Business

Tolaram’s Guinness expands footprint to northern Nigeria after Diageo exit

Guinness Nigeria has expanded its distribution foothold to several states in the north after the exit of British drinks giant Diageo just over a year ago, Girish Sharma, the company’s managing director and chief executive officer, told The Africa Report in an exclusive interview in Abuja.

“First and foremost, we’ve continued the good work that Diageo had done. Geographically, we’ve tried to expand our coverage,” he said while speaking on how Guinness Nigeria has fared since Tolaram’s takeover.

The northern part of Nigeria was not directly catered to during the Diageo era, he said, adding that the company did not go beyond Abuja after its expansion to the country’s capital.

“One of the very first things that we did, and that was one of the quick wins for us as well, was to actually open up Guinness Nigeria to other geographies.

“Today, for example, Guinness Nigeria has distributors as far as Maiduguri, Zamfara and Sokoto,” Sharma said.

Guinness Nigeria is a beverage company producing both alcoholic and non-alcoholic beverages.

Two of its products “that sell a lot in the northern part of Nigeria” are Malta Guinness and Dubic Malt, according to the CEO.

Tolaram, a conglomerate with interests in consumer goods, digital services, energy and infrastructure, signed a deal to acquire Diageo’s 58.02% shareholding in Guinness Nigeria in June last year and completed the transaction three months later.

It raised its stake to 70.86% this year through its subsidiary N Seven Nigeria Limited, which bought out minority shareholders.

Naira’s stability underpins turnaround

Guinness Nigeria was one of the companies hardest hit by the large devaluations of the naira in 2023 and 2024.

The liberalisation of the foreign exchange regime, designed to unify exchange rates, saw the naira fall more than 70% against the dollar in under eight months.

One of the very first things that we did, and that was one of the quick wins for us as well, was to actually open up Guinness Nigeria to other geographies

Businesses heavily reliant on foreign currency for imports or debt servicing bore the brunt, with many reporting steep forex losses and having struggled to repatriate earnings.

The Lagos-listed brewer staged a comeback in the year ended 30 June 2025 as it swung to a profit after tax of N16.2bn ($11.2m) compared with a loss of N54.77bn in the previous year.

It posted a profit of N10.08bn in the three months to September as revenue jumped 66% to N496.61bn.

Its shareholder funds, which turned negative in March 2024, surged to N28.44bn in September 2025 from N1.86bn in December.

“I think a big reason why we’ve been able to turn around the fortunes of Guinness Nigeria is the moves that have been made by the government to stabilise the currency,” Sharma said.

The naira has found a measure of stability over the past year, rising to about N1,440 per dollar on 11 November from as low as N1,900/$ in the first quarter of last year.

“Foreign exchange stability has really helped Guinness Nigeria,” the CEO said.

“The only request to the government is consistency. They have to ensure that stability remains, for us to continue to grow. There are green shoots now, but we need to see further growth.”

Expansion beyond Nigeria on the cards

The Guinness Nigeria boss said the company would consider expanding beyond Nigeria to tap opportunities in other markets.

“There are lots of opportunities, but we want to take it easy because we strongly feel that there are opportunities for us to grow and consolidate in Nigeria,” he said.

“I would rather first of all do that before we start looking at other markets outside of Nigeria.”

The African alcoholic beverage market has been experiencing significant growth in recent years due to changing consumer preferences, rising disposable income and increasing young population, according to market intelligence firm 6Wresearch, which expects it to grow by 7.1% annually between 2025 and 2031.

Sharma said in addition to the geographical expansion in Nigeria, the company has also focused on becoming more efficient in running its factories and managing its workforce to boost productivity.

He described the Nigerian drinks market as “very exciting” and “extremely competitive”.

“Clearly, one thing that we strongly believe in our DNA as Guinness Nigeria, as a Tolaram Group-owned company, is that competition is generally very good for the country,” he said.

“It keeps everyone on their toes, and it keeps you hungry for growth as well.”

… a big reason why we’ve been able to turn around the fortunes of Guinness Nigeria is the moves that have been made by the government to stabilise the currency

He pointed out that just over a year ago, Tolaram had zero footprint in the alcohol and beverage industry.

“The alcoholic beverage industry is predominantly led by very few companies. Now we feel very privileged to now sit at that table and create an impact, starting from Nigeria and then hopefully expanding beyond Nigeria,” Sharma said.

The market is dominated by global players including Heineken and AB InBev.

Nigeria’s large, young population offers significant market potential, despite currency fluctuations and regulatory challenges, according to research firm Mordor Intelligence.(The Africa Report)

-

News21 hours ago

News21 hours agoHardship: How FCT Women Are Converting Their Private Cars To Commercial Use

-

News21 hours ago

News21 hours ago‘It was cross-examination’ — Charles Aniagolu says Mehdi Hasan didn’t interview Bwala

-

Business21 hours ago

Business21 hours agoMiddle-East War Pushes Up Petrol, Food Prices

-

World News21 hours ago

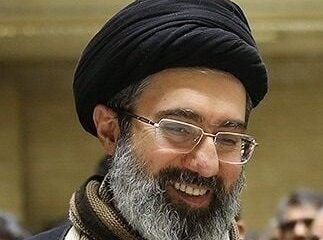

World News21 hours agoMojtaba, Khamenei’s son, appointed as Iran’s new supreme leader

-

News21 hours ago

News21 hours agoCharge Or Release El-Rufai – Lawyers, ADC Tell ICPC

-

News19 hours ago

News19 hours agoFiscal strain shadows Nigeria’s reforms despite revenue gains- Senator Musa

-

Politics21 hours ago

Politics21 hours agoAbsence from congress, meetings with opposition figures, is Badaru on his way out of APC?

-

News20 hours ago

News20 hours agoFashola, Banire lead Lagos pushback against federal bid to control coastlines