Business

Naira is overvalued by 30% against the dollar – Report

Nigeria’s naira is the most overvalued currency in Africa according to a new report from Renaissance Capital Africa (Rencap).

According to RENCAP the Naira is overvalued by as much as 30% based on real effective exchange rate model (REER).

The analysis is coming at a time where the exchange rate is at one of its strongest levels in over a year and external reserves hitting $41 billion.

What the report is saying

The report opines that Nigeria has been experiencing food price deflation throughout 2025, suggesting the current headline inflation rate of 20% is over stating the inflation rate.

While the National Bureau of Statistics (NBS) reported inflation above 20% in August, the Rencap report projects that inflation is closer to 12% in October, 10% by December, and on track for 6% in 2026.

- Nigeria updated its consumer price index basket in January assigning new weightings to various items.

- This led to a drop-in inflation rate from about 34.8% in December 2024 to 24.48% in January 2025.

- The gap between official and unofficial inflation data, however, raises credibility issues. Rencap highlights “peculiar anomalies” in the Consumer Price Index (CPI) basket which is a measure for inflation rate.

- For example, non-alcoholic beverages account for 12% of the CPI basket, more than transport (11%) and four times the weight given to telecoms (3%).

This distortion, it argues, has caused official CPI to diverge from actual price trends.

- Rencap suggests that this faulty data has left the Central Bank of Nigeria (CBN) “keeping policy excessively tight.”

- With policy rates still at 27% despite inflation closer to 10%, Nigeria now has one of the highest real interest rates in the world at 17%.

- For context, Egypt’s real rate is 14% and Argentina’s just 6%.

Important to note that most of its assumptions are at best technical and may not the reality of a lot of Nigerians in terms of prices.

What this means for Naira

This mix of tight monetary policy, a stable exchange rate, and a current account surplus has created an artificial stability around the naira, Rencap opines.

- But it also warns that the naira is now more than 30% overvalued, making it the most mispriced currency on the continent.

- In the short term, the currency is expected to hold steady at N1,400–N1,450/$ by year-end 2025.

- But once interest rates are eventually cut and domestic credit growth resumes, imports are expected to surge.

This could trigger a 30% depreciation in the currency by 2026–2027.

FPI expectations

The report is also coming at a time when global investors are recalibrating their positions in African markets.

With oil prices stuck in the $60–70 per barrel range and the dollar expected to weaken, the investment house notes that local debt in both Nigeria and Ghana has become increasingly attractive.

However, the underlying dynamics driving both countries are markedly different.

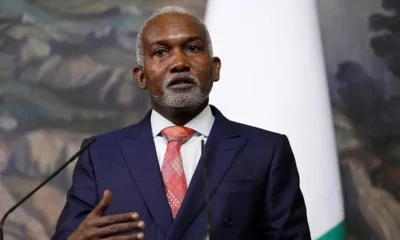

With President Bola Tinubu seeking re-election in 2027, Rencap expects the CBN may delay aggressive rate cuts until after the elections, prolonging the naira’s artificial strength. (Nairametrics)

-

World News9 hours ago

World News9 hours agoIran Confirms Supreme Leader’s Death As Attacks Continue

-

Politics9 hours ago

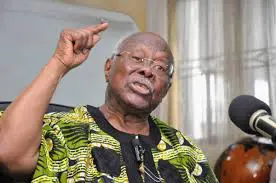

Politics9 hours agoNigerians Are Hungry, Will Shock You In 2027 – Bode George Tells APC

-

News9 hours ago

News9 hours agoFG Issues Advisory To Nigerians In Middle East

-

World News9 hours ago

World News9 hours agoAyatollah Ali Khamenei: The Leader Who Shaped Iran’s Defiance

-

Metro9 hours ago

Metro9 hours ago‘I won’t be bullied’ – Seyi Tinubu addresses VDM’s claim of secretly funding King Mitchy’s charity work

-

Opinion8 hours ago

Opinion8 hours agoReflections on FCT polls and voter apathy

-

News9 hours ago

News9 hours agoTinubu Renews Tenure Of Audi, NSCDC CG

-

News9 hours ago

News9 hours agoLassa Fever Kills 10 Health Workers In Benue