News

Oyedele Finally Breaks Silence on Alleged Alterations to Tax Reform Laws

Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, on Monday addressed allegations of changes to the recently passed tax reform laws.

His comments come amid calls from former Vice President Atiku Abubakar, Labour Party 2023 presidential candidate Peter Obi, and several civil society organisations for a suspension of the laws’ implementation.

Speaking in an interview, Oyedele acknowledged that certain aspects of the version passed by the National Assembly may need amendments.

“Even if it is established that there have been substantial alterations to what the National Assembly passed, my view is to identify those provisions, which are not part of the law, and proceed to implement the law as passed by NASS while addressing how those issues arose and what to do about them,” he said.

He added, “Regarding the version passed by NASS, my committee and I have noted areas where we need to request amendments through the President due to issues with referencing and definitions.”

Oyedele also weighed in on the ongoing controversy surrounding discrepancies between the laws passed by the National Assembly and the versions subsequently gazetted and made public.

Abdulsamad Dasuki, a member of the House of Representatives, had raised concerns that the gazetted laws did not reflect what lawmakers debated and approved.

He argued that his legislative rights had been breached.

“Before you can claim there is a difference between what was gazetted and what was passed, we must have access to the version that was passed.

“The harmonised bills certified by the clerk and sent to the President are not publicly available. Only lawmakers can authoritatively confirm what was sent,” Dasuki said.

Oyedele also clarified issues around Section 41(8), which requires a 20 percent deposit. He stated that the provision appeared in a draft gazette but was not included in the final version.

“Some people circulated a report of the committee before the committee had even met. What is out there in the media did not come from the House committee. We should allow the committee to conduct its investigation,” he said.

President Bola Tinubu signed the four tax reform bills into law, marking what the government describes as the most significant overhaul of Nigeria’s tax system in decades.

The laws, which faced strong opposition from some northern lawmakers, are set to take effect on January 1, 2026.

They include the Nigeria Tax Act, the Nigeria Tax Administration Act, the Nigeria Revenue Service (Establishment) Act, and the Joint Revenue Board (Establishment) Act, all operating under a single authority: the Nigeria Revenue Service.

-

News10 hours ago

News10 hours agoAnother 130 Abducted Niger Schoolchildren Regain Freedom

-

News10 hours ago

News10 hours agoSoldiers ambush Boko Haram convoy, kill 21 terrorists in Borno

-

News9 hours ago

News9 hours agoUS Ambassador explains visa restrictions on Nigerians

-

Business10 hours ago

Business10 hours agoPetrol price now N739/litre at MRS… report stations selling above rate – Dangote refinery tells Nigerians

-

News10 hours ago

News10 hours agoNDLEA recovers N5bn cocaine hidden in children apartment

-

Business10 hours ago

Business10 hours agoJob losses trigger N8.43bn pension withdrawals in three months

-

News6 hours ago

News6 hours agoPressure Mounts Over Tax Laws

-

News10 hours ago

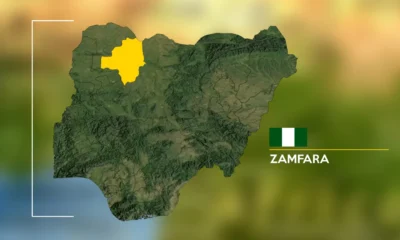

News10 hours agoBandits Hit Zamfara Community, Kill 1, Abduct 5