Business

How CBN Cut 5,687 Bureau De Change Operators To 82

The Central Bank of Nigeria (CBN) has highlighted how the number of legacy Bureau De Change (BDCs) operators decreased from 5,687 to just 82 in its updated capital and compliance requirements, a major shake-up of the country’s foreign-exchange retail scene.

The regulatory reset marks one of the boldest clean-ups the subsector has seen in years, underscoring the central bank’s commitment to tighter governance and stronger market discipline.

In its online FAQs on the current reform of the Bureau De Change sub-sector, the CBN noted that 82 BDCs met the updated guidelines by November 30, 2025, while the other 5,602 failed to do so, resulting in their licenses becoming invalid.

The bank stated that the market had plenty of time to comply, with an initial six-month transition from June 3, 2024, to December 3, 2024, followed by another six-month extension that ended on June 3, 2025.

The regulator says the end of the extended window marks the close of a gradual compliance phase, and any legacy operators that didn’t meet the set benchmarks are now out of the formal market. An updated list of authorized BDCs is now available on its website to guide stakeholders.

The move is part of a wider reform plan. While the CBN listed 5,687 licensed BDCs in 2023, the number dropped sharply after the bank revoked 4,173 licenses on March 1, 2024, citing ongoing regulatory violations.

“As of November 27, 2025, just 82 operators had gained final approval under the tougher regulatory framework now defining the subsector”, the document noted.

The FAQ document tackled common questions from operators and the investing public, explaining that street currency traders are people carrying out unregistered cash deals in public spaces without approval. This contrasts with licensed BDCs, which operate fully within regulatory guidelines and are officially listed by the CBN.

Regarding ownership, the bank emphasized that BDC licenses aren’t tradable and operators can’t transfer ownership or control without prior approval from the CBN. Any merger, acquisition, capital restructuring, or operational handover must get formal consent. Families can pool resources to apply for a BDC, but they must strictly follow all outlined guidelines.

The CBN also stated that BDCs are not allowed to finance or get involved in unrelated businesses, no matter the size of their capital reserves.

It noted that while there’s no cap on the amount of foreign exchange an individual can sell to a licensed BDC, operators must strictly follow Anti-Money Laundering, Combating the Financing of Terrorism, and Counter-Proliferation Financing rules. For any transaction over $10,000, BDCs must collect all required documents showing the source of the funds.

The updated framework marks a clear regulatory change, aiming to make the FX retail sector more transparent, curb market abuse, and boost investor trust in Nigeria’s financial system.(Inside Business Online)

-

Business23 hours ago

Business23 hours agoOil Industry Contracting: NCDMB Issues NCEC Guidance Notes, Rules Out Transfer of Certificate

-

News22 hours ago

News22 hours agoKnocks For Tinubu For Attending Wedding Without Visiting Kwara Massacre Victims

-

Politics23 hours ago

Politics23 hours agoMakinde, Wike camps set for showdown at PDP HQ today

-

Business22 hours ago

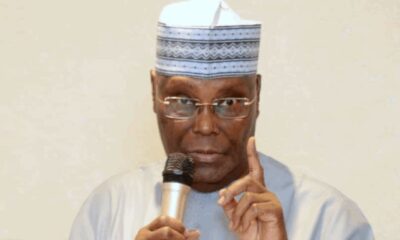

Business22 hours ago‘Should have been sold before rehabilitation’ — Atiku asks NNPC to discontinue proposed refinery deal

-

News23 hours ago

News23 hours agoElectoral Act standoff: Senate calls emergency plenary as protests loom

-

News22 hours ago

News22 hours agoInsecurity: ADC Spokesman Taunts Tinubu, Says Nigeria Has No Gov’t

-

News22 hours ago

News22 hours agoAbia blames typo after allocating N210m for photocopier in 2026 budget

-

Politics22 hours ago

Politics22 hours agoElectoral Act: NLC Threatens Mass Action Over Senate’s Rejection Of Real-Time Transmission Of Results