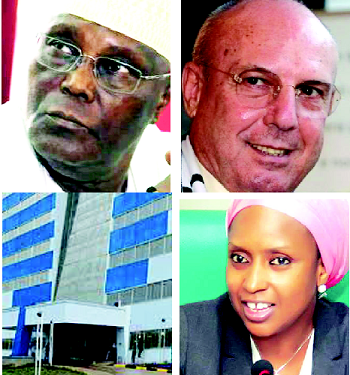

Atiku’s exit paves way for Intels to stay

It was a protracted saga between the two parties. The Nigerian Ports Authority (NPA) and the Integrated Logistics Limited (Intels). Both parties co-joined in a going business partnership which eventually turned sour.

Under the partnership, which was consummated in 2006, Intels emerged as an agent of the NPA and concessionaire to the Onne Ports, Rivers State. As concessionaire, Intels was required to provide pilotage services to guide ships into and out of the ports. Payment of pilotage fees, collected by Intels, is mandatory for vessel owners on ships of 35 metres overall length. This amount is subsequently shared between two stakeholders – the concessionaire, Intels; the port landlord, that is the NPA acting on behalf of the Federal Government. This transaction preceded the time Atiku Abubakar, a core investor in Intels, was Vice President.

By virtue of the incentives, opportunities and special privileges in the concession, the lobbying, horse trading and shenanigans in participating in the scheme were high wired. However, with over three decades of operating in the country, Intels was no stranger to the business and political terrain of the land. Therefore, when the controversy that befell the deal came to the fore in 2016 and thereon to 2017, especially on the compliance, or non-compliance of Intels with the Treasury Single Account (TSA) policy of government, a business decision had to be taken to mitigate the unfolding development.

Olive branch

As the disagreement became more intense in October 2017, Intels major shareholder and co-founder, Gabriele Volpi, tendered an apology on behalf of the company over its disagreement with the NPA. It was a wise move considering that the NPA had made clear its intention to terminate the pilotage agreement it had with the company.

Volpi, a naturalised Nigerian but of Italian decent, apologised to the Federal Government and NPA over the disagreement with Intels. “I was not personally involved in the negotiations with NPA, but we apologise for what has happened. We intend to comply with the directive of government and transfer all the revenue to the TSA because we are a law-abiding company,” Volpi said.

Stakeholders in the industry and those knowledgeable with the ensuing politico-economic power play, rationalised that Volpi may have made the move to douse the tension the disagreement had created, and leave the door open for future engagement with the government on other projects.

Divestment

Atiku, whose stake in Intels is estimated to be about $100 million, sources say, may have commenced his divestment option probably since 2018 before its eventual completion last month. The move is rumoured to be the outcome of an unwritten agreement designed for peace to reign. The said equity was sold in three tranches of $60million, $29million and $24.1million to Orleal Investment Group, the parent company of Intels.

Atiku, in a statement by his spokesman, Paul Ibe, said his decision to sell off his shares in Intels is a culmination of years of long-drawn battle between officials of the President Buhari Muhammadu administration. Ibe said his principal’s persecution by the government was threatening Intels’ multi-million dollar business.

Not so, Intels retorted. The company in a swift reaction, alongside its parent company, Orlean Invest Holding, denied insinuations that its business had at any time been hindered by political influences from the current government.

“The company has always operated according to market logic, thanks to its history and commitment to the development of the Nigerian economy in the oil and gas logistics sector. The ongoing contradictions are part of a natural commercial divergence, which will hopefully be resolved, as in the past, by a new approach, in the interest of all the parties, also according to the social role that Intels plays in the country.

“The severance from the world of Atiku Abubakar was an economic decision, in the exclusive interest of the company, and to irreconcilable strategic differences with the new governance structure of the Intels – Orlean Invest Group,” a statement signed by Tommaso Ruffinoni, Intels’spokesman said.

Battles

In 2008, there was a move to grant Intels the management of the Lagos Pilotage District with exclusive right to handle oil and gas cargoes. This was, however, refused by the late President Umaru Yar’Adua, on the basis that such would erode competition in the sector.

But Yar’Adua’s successor, President Goodluck Jonathan, was later to concede to Intels exclusive control over all oil and gas cargoes at terminals in Onne, Warri and Calabar. This angered other stakeholders in the oil and gas sector like Ladol, which immediately instituted legal action. For the stakeholders, such was an aberration to the concession agreement it entered with the government.

By 2016, one year into this administration, the government mooted the idea of reforming the ports. The Minister of Transportation, Rotimi Amaechi, was said to have highlighted the need to take a look at the monopoly of the oil and gas pilotage enjoyed by Intels.

According to sources, the Attorney-General of the Federation, Abubakar Malami, was said to have advised and described the exclusivity granted to Intels as “not only unknown to the shipping industry, but that it encourages monopoly and, therefore, inimical to the investment climate in the country.”

Besides, the AGF, in a letter addressed to the NPA had argued that the agreement which had allowed Intels to receive revenue on behalf of NPA for 17 years was in contravention of the Nigerian Constitution, especially because of the implementation of the Treasury Single Account (TSA) policy of the government.

Consequently, in April 2017, the President approved the recommendations of the AGF for reversal of the exclusive handling of oil and gas cargoes at Intels controlled ports. This decision obviously placated Ladol, which immediately withdrew its subsisting suit against the Federal Government from the Federal High Court, Lagos.

On October 10, 2017, the NPA terminated its contract with Intels based on the advisory from AGF, who described the arrangement as misconceived and unconstitutional. Intels, however, went to court challenging the decision of the NPA. Last August, a Federal High Court in Lagos granted an interim injunction stopping the NPA from terminating the role of Intels as manning agent in the Pilotage Districts of Lagos, Warri, Bonny/Port Harcourt and Calabar. The judge, Rilwan Aikawa, granted the interim injunction in the suit number FHC/L/CS/1058/2020 based on an application filed by Intels and Deep Offshore Service Nigeria Limited against NPA.

The NPA, however, issued a Marine Notice to the Lagos Pilotage District (LPD) on September 1, instructing ports users not to deal with Intels, saying services hitherto handled by Intels, have been terminated.

A furious Intels, in a rebuttal, said: “NPA’s publication is highly selective, inaccurate and should be disregarded, as it seeks to circumvent legal due process. Indeed, a dispute has arisen over NPA’s right to terminate our role as managing agent in the Pilotage Districts of Lagos, Warri, Bonny/Port Harcourt and Calabar. This dispute has been submitted to arbitration, and the arbitral proceedings have already commenced.”

OGFTZ

Along the country’s coastline, are four established Oil & Gas Free Zone Areas (OGFTZA). These are Onne Oil and Gas, Rivers state; Warri Oil & Gas Free Zone, Delta State; Eko Support Free Zone, Lagos State and Ikot Abasi Oil and Gas Free Zone, Akwa Ibom State. The first oil and gas export free zone to be established in the country was the Onne Oil and Gas Free Zone in Rivers State. These projects were expected to facilitate the development of a world class export-oriented oil and gas processing city in the country. The OGFTZ, with an estimated $20 billion as value of investment in the early years, was targeted to favour foreign investment in the country and aimed at creating employment, welfare, transfer of technology and a generic economic development. It also aims at maximising the country’s natural resources. Hence, the seemingly overwhelming and attractive incentive offered.

Business incentives

To achieve this, incentives were put in place to serve as a catalyst for investors. These include but not limited to allowance of a 100 percent repatriation of capital investment, remittance of profits and dividends allowed, no import or export licenses required; 100 percent of Free Zone (FZ) goods can be sold in Nigeria; 100 percent foreign ownership of business allowed, duty-free stock, equipment, spare parts, pipes, no double-handling in and out of Nigeria. Furthermore, enterprises in the Free Zones are allowed to export into the Nigerian territory up to 100 per cent of their products.

Tax incentives

Enterprises operating in the FZ are also exempted from payment of value added tax, withholding tax, corporate tax and/or capital gains tax. Still, a 75 percent import duty rebate on items associated or related to the business concern, investment or partnership, under any guise, remains a juicy attraction for any discerning investor.

Customs Duty Exempt

Under the special economic incentives encapsulated in the free trade zone arrangement, businesses under the initiative do not pay customs duty payable for goods stored within the Free Zone or goods consumed within the Free Zone (including equipment and machinery); no customs duty payable for export of Free Zone goods to other countries; Free Zone goods may be transferred under customs’escort from any port or airport of entry in Nigeria to Oil and Gas Free Zones.

Immigration incentives

This is targeted at foreign firms operating in the FTZs. Expatriates working in the zones are allowed some form of immigration immunity, hence they are granted free movement in and out of the zones, including immigration fast-track procedure, when required.