Big 4 maintain market dominance as audit firms earn N17.34 billion fees in 2023

The big audit firms in Nigeria, KPMG, PWC, Deloitte, and EY, typically referred to as the Big Four maintained industry dominance yet again in 2023, as 50 of the most capitalized companies on the Nigerian exchange paid a total of N17.34 billion as audit fees.

This represents a whopping 46.7% increase compared to N11.82 billion paid out to auditors in the previous year.

This is according to analysis carried out by Nairalytics, the research arm of Nairametrics based on the audited financial statements of the companies.

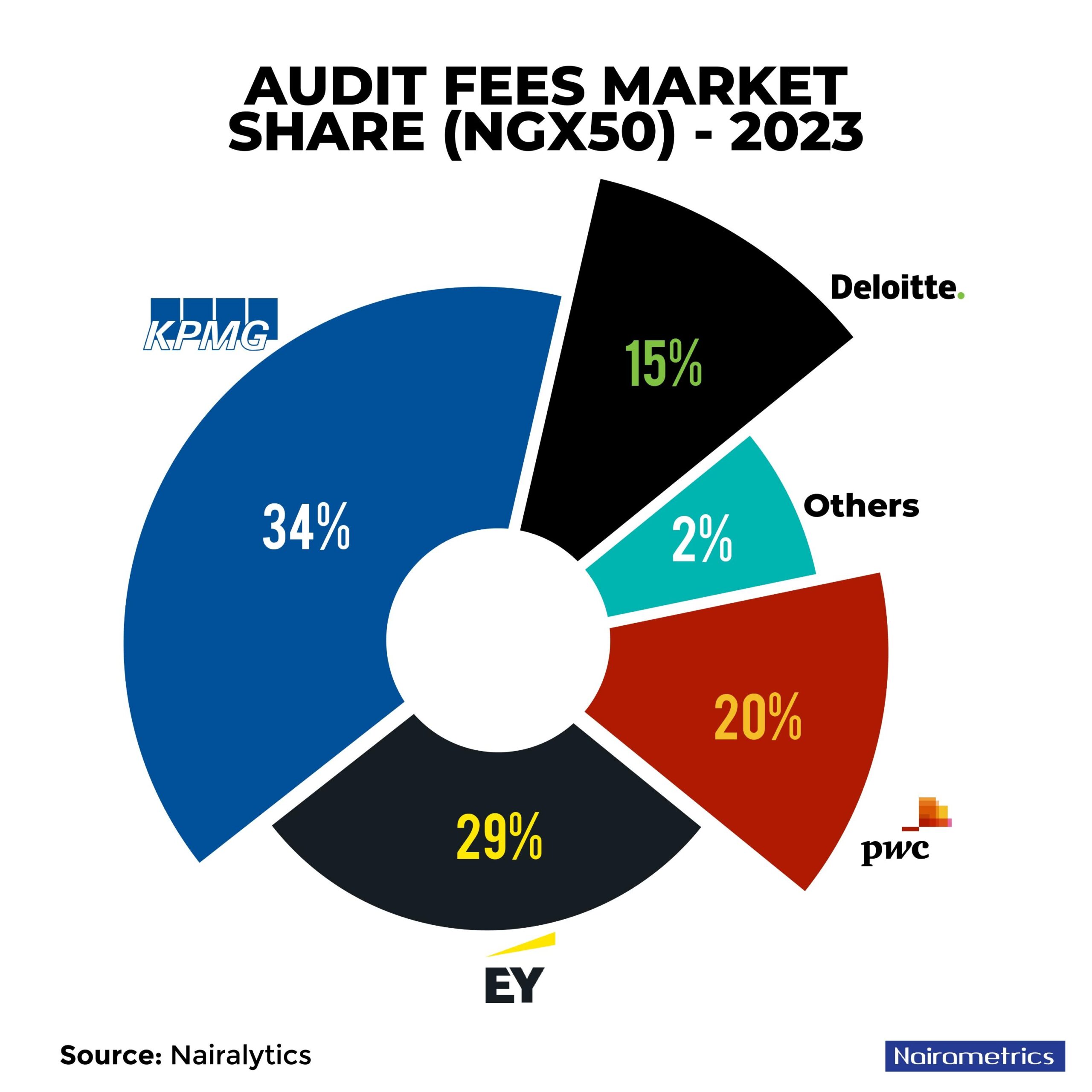

Further analysis shows that KPMG led the pack with a 34.5% market share in terms of income, followed by EY and PWC with 29% and 20.4% shares respectively.

However, based on the number of clients, PWC ranked first with a share of 28%, closely followed by Deloitte at 26%, while EY accounted for 22% of the share.

External auditors play a pivotal role in ensuring the integrity and transparency of financial statements. By providing an independent assessment of a company’s financial health, they enhance investor confidence and contribute to the overall stability of financial markets.

- In Nigeria, where regulatory scrutiny and market expectations are on the rise, the demand for robust external auditing services has become more pronounced. Auditors help detect and prevent fraud, ensure compliance with regulatory requirements, and provide valuable insights that can drive operational efficiency.

- These auditors charge varying amounts to companies based on different factors such as size and complexity of the company, industry, regulatory environment, internal control environment, scope of audit, experience and reputation of the audit firm, duration of audit, and geographical location amongst others.

- It is worth adding that the industry leader-board often changes as a result of the regulation of a 10-year period for the rotation of auditors to public companies according to the Nigerian Code of Corporate Governance (NCCG) 2018, issued by the Financial Reporting Council of Nigeria (FRC).

- Nairalytics analysed the highest-grossing audit firms of 2023 in Nigeria, providing insights into the sectoral distribution of audit cost, and big-ticket audit accounts in the country.

Highest grossing Auditors

4: Deloitte – N2.52 billion

- Deloitte ranked fourth on the list of audit firms with the highest audit revenue from the list of companies in 2023, earning a total of N2.52 billion and accounting for 14.6% of the entire market share.

- This however represents a decline from the N2.85 billion recorded in the previous year, partly due to the takeover of the UBA account by EY.

- Meanwhile, big-ticket accounts like FCMB, Fidelity, Sterling Holdings, and Transcorp ensured the multinational remained a major force in the Nigerian audit industry in the review period.

- Deloitte boasts of a rich client base across the agricultural, banking, conglomerate, consumer goods, energy, industrial goods, oil and gas, as well as services.

3: PWC – N3.54 billion

- PriceWaterCooper (PWC) ranked third on the list with a gross earning of N3.54 billion from the listed companies, representing 20.4% market share. Its revenue from the companies declined by 18.1% compared to the previous year when it earned a total of N4.32 billion.

- The decline was following the change of auditors by Access Holdings from PWC to KPMG.

- However, major accounts such as Zenith Bank, Seplat, Stanbic IBTC, and BUA Cement played a crucial role in sustaining PwC’s significant presence in the Nigerian audit sector.

- These clients, known for their extensive operations and complex financial needs, underscored PwC’s ability to handle large, intricate audit engagements.

- The client base of PWC cuts across banking, consumer goods, energy, industrial goods, oil and gas, and other financial services sectors.

2: EY – N5.04 billion

- Ernst and Young (EY) ranked second on the list with a gross earning of N5.04 billion from the listed companies, representing 29% market share. Its revenue from the companies surged by 179% compared to the previous year when it earned a total of N1.8 billion.

- Key to EY’s impressive growth were its major clients, including UBA, GTCo, MTN Nigeria, and Lafarge Africa. These big-ticket accounts underscored EY’s capability to handle complex and extensive audit engagements, solidifying its status as a dominant force in the Nigerian audit market.

- The firm’s success highlights the importance of securing high-profile clients in driving revenue and market presence in the competitive audit industry.

EY’s client base cuts across agriculture, banking, aviation handling, consumer goods, industrial goods, other financial services, and telecommunications sectors.

1: KPMG – N5.98 billion

- In 2023, KPMG topped the list of audit firms in Nigeria, generating the highest revenue of N5.98 billion. This impressive figure represents a 226% increase from the previous year’s earnings of N2.64 billion, capturing a commanding 34.5% market share.

- KPMG’s robust performance was driven by significant clients such as Access Holdings, FBN Holdings, Dangote Cement, and Flour Mills Nigeria.

- These big-ticket accounts not only bolstered KPMG’s revenue but also reinforced its position as a leading force in the Nigerian audit industry.

- Its client base is spread across banking, consumer goods, industrial goods, and insurance sectors.

The banking sector leads payment ranking

As explained earlier, audit fees are largely driven by different factors, one of which is the size and regulatory environment of the industry. Analysis by Nairalytics shows that the banking sector paid the highest audit fee in 2023, grossing a total of N11.43 billion, accounting for almost 66% of the total.

- Banks typically incur higher audit costs compared to other types of companies due to several distinct factors associated with their operations, regulatory environment, and risk profile. The banking sector audit costs were largely driven by major banks like UBA, Access Holdings, GTCo, FBN Holdings, and Zenith Bank.

- Using the average audit cost per company, which is more reflective of the true audit cost, the banking sector also leads the pack with an average of N1.04 billion audit cost in 2023 followed at a distance by industrial goods with N312.8 million and telecommunications with N276 million.

- Other sectors on the rank include oil and gas with N196.24 million, conglomerate (N157.4 million), consumer goods (N142.1 million), and agriculture with N70.7 million.

Big-ticket Audit accounts

In terms of companies with the highest audit cost, banks dominated the top 5 list of companies, which was led by UBA, having spent N2.56 billion on its 2023 annual audit. This is 109.2% higher than the N1.23 billion recorded in the previous year.

- United Bank for Africa (UBA) is a Multinational pan-African financial services group headquartered in Lagos Island, Lagos and known as Africa’s Global Bank. It has subsidiaries in 20 African countries and offices in London, Paris and New York, hence the high audit cost.

- Following UBA was Access Holdings with N2.18 billion spent on paid to its auditor in 2023. Others include GTCo with N1.55 billion, FBN Holdings (N1.54 billion), and Zenith Bank with N1.34 billion.

- Meanwhile, the likes of Dangote Cement (N1.27 billion), FCMB (N787.6 million), and Seplat Energies (N630 million) also made the list.

Bottom line

- The increase in audit fees in 2023 underscores the growing confidence in and reliance on external auditors by Nigerian companies. This rise in expenditure can be attributed to several factors, including the increasing complexity of financial regulations, the need for more comprehensive audits, and the rising expectations from stakeholders for greater financial transparency and accountability.

- The dominance of the big audit firms in Nigeria’s financial sector illustrates the essential role they play in upholding the standards of corporate governance.

- As the industry continues to evolve, the competition among these firms is likely to intensify, driving further improvements in audit quality and service delivery.

- For investors, regulators, and the companies themselves, the presence of strong, independent external auditors remains a cornerstone of a healthy financial system.

Methodology

- A non-random sample of the 50 most capitalized companies on the NGX was selected for this survey, which accounted for 83% of the entire market size.

- Audit cost implies the amount paid to auditors for both interim and final account audits for the financial year.

- The average audit cost per sector is calculated as the total audit cost in the sector divided by a number of companies.

(Nairametrics)