Business

SEC approves ‘marked to market” valuation for fixed income securities

The Securities and Exchange Commission (SEC) of Nigeria has approved a two-year transition period, starting September 22, 2025, for fund managers to fully adopt mark-to-market valuation of fixed income securities.

This means that instead of valuing bonds at their purchase price (amortized cost), managers will gradually shift to valuing them at their current market price, which reflects the true and up-to-date value of the assets.

As part of the transition, the SEC has also granted temporary forbearance on asset-allocation rules

- Normally, funds must keep a 70:30 split between mark-to-market and amortized cost, but for the next two years, managers can work with a more flexible 50:50 balance to ease the adjustment process.

- While this hybrid method is permitted, all new fixed income purchases must immediately be valued on a mark-to-market basis.

To ensure accountability, every fund manager is required to submit an implementation plan to the SEC by October 2, 2025, showing how they intend to achieve full compliance before the grace period ends.

In addition, the SEC will partner with FMAN and other stakeholders to carry out investor education programs so that the investing public understands the changes.

(Nairametrics)

-

Business12 hours ago

Business12 hours agoOil Industry Contracting: NCDMB Issues NCEC Guidance Notes, Rules Out Transfer of Certificate

-

News12 hours ago

News12 hours agoKnocks For Tinubu For Attending Wedding Without Visiting Kwara Massacre Victims

-

Politics12 hours ago

Politics12 hours agoMakinde, Wike camps set for showdown at PDP HQ today

-

News12 hours ago

News12 hours agoElectoral Act standoff: Senate calls emergency plenary as protests loom

-

Business12 hours ago

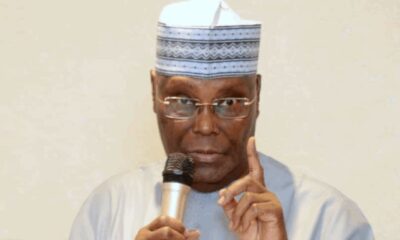

Business12 hours ago‘Should have been sold before rehabilitation’ — Atiku asks NNPC to discontinue proposed refinery deal

-

News12 hours ago

News12 hours agoInsecurity: ADC Spokesman Taunts Tinubu, Says Nigeria Has No Gov’t

-

News12 hours ago

News12 hours agoAbia blames typo after allocating N210m for photocopier in 2026 budget

-

News12 hours ago

News12 hours agoIdle refineries gulp N13tn as NNPC admits waste