ATMs dispense N30tr in six years despite errors

• 70,000 ATM shortfall slows operations

• Poor network, downtime deepen crises

• Dispense errors in Nigeria highest globally

• ATCON tasks banks on redundancy infrastructure

The Guardian investigation revealed that three in every 10 transactions failed during the last Eid-El Kabir celebration, as failed PoS transactions were put at 23 per cent, according to the live transaction updates from the Nigeria Inter-Bank Settlement System (NIBSS). The updates, for instance, showed that about 309,016 attempts to make payments on PoS terminals were not successful. This, according to analysts, was a very significant fraction of the 1.349 million transactions as of 3.16pm of the first day of the celebration.

According to the data, the issuer banks contributed the most to failure of transactions as 68,697 of the failed attempts were attributed to errors on their platforms. This was closely followed by errors emanating from the customers, which accounted for 37,034 of failed payments.

Confirming the ATM dispensing challenge, Divisional Chief Executive Officer, Interswtich, Akeem Lawal, said dispensing error is highest in Nigeria than any other part of the world.

Lawal, who revealed this at the Fintech 1000+ webinar, said this was because of the type of currencies that are in the ATMs, “Abroad, ATMs dispense new mints.”

Data from NIBSS showed that Nigerians moved about N30trillion in ATM transactions between 2014 and 2019, with 2018 and 2019 each recording N6trillion worth of transactions. The volume of ATM transactions with the six-year period stood at about 4 billion; meaning that Nigerians used the ATMs four billion times in six years.

THE increasing rate of transaction failures, through electronic payment (ePayment) channels, also include electronic money transfers, unstructured supplementary service data (USSD), among others. Lawal said users are becoming increasingly frustrated with PoS debit errors, network glitches, card rejection, dispense errors, and non-reversal of failed transactions at PoS, and ATM terminals.

In the same vein, the supposedly instant and real-time web transactions also record untold hitches.

The Guardian gathered poor e-payment services had forced many to abandon use of such services offered by banks, preferring, instead, to withdraw money inside banking halls, the queues notwithstanding.

Users of electronic banking services claimed they had experienced agonising moments owing to wrong debiting at ATMs and PoS. They specifically complained about undue delays in electronic transactions arising from network failure. They put the blame on government and banks for failing to provide the right infrastructure.

Peter Anselem, who narrated his recent experience to The Guardian, said he was in Abuja last week, and had urgent need to send money to his wife in Lagos to complete a transaction: “You wouldn’t believe that for complete 48 hours, the transaction didn’t go through; even though I used different bank platforms, it was the same story. I had to enter the banking hall after two days, to do the transaction. For a fact, network services in Abuja are very poor. I don’t know what can be done about it.”

Lagos-based Theophilus Adekunle, said a bank’s ATM terminal debited his account without dispensing the N15, 000 he wanted to withdraw.

Adekunle, who said that such had been one of the issues with the ATM terminals, stressed that this was not peculiar to a particular bank. “Virtually all of them have that issue.”

According to him, despite CBN directive on instant reversal in dispensing error, “I didn’t get my money back until after seven days. I had to go and lodge complaints at one of the branches.”

Another user, Mrs. Oluchi Ibinabo complained that the ATMs often displayed “Out of Service” on its screen at critical periods, making it difficult for people to withdraw money.

Ibinabo said it was disappointing that after spending much time on the queue, “one would now be unable to withdraw cash, due to lack of service on the ATM.”

Stanley Adekunle, an attendant in a super market at Ajao Estate, Lagos, painted a different picture of the situation. According to him, “another issue we are seeing lately is that some of these PoS terminals choose the bank cards to work with. We have had issues with ATM cards. When the cards are slotted in, after pressing the details, in the midst of processing, the money has been deducted; then suddenly it will show transaction denied or failed. This is the new order of the day.”

Telecoms analysts, Kehinde Aluko, said that, while poor networks from telecommunications operators account for a percentage of the challenge, the level of infrastructure was low.

Corroborating the low level of infrastructure, especially ATM terminals, Head, e-Channel Services at FirstBank, Bob Nwojo, at the Fintech+ webinar, said effective use of ATM had continued to evolve and had continued to find application in meeting daily cash and non-cash transactions by Nigerians.

He however, noted that Nigeria was far behind, even as the global ATM market, which accounted for $18.44 billion in 2018, is expected to grow at CAGR of 10.4 per cent over the forecast period 2019-2022 to account for $44.18 billion by 2027.

According to him, ATM should become the bank of the future as more bank branches close. He also informed that teller machines would adopt biometric identifiers, like fingerprint and facial recognition, to enable cardless usage and more sophisticated functions.

He further said that, experts had already recognised that cash machines were crucial to lives of consumers and still offered essential services, adding that the ATM channel “remains the primary, most convenient and most reliable way to retrieve cash.”

In Nwojo’s comparison, Nigeria lags far behind peer countries with 16.3 ATMs per 100,000 adults vis-à-vis South Africa (67.3 ATMs) and Brazil (106.7 ATMs); India with three times the population of South Africa, Nigeria has four times fewer ATMs per 100,000 adults.

Specifically, Brazil has 211 million population; 106.7 ATM per 100,000 adults; 19.2 bank branches per 100,000 adults and a total ATM base of 172,600 in 2019. South Africa has 58 million population, ATM per 100,000 adults is 67.3; bank branches per 100, 000 adults stood at 17.3 and total ATM base in 2019 was 30,000.

India has 1.3 billion population, and ATM per 100,000 adults is 22 while bank branches per 100,000 adults stood at 16.8 and total ATM base in 2019 was 238,000.

However, Nigeria which hosts a population of 200 million people has 16.3 ATMs to serve every 100,000 and 4.4 bank branches to serve every 100,000 adults as the country’s ATM base as at the end of 2019 stood at 18,731.

Nwojo continued, “With three times the population of South Africa, Nigeria’s total ATM/100,000 adults is four times less than that of South Africa. With similar population figures, Brazil has nearly 10 times the number of ATMs than Nigeria and over four times the number of branches per 100,000 customers.”

Executive Director, Sales and Strategy, Inlaks, Tope Dare, also stressed the infrastructure gap, saying that though the Central Bank of Nigeria (CBN) targets deployments of about 93, 380 ATM terminals by 2025, Nigeria currently has 22, 800 with a gap of about 70,000.

The Secretary, Product, Pricing and Revenue Assurance at the Committee of e-Business Industry Heads (CeBIH), Dipo Alabede, said Nigeria needs more ATM terminals to boost services.

Alabede, who also heads Digital Banking at Sterling Bank, revealed that it cost about N10 million to deploy a single terminal. He stressed that ATM business were still run at a loss in Nigeria.

In the foregoing, checks by The Guardian showed that, to deploy more terminals, about N700 billion may be required by operators for more ATM terminals.

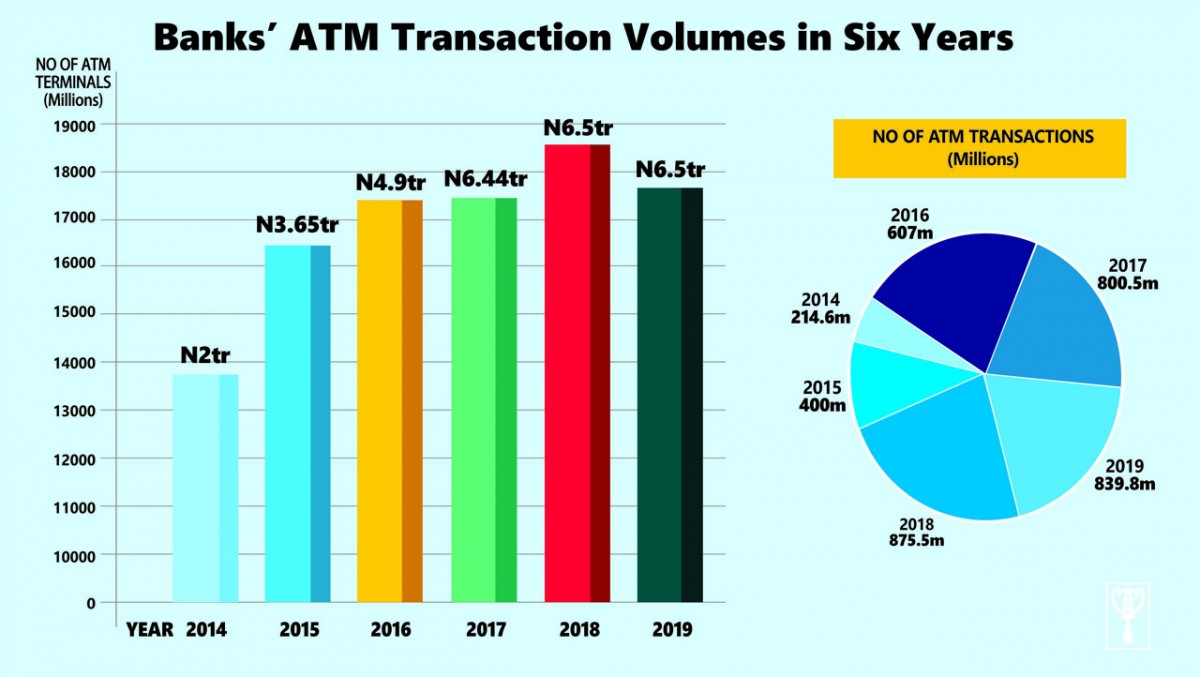

The Guardian findings showed that there has been significant increase in the number of ATM terminals deployed, transaction volumes and values.

For instance, statistics from NIBSS revealed that in 2014, 13,770 terminals were deployed, with a transaction volume of 214.63 million, valued at N2 Trillion. In 2015, Nigeria had 16,406 terminals, 0.40 billion-transaction volume, valued at N3.65 Trillion.

By 2016, the ATM terminals rose to 17, 398. It delivered 607-million transaction volume, valued at N4.9 Trillion. In 2017, there were 17, 449 terminals that carried out 800.5 million transactions, which is worth N6.44 Trillion.

Furthermore, the data showed that ATM terminals rose to 18,615 with 875.5 million-transaction volume, valued at N6.5 Trillion. Last year, active ATM terminals were 17,518, and carried out 839.8 million volume of transaction valued at N6.5Trillion.

MEANWHILE, the adoption of electronic transactions for customers earned GTB, UBA, and others N135.15 billion earnings between January and September 2019.

Data from Nairametrics regarding the unaudited 2019 third-quarter reports of the banks showed that their revenue from electronic transactions grew by 57 per cent as against the N86.312 billion they earned from the first 10 months of 2018.

The banks were able to secure the earnings from the fees and commission charged on ATM transactions, USSD, Internet banking, Point of Sale payments, electronic bills payment and agency banking.

The banks include Zenith Bank Plc, First City Monument Bank Plc, Access Bank Plc, Guaranty Trust Bank Plc, United Bank for Africa Plc, Sterling Bank Plc and First Bank of Nigeria Limited.

Zenith Bank earned the highest income on electronic platforms from January to September this year, reporting N35.32 billion revenue, a 100 per cent revenue boost from N17.66 billion in the corresponding period of 2018.

First Bank ranked second in the value of earnings from electronic payments, reporting N34.42 billion revenue, a 46 per cent increase from the N23.59 billion generated during the same period in 2018.

With N26.71 billion revenue, UBA recorded a 44 per cent increase in electronic banking income in the nine months under review in 2019 as against N19.95 billion earned in the same period in 2018.

Earnings from electronic transactions by GTBank rose by 63 per cent from N6.77 billion from January to September 2018 to N11.04 billion in the same period in 2019.

Access Bank’s electronic business income in the first nine months of this year amounted to N8.85 billion, an increase of 58 per cent over the N5.79 billion revenue earned in the corresponding months in 2018.

Advising the banks on network challenges, President, Association of Telecommunications Companies of Nigeria (ATCON), Olusola Teniola, said they needed to ensure that they purchase enough bandwidth on various channels.

Teniola said bank servers needed to have performance improvements to cope with increased demand in transactions that need to be processed, especially during peak hours.

“It is obvious that they need to consider moving their services to local content-based Data Centers and Cloud offerings that reduce the latency issues and session time-outs that they experience and to which they blame the errors as ‘network problem.

“Finally, the banks need to consider outsourcing all their back-office systems both IT and Telecoms to indigenous competent specialists that are able to manage it better and move away from in-housing IT equipment and telecoms equipment, which they struggling to manage, so that they can focus on their core competency in banking,” Teniola stated.

ON how e-payment services can be hitch-free, Teniola said it would happen when CBN finally allows telecoms operators to take the lead in building the infrastructure required to develop robust and secure underlying layer that caters to the idiosyncratic environment that depicts Nigeria and the way businesses are done.

According to him, at the moment, there is an opportunity to bring in the 63 per cent of Nigerians, who are financially excluded into a Digital Financial Service (DFS) similar to MESA success in Kenya.

“Many of our members are capable and willing to build the same success in Nigeria and we encourage the CBN to move from Approval In Principle (AIP) for Payment Service Bank (PSB) to a full PSB licensing for all the MNOs and other Service Providers. We have the track record of building the biggest telecoms market in Africa, we can do the same in the DFS space,” he stated. (Guardian)