CBN directs banks to open dollar account for remittances

The Central Bank of Nigeria (CBN) has mandated commercial banks to open new dollar account with offshore lenders for receiving international money transfers.

The directive was disclosed by WorldRemit- an International Money Transfer Operators (IMTO) player to its clients.

The new directive on dollar account opening is coming two months after the CBN raised the alarm that its policy mandating IMTOs to pay diaspora remittances beneficiaries in dollars is being flouted.

The regulator further directed that all mobile money operators should disable wallets from receipt of funds from IMTOs following suspected abuse of policy guidelines by the IMTOs.

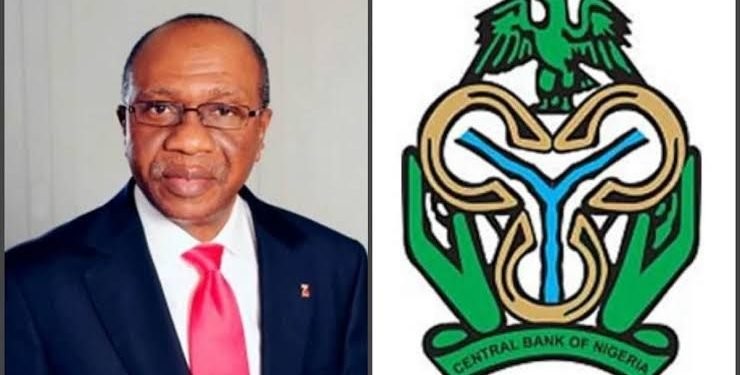

According to CBN Governor, Godwin Emefiele, analysed data on IMTOs inflows into the country over the past year, and through investigations showed that some IMTOs, rather than compete on improving transaction volumes and create more efficient ways for Nigerians in the Diaspora to remit funds, resorted to engaging in arbitrage arrangements on the naira-dollar exchange rate.

This, to a large extent, resulted in a significant drop in flows into the country.

Emefiele discouraged the use of unsafe unofficial channels, which also supported diversion of remittance flows meant for Nigeria, thereby undermining Nigeria’s Foreign Exchange management framework.

In its response to the new policy, WorldRemit, said it welcomed the CBN announcement that all Nigerian banks will be mandated to facilitate money transfers by automatically opening US Dollar bank accounts for those who do not currently have US Dollar bank accounts.

“This development ensures that all international money transfers will be successfully processed even if senders enter Naira account details for transactions.

“Further to this announcement, the CBN also stated that a $2,000 withdrawal limit will apply to these accounts,” it said.

Country Manager, Nigeria and Ghana, at WorldRemit, Gbenga Okejimi, said: “We are very pleased by the CBN’s decision to mandate Nigerian banks to help citizens who do not have a USD account by automatically providing this facility on their behalf. This development will make all the difference to those who receive support from family and friends abroad”.