Eight months after, subsidy gains favour governors over citizens

…34 states record N1.6trn surplus in 2024– W’Bank

The complete removal of petrol subsidies in October 2024 was supposed to be a painful but necessary sacrifice, one that would free up billions for national development and ease Nigeria’s fiscal burdens.

But one year after the policy took full effect, it is a tale of two situations—one where state governors bask in unprecedented revenue windfalls, and another where ordinary citizens struggle to survive amid skyrocketing prices and dwindling incomes.

The World Bank’s latest Nigeria Development Update (NDU) revealed a disturbing paradox: While state governments recorded a staggering N1.6 trillion surplus in 2024, millions of Nigerians sank deeper into poverty, unable to afford necessities due to the inflationary spiral triggered by subsidy removal.

The broken promise of subsidy removal

When the federal government finally ended petrol subsidies in October 2024, officials promised that the savings would be reinvested in public transportation, healthcare, education, and infrastructure.

However, according to the World Bank, only half of the expected revenue gains have reached the federation account, leaving Nigerians to bear the full brunt of higher petrol prices without seeing commensurate benefits.

Alex Sienaert, World Bank’s lead economist for Nigeria, explained at the report’s launch in Abuja:

“NNPC began applying the official exchange rates for all its transactions and fiscal revenue calculations back in October, so no more implicit subsidy. But as of January, NNPC was still only transferring about half of the resulting revenue gains from the subsidy elimination to the federation,” Sienaert said.

The delay, he noted, was due to unresolved arrears and financial reconciliations between the NNPC and the federal government. This means that while Nigerians endured the pain of subsidy removal, the financial relief meant to cushion the effect remained stuck in bureaucratic limbo.

State governors smile to the bank

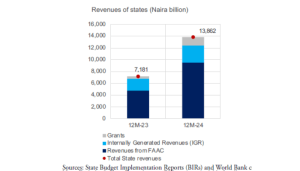

While the federal government grapples with incomplete remittances from NNPC, state governments are swimming in cash. Data from the World Bank shows that 34 states recorded a combined surplus of N1.6 trillion in 2024, a massive jump from the N437 billion surplus in 2023.

The biggest beneficiaries were oil-producing states like Akwa Ibom, Delta, and Ondo, which enjoyed a 31 percent share of the increased revenue, thanks to the 13 percent derivation fund.

Their revenues surged from higher crude oil earnings, refunds from previous deductions, and a 46 percent increase in internally generated revenue (IGR).

“The seven oil-producing states accounted for 31 percent of the total revenue increase in 2024,” the World Bank report stated. Additionally, grants and aid to states nearly tripled, further boosting their financial standing.

With overflowing coffers, state governments ramped up spending, particularly on capital projects (CAPEX). Total state expenditure rose from N6.7 trillion in 2023 to N12.2 trillion in 2024, with CAPEX more than doubling from N3.3 trillion to N7.4 trillion.

But back on the streets, there’s little sign that this boom is benefiting the people who need it most.

‘We Are Sacrificing Alone’

On paper, increased state spending should translate to better roads, schools, and hospitals. But for many Nigerians, there is little evidence of such investments.

In Lagos, bus driver Adewale Ojo scoffed at the idea that states are using their funds wisely. “Since the removal of petrol subsidy, transport fares have doubled, but our roads are still terrible,” he said. “Every month, we hear that the government has more money, but nothing changes for the poor.”

Citizens in both urban and rural areas have described the effects of subsidy removal as devastating. A bag of rice now sells for N85,000; transport fares have doubled; and the cost of electricity, where available, has surged.

In Surulere, Mojisola Adebayo, a market woman, said business has slowed because fewer people can afford food. “What are we gaining from this hardship?” she asked. “They are building bridges and painting government houses, but our children are out of school,” she noted.

“Before subsidy removal, I could feed my family with N20,000 a week,” said Grace Okon, a social media marketer, said via X, formerly known as Twitter. “Now, the same amount barely lasts a meal. How are we supposed to survive?”

Reorient public spending – World Bank

In its latest Nigeria Development Update, released in May 2025, World Bank urged Nigeria to adopt a more targeted approach to public spending by establishing a compact between the federal government and states, aimed at improving the country’s development outcomes.

The bank emphasised the need for Nigeria to reallocate its public resources more efficiently, particularly in sectors critical to human development such as primary healthcare and basic education.

“To spend better, Nigeria should reorient its public resources towards meeting its development goals,” the report stated. “A compact could enshrine spending commitments that would strengthen the allocative efficiency of spending.”

The World Bank suggested that the compact includes minimum spending thresholds on health and education, for example, as a percentage of total state budgets. It also called for increased funding to the Basic Health Care Provision Fund (BHCPF) and the Universal Basic Education Commission (UBEC), as well as performance-based financing through matching grants.

With Nigeria’s 36 states and the Federal Capital Territory (FCT) responsible for the majority of spending on essential public services and infrastructure, the report noted that coordinated action is necessary to improve outcomes nationwide.

In addition to spending reforms, the World Bank urged improvements in the Federal Accounts Allocation Committee (FAAC) system. Recommendations included capping non-statutory deductions and publishing data and documents from FAAC participants to enhance transparency and accountability.

The proposed compact, according to the Bank, could also include strategies for aligning skills development with the needs of the private sector to promote inclusive economic growth. (BusinessDay)