The Central Bank of Nigeria (CBN) says credit extended to the government by banks surged to N42.02 trillion in September 2024, representing a 78.6 percent increase from N23.52 trillion in January.

Credit to the government typically includes loans, bonds, and other forms of financial support banks and financial institutions provide to governments.

According to data from the CBN, credit to the government experienced fluctuations from January through September.

The figure stood at N23.52 trillion in January, jumping to N33.93 trillion in February before falling to N19.59 trillion in March.

The apex bank said credits to the government slightly rose to N19.98 trillion, followed by a significant increase to N28.38 trillion in May.

By June, according to the data, the figure declined to N23.93 trillion and further decreased to N19.83 trillion in July.

The trend shifted upward again in August, with credit reaching N31.15 trillion and finally peaking at N42.02 trillion in September.

‘CREDIT TO PRIVATE SECTOR SLIGHT DECLINED IN NINE MONTHS’

Amid an uptick in government borrowing, the CBN data showed that credit to Nigeria’s private sector fell by 1 percent between January and September this year.

The data said credit to the private sector started the year at N76.48 trillion in January, rising to N80.86 trillion by February. In March, however, it declined to N71.21 trillion and rose marginally to N72.92 trillion in April.

By May, credit increased by 2 percent, reaching N74.31 trillion, followed by N73.19 trillion in June and N75.51 trillion in July. In August, the amount slightly dropped to N74.73 trillion before edging up to N75.84 trillion in September.

According to TheCable Index analysis, the figures indicate a general fluctuation in private-sector lending throughout the period, despite an overall increase in government borrowing.

MONEY SUPPLY HIT N108.95 TRILLION IN SEPTEMBER

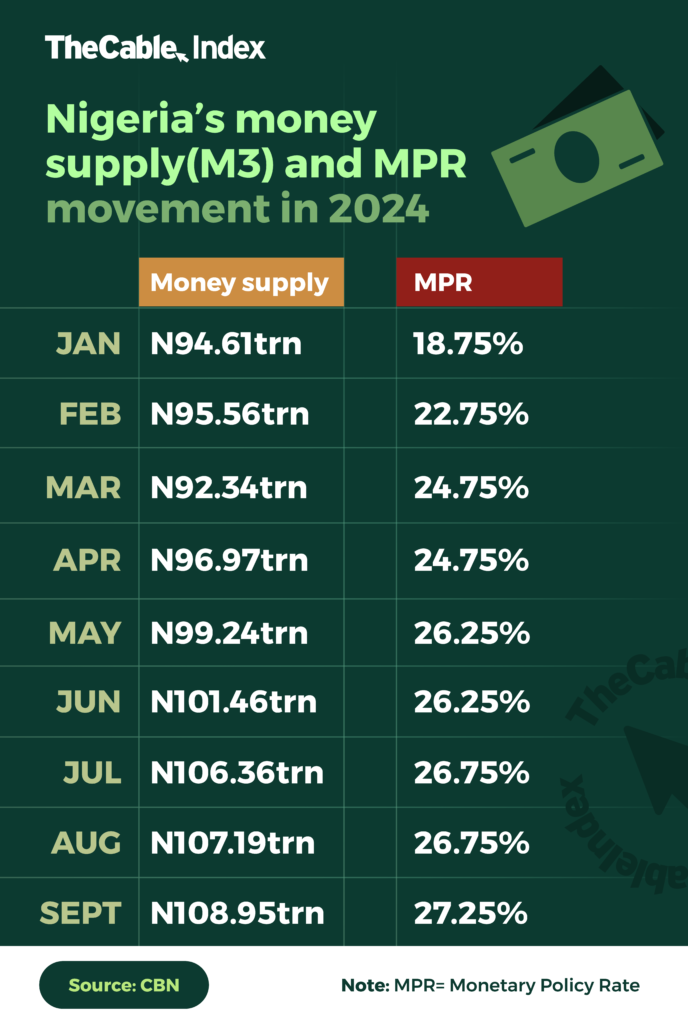

Despite the Monetary Policy Committee’s tightening measures, aimed at reducing excess liquidity to manage inflation, the money supply (M3) trended upward between January and September.

The M3 represents the total money circulating in the economy, encompassing both easily accessible funds and less liquid forms of money.

In January, M3 stood at N94.61 trillion, rising to N108.95 trillion by September — a 15.16 percent increase within the period.

In September, the MPC of the CBN raised the monetary policy rate (MPR), which benchmarks interest rates, from 26.75 percent to 27.25 percent.

Announcing the decision of the committee after its 297th meeting, Olayemi Cardoso, CBN’s governor, said the increase was to further tame inflation.

“The uptrend poses severe concerns to members as it clearly indicates the persistence of inflationary pressures,” he said.

“Members thus reiterated the need to work in close collaboration with the fiscal authority to address the current upward pressure on energy prices.”

The CBN governor said the MPC noted the continued growth in money supply, recognising the need to curtail excess liquidity in the system as well as address foreign exchange demand pressures. (The Cable)