Kill 35

-

News11 hours ago

News11 hours ago‘Attack on PIA’ – PENGASSAN asks Tinubu to rescind executive order on oil revenue

-

Politics11 hours ago

Politics11 hours agoWike Moves ‘Rivers War Team’ to Abuja to Secure APC Victory in Council Polls

-

Opinion11 hours ago

Opinion11 hours agoDeepfakes, the liar’s dividend and the battle for truth ahead of 2027

-

Business11 hours ago

Business11 hours agoAlleged pregnancy complications: SunTrust Bank MD seeks court permission to travel abroad

-

News11 hours ago

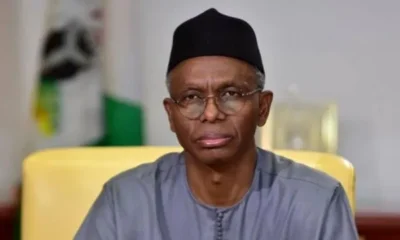

News11 hours agoEl-Rufai’s lawyer protests home raid amid ICPC detention

-

News11 hours ago

News11 hours agoBREAKING: Another Kano Market On Fire

-

Metro9 hours ago

Metro9 hours agoHow bandits hacked Ondo monarch to death — Daughter