News

FG’s N30trn revenue gap puts fiscal management under scrutiny

The federal government is grappling with a staggering N30 trillion revenue shortfall in the 2025 fiscal year, a development analysts say exposes deep weaknesses in fiscal management and entrenched corruption that continue to frustrate revenue mobilisation.

The disclosure starkly contradicts official optimism expressed in September, when President Bola Tinubu said the government had already met its 2025 revenue target by August, citing reforms and improved non-oil sector performance.

The President had emphasised that his administration’s Renewed Hope Agenda had prioritised critical infrastructure, health improvements, food security, and enhanced safety for Nigerians.

“We have met our revenue target for the whole year, and we met it in August. Nigeria is not borrowing a dime from local banks. The economy is stabilised; nobody is trading pieces of paper for exchange rate anymore,” the President had said early September during a meeting with former members of the defunct Congress for Progressive Change (CPC) at the Presidential villa, Abuja.

But contrary to his claim, Wale Edun, minister of Finance and coordinating minister of the Economy, on Monday, admitted during an interactive session with the lawmakers that the government has generated only N10 trillion against the N40 trillion projected.

This liquidity crunch has prompted the deferral of 70 percent of 2025 capital projects to 2026, leaving contractors – both local and international – protesting unpaid bills and casting doubt on budget execution.

Despite repeated assurances of economic recovery, analysts say the revenue miss points to a deepening fiscal crisis, persistent mismanagement and weak transparency.

They argue that revenue leakages remain widespread even as government agencies report successes, pushing the administration to rely heavily on borrowing with National Assembly approval, including Eurobond issuances.

Jide Ojo, a renowned public affairs analyst, described the shortfall as a clear signal of Nigeria’s liquidity woes, shattering the narrative of a rebounding economy.

He lambasted revenue leakages and mismanagement, noting the irony of fresh loans despite professed target hits.

“The chicken is coming home to roost. Some of the concerns many financial experts and economists have raised about the pallor state of the Nigerian economy have finally been admitted, although indirectly,” Ojo told BusinessDay.

He recalled Tinubu’s September claim of meeting the full 2025 target, which fueled skepticism when capital spending lagged. “You know, as of September, the President was grandstanding that the government had met their revenue projection for 2025. And people have asked the question, if you did, why is the capital component of the 2025 budget not funded, to the extent that local and international contractors are now protesting non-payments for their contract award?”

Ojo tied the situation to the 70 percent capital deferral, calling it a red flag on planning and execution. He deemed the 2026 budget premature, lacking foundation beyond salary payments, and urged greater transparency.

“It’s very concerning. We are now carrying over 70 percent of capital projects into the new year. So, there is no basis to even have the 2026 budget in the first place. There is no basis. Except for, maybe, salaries.”

Vahyala Kwaga, deputy country director at BudgIT, attributed the revenue shortfall to weak monitoring across the revenue collection chain. He urged stricter prioritisation of capital spending to reduce delays and cautioned that heavy borrowing could further strain domestic financial markets.

“We recently rolled over our Eurobonds. So yes, we were able to liquidate some, but by borrowing new ones. So, we are still trapped within that cycle of repayment,” he said.

Kwaga stressed that personnel costs would persist, but capital allocation remains murky without self-sustaining returns.

“For the existing projects, of course, personnel will be taken care of, but it’s not clear how well the government will be able to prioritise its capital expenditure regime, because for every naira, it should be able to pay itself back. And the government doesn’t seem to be pursuing a regime of revenue growth as aggressive as it should.”

He advocated business-friendly policies to unlock company income taxes, alongside thriving citizens boosting VAT and levies, especially with new tax laws from January 1.

On his part, Awaal Musa Rafsanjani, executive director of CISLAC, urged a shift from consumption to production for revenue growth, decrying waste, resource mismanagement, and a hostile environment shuttering companies.

He slammed the parasitic economy, where borrowings outpace revenues despite improvement claims.

“We are running a very parasite economy. So, it’s not surprising that the government is coming up with these, but they have been telling people that the economy has improved. They are not able to finance the 2025 budget despite the huge borrowing. So, why are we borrowing?” Rafsanjani asked.

He argued that revenues are increasingly used to service debt without generating growth and called for an end to what he described as reckless borrowing.(BusinessDay)

-

News21 hours ago

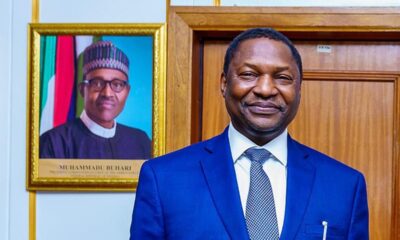

News21 hours agoMalami’s billions traced to Abacha loot, Paris Club refunds, CBN agric loans – Report

-

Business13 hours ago

Business13 hours agoBREAKING: Otedola sells shares in Geregu Power for N1trn

-

News18 hours ago

News18 hours agoBREAKING: Anthony Joshua in road crash, two die

-

Politics2 hours ago

Politics2 hours ago2027: Lead us into APC, Kano supporters urge Kwankwaso

-

Business2 hours ago

Business2 hours agoTax reforms won’t spike airfares – FG counters Onyema

-

News17 hours ago

News17 hours agoTinubu Asks Edun to Resign, But Reluctant To Fire Him – Report

-

Business2 hours ago

Business2 hours agoLess than 1% insured: Nigeria’s informal workers navigate life without protection

-

News13 hours ago

News13 hours agoNational grid collapses again, power supply drops to near zero nationwide