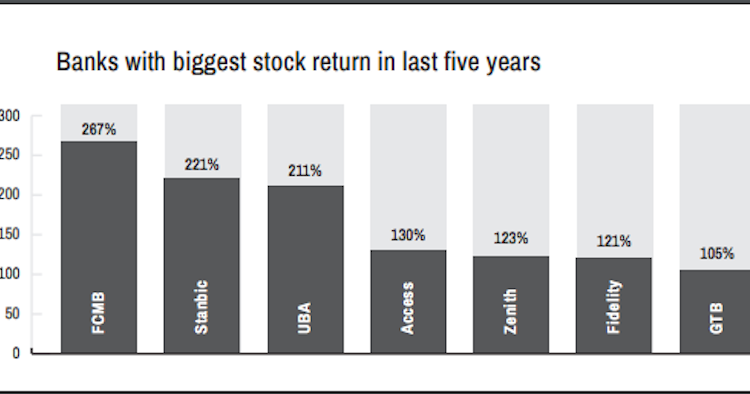

FCMB, Stanbic lead biggest banks stock return in 5yrs

These companies have also recorded strong growth in profitability over the period, an indication that the rally may be driven by the companies’ sound fundamentals.

Of all the companies listed on the NSE, only seven banks have delivered over 100 percent stock returns to investors since 2016.

The analysis was carried out using the share prices of each company as at January 2021 compared to January 2016.

FCMB

First City Monument Bank’s stock has risen 267 percent to N3.38 as at January 29, 2021, from N0.92 in the same period of 2016. FCMB’s net profit has also grown 7 percent to N13.9 billion in the first nine months of 2020 compared to N12.9 billion in the first nine months of 2016.

Stanbic IBTC

Stanbic IBTC Holdings’ share price has soared 221 percent between January 2016 and January 2020. Stanbic’s shares surged to N45 in January 2021 from N14 in January 2016. The bank reported a net profit of N94.7 billion in 2020, a 232 percent increase compared to N28.5 billion recorded in 2016.

UBA

United Bank for Africa’s shares has returned 211 percent between January 2016 and January 2021, as stocks rose N9.05 per share to N2.91 in that time.

The bank’s profit also surged 48 percent to N77.1 billion in the first nine months of 2020 compared to N52.2 billion in the same period of 2016.

Access Bank

Access Bank has seen its shares jump 130 percent to N9.3 from N4.05 in periods under review. Not only have the shares rallied, but profit also grew 104 percent to N116.6 billion in the first nine months of 2020 from N57 billion in the same period of 2016.

Zenith Bank

Zenith Bank is another bank whose shares have surged 123 percent in the last five years. The bank’s share stood at N27.2 in January 2021, from N12.2 recorded in January 2016.

Zenith Bank’s profit after tax rose 59 percent to N159.3 billion in the first nine months of 2020 from N100 billion in the same period of 2016.

Fidelity Bank

Over the last five years, Fidelity Bank’s shares grew 121 percent to N2.72 per share as of January 2021 from N1.23 per share as of January 2016. The bank’s net profit jumped 188 percent to N28 billion in the first nine months of 2020 from N9.7 billion as at 2016.

GTBank

Guaranty Trust Bank has seen its stocks surge 105 percent to N34.5 as at January 2021 from N16.87 in January 2016. During the period, its net profit grew 8 percent to N142.2 billion in the first nine months of 2020 compared to N132.2 billion in 2016.