Awaiting Lekki Seaport’s take off

The Minister of Transportation, Rotimi Amaechi, was in Lagos recently to examine the level of work at the Lekki Deep Seaport. OLUWALEMI DAUDA,who was on the minister’s entourage, reports

For long, Nigerians have complained about the congestion at the Apapa, Lagos ports, and the bad access roads to them. It is against this background that the Federal Government floated the idea of an alternative seaport in the former nation’s capital. It is aimed at giving succour to operators and stakeholders in the sector.

The Minister of Transportation, Rotimi Amaechi, noted this advantage during an inspection of the port planned for completion next year.

Amaechi, accompanied by officials of the Federal Ministry of Transportation and other government agencies, including the Nigerian Ports Authority (NPA), the Nigeria Shippers’ Council (NSC) and the Nigerian Maritime Administrative and Safety Agency (NIMASA), was impressed with progress of the Lekki Deep Seaport project.

He said: “I am very delighted and impressed with the pace and the progress of construction on this project from the last time I was here in November, 2020. The promoter of the project, Lekki Port LFTZ Enterprise Limited, has demonstrated a strong commitment and capacity to deliver the project as agreed.”

The Minister, however, urged the management of Lekki Port LFTZ Enterprise Limited and other stakeholders to ensure that the port became operational by mid-2022.

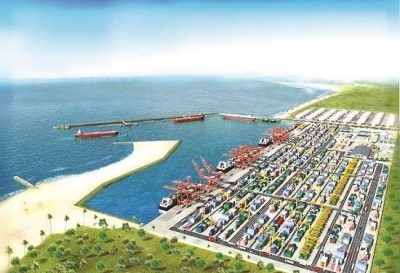

The Lekki Deep Seaport

The seaport is a multi-purpose project in the heart of the Lagos Free Trade Zone, and is expected to offer support to the burgeoning commercial operation across Nigeria and the entire West African region.

The port has deepwater berths with a 670-metre turning circle and a harbour basin 14 metres deep and it has the following advantages:

- Rising demand for container capacity levels in Lagos.

- Significant growth in sectors, such as finished goods, within the country and the regions that are linked to high levels of containerisation.

- Potential to transform into the first major transshipment hub in the region, servicing the regional sea routes and the hinterland at the same time.

- First-mover advantage in providing deepwater facilities to support large container volumes, liquids and dry bulk cargo.

- Downstream procession facilities contributing to the need for liquid bulk facilities.

The development of the Lekki Port is being undertaken by the NPA, the Lagos State Government and an Investment Holding Company incorporated to hold the non-Nigerian governmental interests in the seaport.

Status of the project

Briefing the Minister and his entourage on the status of the port, the Chairman, Lekki Port LFTZ Enterprise Limited, Mr. Abiodun Dabiri, said the port construction had reached 55.48 per cent completion.

Dabiri added that dredging and reclamation had reached 61.11 per cent, quay wall 50.39 per cent, breakwater 67.49 per cent while the landside infrastructure development had reached 33.70 per cent completion.

The LFTZ chairman assured the Minister and the stakeholders that the project was on course. He declared that at the end of third quarter (Q3) 2022, they would complete the construction while commercial operations would commence by fourth quarter (Q4) 2022 as planned.

“We understand the significance of this project to the economy and we would not fail to play our part to ensure that it is delivered as and when due,” he said. He thanked the Minister and his team for providing the support that has assisted the company to deliver on the mandate given to it on the project.

Financing agreement

The signing of a financing agreement for the seaport was done in Lagos about two years ago, and it promised to increase the capacity of the country to handle its imports and exports in real time.

Over the years, efforts to develop deep seaports in Nigeria have not yielded any positive results as unstable government policies, lack of safety and security of funds invested by promoters hindered the development of Greenfield seaport. The deep seaports were conceived to improve the cargo handling capacity of Nigerian ports and thereby increase Nigeria’s gross domestic product (GDP). The handling capacity of ports in Nigeria is put at 60 million metric tonnes, while demand and usage is about 100 million metric tonnes. These are expected to rise with the increasing population, urban expansion and attendant demand for more markets.

The cargo throughput handled in the ports increased from 66,908,322 metric tonnes in 2009 to 74,910,282 metric tonnes in 2010, indicating a 12 per cent increase. According to global trends in port development, out of over 100 seaport development projects being executed in the world, approximately 75 per cent of these are deep seaports or terminals.

The balance is mostly inland waterway ports and jetties.This clearly indicates that Nigeria needs better designed port facilities in tune with increased cargo traffic, for the country to be globally competitive. Also, as emphasis is shifting to larger and more economical vessels that require deeper harbour drafts; global logistics trends have made the need for deep seaports more imperative.

Nigeria is not far from achieving the dream of developing a deep seaport though. About two years ago, Tolaram Group, the parent company of the Lekki Port LFTZ Enterprise Limited, concluded negotiation and signed off a $629 million (N226.44 billion) loan facility agreement with China Development Bank (CDB) for the construction of the Lekki Deep Seaport. The development of the seaport was conceptualised to fill a significant gap in projected demand and capacity. Studies indicate that the demand for containers in Nigeria is expected to grow at 12.9 per cent up to 2025.

However, given the expansion constraints on the infrastructure, the capacity in Apapa and Tin Can Island ports in Lagos is incapable to meet the growing demand.

The capacity shortfall for container terminal facilities in Lagos is projected to be 0.8 million Twenty-foot Equivalent Units (TEUs) in 2016, up to 5.5 million TEUs in 2025. The strategic location, optimised layout, and modern facilities provide Lekki Port a distinct competitive edge over other port facility in the West Africa region.

When completed, the multi-purpose port would cover an area of 90 hectares with three container berths, long dry bulk berths, and three liquid berths. Initially, the port would handle close to 1.5 million TEUs of containers yearly, and this would be upgraded to 2.5 million TEUs in the future.

The channel would be dredged to 14 meters depth, which would be deepened to 19 metres as traffic grows while the breakwater, which protects the vessels from the waves, is 1.5 kilometres long.

The agreement, according to a source close to Tolaram Group, is a major step towards the financial close on the funding for the construction of Nigeria’s first deep seaport project, estimated to gulp over $1.6 billion.

The loan facility, the source added, would enhance massive construction at the site and ensure timely completion of the project, which has gone far with the ongoing construction of breakwaters at the port site.

The port project is financed by a consortium of six banks. They are the African Development Bank (AfDB), the European Investment Bank (EIB), Standard Chartered Bank (SCB), RMB, Africa Finance Corporation (AFC) and Standard Bank.

The Lekki Deep Seaport is owned and developed by the Tolaram Group, the NPA and the Lagos State government as equity investors.

Tolaram, which has the concession to build and operate the port for 45 years, appointed the China Harbour Engineering Company (CHEC), the world’s biggest marine engineering company, as the Engineering, Procurement, and Construction (EPC) contractor to oversee the design, construction and inauguration of the port project under the supervision of an American project management consultant known as Louis Berger Group.

However, as Nigeria moves closer to achieving its dream of owning a deep seaport, it is expected that the project will tackle the challenges that may arise from the decreasing capacity of the river ports across the country to handle cargoes as a result of their various stages of collapse and the humongous amount needed for their reconstruction.

What Fed. Govt says

The Federal Government said the Lekki Deep Seaport would be a significant game-changer in the maritime sector with corresponding benefits to the West and Central sub-regions of Africa. The Permanent Secretary, Ministry of Transport, Dr Magdalene Ajanii, said the developers were working assiduously to meet the deadline of fourth quarter 2022 for commencement of commercial operations as directed by Amaechi.

Absence of rail link in the project

Stakeholders in the industry have called on the promoters of the Lekki Deep Seaport, Lagos to address the absence of a rail link in the project.

Going by the gigantic nature of the project, experts are worried that upon completion, the location of the port could become another nightmare in the mold of the Apapa and Tin Can Island ports in Lagos, which have become a hydra-headed problem defying all solutions.

A maritime lawyer and lecturer at the Lagos State University (LASU), Dr. Dipo Alaka, bemoaned the absence of plans for rail connectivity and use of barges on inland water access to the port are some of the challenges facing the multibillion dollars project.

“Go to Apapa and see the huge but avoidable national embarrassment that is going on there.There is congestion in Apapa because those who handed over the ports to the terminal operators failed to plan for the future. There is congestion within and around the Lagos ports because over 95 per cent of our cargo goes on the road. Therefore, both the Lagos State government and the promoters of the Lekki port must ensure that we have a seamless cargo evacuation from the port, if not, it’s laughable to think that we will not have congestion by the time the port becomes operational,” Alaka said.

These fears are not unfounded considering that upon completion, the Ibeju-Lekki-Epe axis will be home to huge traffic arising from the operations of the deep seaport and the Dangote Refinery among the other major projects sited in the Lekki Free Trade Zone.

Although a senior official of the port, who craved anonymity, agreed that the master plan of the project does not include rail, he however said it is not too late to include same in the project because adjustments are possible in any ongoing project. However, for this to be done, the official said there is the need for the Federal Government, as represented by Nigeria Ports Authority (NPA) to contact them and the rail would be factored into the project.

“The masterplan of this project doesn’t include rail. But we are aware that there is massive rail development going on in Nigeria and if NPA gets in touch with us, we will adjust and incorporate it in the work,” he assured.

Similarly, the Relationship Director, Lekki Deep Seaport, Adesuwa Ladoja, however, said a discussion on a national rail project was ongoing with the Federal Ministry of Transportation to avoid the Apapa situation.

“These issues will be solved in an optimal manner. Proper plans have been put in place to ensure everything comes out fine. Already, we have seen big multinationals investing in the zone,” she said.

Experts in port construction said since the coastal rail would come through the neighbourhood of the Lagos Free Zone, incorporating a rail system into the deep sea port may likely not be an issue if quickly address by the government.

What the stakeholders say

Stakeholders said since the inauguration of the Lekki Deep Seaport on March 29, 2018, it has rekindled the hope of many importers whose shipping firms take their cargoes to neighbouring ports for discharge because Nigeria’s shallow waters cannot carry large vessels.

But on completion of the seaport next year, the country is targeting about 1.5 million 20-foot equivalent unit (teus) container capacity yearly which is expected to increase to as high as about 4.7 million when the project’s operations commence fully.

Contribution to GDP

The country’s ports are the shallowest and riskiest in the West African sub-region, a situation that has necessitated many shipping firms to call on other neighboring ports.This has cost the nation a lot in terms of cargo throughput, contribution to Gross Domestic Products (GDP) and employment. According to the President, National Council of Managing Directors of Licensed Customs Agents (AMDCLA), Lucky Amewero, Nigeria has lost its maritime leadership position to other countries not only because of security lapse but also because of shallow draft. While Nigerian water is 13 metres deep, Ghana is 19 metres, Togo is 16 metres, Cotonou 15 metres and Cameroon is 16 metres.

Amewero, however said, with the quick development of the Lekki deep seaport, and the assurance given by its promoters, the country stands a better chance of generating more revenue and creating employment that would boost the economy.

The Federal Government, it was learnt, expects the port to influence the generation of up to 170,000 direct and indirect jobs into the economy.

Lekki port, it was gathered, is designed to ensure that Nigeria retains its pride of place in the West African sub-region to provide berthing for larger vessels, which is the growing global trend in the maritime sector.

On completion, Lekki Port will be equipped with the best infrastructure and terminal services to attract and maintain large volume shipping line customers. Facilities at the port will include well-designed marine infrastructure, container, dry bulk and liquid terminals, making it a truly multi-purpose port.

Vessels will approach Lekki Port through a 9km long and 19 metre deep navigation channel reaching the 600m wide turning basin. The port is protected against ocean waves and currents by a main breakwater of 1.500m long and a secondary breakwater of 300m, providing a controlled environment for the handling of vessels alongside the 1.500m quay at a water depth of 16.5m and three liquid jetties with 19m water depth. For safe and secure handling of shipping, berthing facilities for marine services (Tugboats, Pilot boats) are provided as well.

Its container terminal will have a 1,200m long quay, three container berths and a storage yard with over 15,000 ground slots. The general arrangement of the container storage and handling area shall consist of a stacked container arrangement. The terminal is designed to support a throughput of 2.7 million yearly.

(The Nation)