Business

Banks’ Credit To Private Sector Drops By N6trn In 4 Months

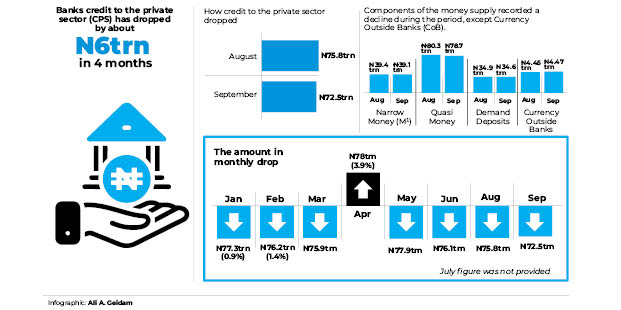

Credit to the private sector (CPS) by deposit money banks (DMBs) has dropped by about five per cent month-on-month (MoM) to N72.5 trillion in the month of September, according to the data obtained from the Central Bank of Nigeria (CBN).

With the latest drop, the credit to the private sector has dropped by over six trillion in the last four months amidst complaints of prohibitive interest rates which have limited the capability of private businesses to secure banks’ facilities.

The money and credit statistics data released by the CBN indicated that the credit to the private sector dropped from 75.8 trillion in August to 72.5 trillion in September.

Daily Trust reports that there has been a sustained decline in the last since the beginning of the year after the figure ended 2024 with N78 trillion.

It dropped to N77.3 trillion in January representing 0.9 per cent decrease; N76.2 trillion (1.4%) in February; 75.9 trillion in March and in April the figure rose by 3.9 per cent to N78 trillion.

However, between April and September, the CPS which includes loans, trade credits and other account receivables and supports provided by banks to the private sector has consistently recorded a decline, down by 7.7% within the period.

From N78 trillion in April, it dropped to N77.9 trillion in May; N76.1 trillion in June; N75.8 trillion in August and N72.5 trillion in September; the July figure was not provided in the data.

The data also showed that the various components of the money supply recorded a decline during the period, except Currency Outside Banks (CoB).

Narrow Money (M¹), also declined by 0.76 percent MoM to N39.1 trillion in September from N39.4 trillion in August.

Quasi Money decreased by 1.99 percent MoM to N78.7 trillion in September from N80.3 trillion in August.

Likewise, Demand Deposits fell by 0.86 percent MoM to N34.6 trillion in September from N34.9 trillion in August.

But Currency Outside Banks rose marginally by 0.45 per cent month on month to N4.47 trillion in September from N4.45 trillion in August.

The decline in money supply is driven by a 2.1 percent MoM decline in credit to the economy to N96.7 trillion in September from N98.8 trillion in August, according to analysts.

The Apex Bank had during the Monetary Policy Committee (MPC) meeting held last month cut interest rates by 50 basis points from 27.5 per cent to 27 per cent. It was the first time in five years that the apex bank would cut rate due to the slight disinflation trend in the economy.

However, businesses insist the current rates are too high and prohibitive for businesses as some banks charge as much as 30 per cent as borrowing rates.

Why decline in credit – Expert

Experts and analysts say the steady decline in CPS was largely due to the cost of borrowing which is too high and not sustainable for any entrepreneur.

Director/CEO, Centre for the Promotion of Private Enterprises (CPPE), Dr. Muda Yusuf said no business can be profitable with a 30 per cent borrowing cost.

According to him, the high interest rates do not encourage people to borrow.

He said, “It’s more about the cost of borrowing which is too high. What do you want to do with an interest rate of 30% or even 35%? What do you want to do with that that would be profitable? One major factor which I think is responsible is the high interest rate. Most of those figures that are still outstanding are possibly people that are already owing the banks.

“You know when you are already owing them, it’s not easy to return their money because you have used the money to buy machinery, otherwise the figure would have been much less than that if people had their way.

“So basically the issue is about the cost of the credit. For me, I think that’s the biggest factor in the decline because high interest rates do not encourage people to borrow. It doesn’t.

“Look at all the sectors. How many sectors can we say can support a credit of even over 20%? How many sectors? What will be your return on investment for you to be able to pay that kind of interest rate? That for me is the biggest factor.”

Given the last rates’ cut by the CBN, Yusuf stated that further rate cuts would be largely driven by inflation numbers.

“All these things will depend on what happens to inflation numbers, what happens to exchange rates, you know, and those factors. If those variables are still in good territory, if they are improving, then that’s an indication that there is no major risk in the macroeconomic environment if there is a relaxation of the monetary condition.

“So it depends on what happens at the time of their (MPC) meeting. If inflation continues to drop and even appreciates as you can see then you may expect a further rate cut. So it is a conditional thing.”

A financial analyst and aviation stakeholder, Capt. Samuel Calcrick who was speaking yesterday at a 2025 Transportation summit in Lagos said no business can survive by borrowing at 30 to 35 per cent when the profit margin is far less than the interest rates.

For instance, he stated that in aviation the profit margin is about three per cent, saying bank’s credit facilities at double-digit interest rates are unrealistic for businesses. (Daily trust)

-

Metro22 hours ago

Metro22 hours agoKidnappers threaten Edo victims over N40m ransom

-

News22 hours ago

News22 hours ago$9m lobbying deal: SANs, bishop urge probe

-

Politics21 hours ago

Politics21 hours agoRemoving Tinubu in 2027 only way to reclaim Nigeria – ADC

-

Metro22 hours ago

Metro22 hours agoRoyal Rumble: Alaafin weighs litigation over Oyo council leadership

-

Social Media News22 hours ago

Social Media News22 hours ago‘God called him, Flavour recalled him’ – Fans react to Odumeje’s new video

-

News22 hours ago

News22 hours agoPolice Rescue 7 Kidnap Victims, Arrest 12 Suspects In Nasarawa

-

News22 hours ago

News22 hours agoNigerians sleep in waste bins amid UK deportation threat

-

Metro22 hours ago

Metro22 hours agoTwo Nigerians kill friend over woman in India