UK crown dependencies to be targeted by transparency campaigners

A key architect of the push to lift the veil of corporate secrecy in UK overseas territories has vowed to now pursue a similar initiative against Guernsey, Jersey and the Isle of Man.

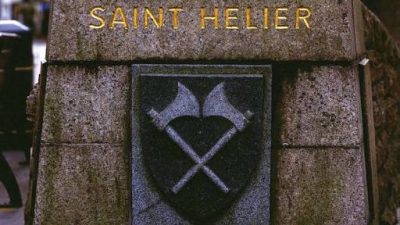

Andrew Mitchell, a Conservative MP and former minister, said the three UK crown dependencies — which are leading offshore financial centres — should be forced to disclose publicly for the first time who owns the companies based there.

Mr Mitchell and Margaret Hodge, a Labour MP and former minister, on Tuesday successfully pressed the government into accepting an amendment to its sanctions bill that will require UK overseas territories including the Cayman and British Virgin islands to make available to the public details of the beneficial owners of companies registered in their jurisdictions.

The MPs regard this move as a critical tool in the fight against tax evasion and money laundering.

But the initiative has prompted an outcry in some UK overseas territories, which have accused the British government of damaging their economic interests.

The territories were also angered by how the transparency initiative did not apply to the crown dependencies, given they all compete for offshore financial business.

But Mr Mitchell said on Wednesday he would fight to ensure Guernsey, Jersey and the Isle of Man adopt similar public registers on the owners of companies based there.

It is unconscionable that these measures should apply to one set of territories and not the other. We need consistency between them all

He said: “We are going to go after the crown dependencies. Now that parliament has made clear that the overseas territories must introduce public registers by the end of 2020, we expect the crown dependencies to adopt the same policy and to share the same values . . . If they do not, then parliament will seek to ensure that they do.”

The crown dependencies were excluded from the amendment to the sanctions bill because they have a different governance structure, which meant it was not possible to bring them within the scope of the legislation, said Mr Mitchell.

But he is investigating the best mechanism to ensure that if the crown dependencies do not voluntarily adopt similar transparency measures, parliament can force them to.

Ms Hodge said: “It is unconscionable that these measures should apply to one set of territories and not the other. We need consistency between them all.”

However the push for similar transparency arrangements in the crown dependencies is likely to meet fierce resistance.

Geoff Cook, chief executive of Jersey Finance, a body that promotes the island as an international financial centre, said there were legitimate reasons for companies and individuals to want privacy.

He also raised doubts about the efficacy of public registers in tackling illicit financial flows if these arrangements are not properly monitored.

“I don’t think criminals will have any problem disguising who they are on public registers if there is no verification,” he said. (Financial Times)