FG has exited Way & Means – Edun

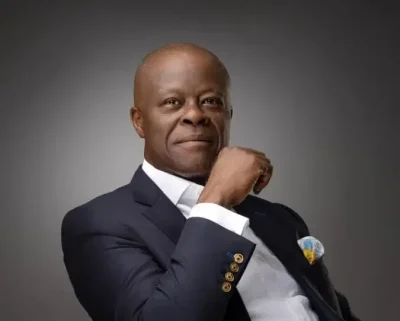

The administration of President Bola Tinubu has exited Ways and Means (borrowing from the Central Bank of Nigeria) within one year, the Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, has disclosed.

Addressing a press conference on the Half Year Performance of the economy in Abuja, this afternoon, he also said that the most critical thing for President Tinubu right now is how to bring down prices of food in the country.

Debts down

His words, “Debt is down in dollar terms. $108 billion to $91 billion. Government has diligently serviced all its loans and obligations without recourse to Ways and Means financing. The government has met all its obligations. We did not rely on Ways and Means

“We are not only talking of international debt service. We are talking of domestic debt service as well. In fact, I can say, this government has exited within a year of President Bola Tinubu’s coming into office. This government has exited Ways and Means borrowing.”

Subsidy is gone technically

Responding to a question on whether the Federation Account was receiving proceeds from the Nigerian National Petroleum Company (NNPC) since the federal government had announced removal of fuel subsidy, the minister said, “Subsidy is gone technically. We do not have provisions for subsidy in the 2024 budget. What we have is a situation in which we have a combination of factors.

“The spike in the exchange rate as a result of the foreign exchange market reforms sent the exchange rate to the roof. It left NNPC in its role, by law, to ensure energy supply with fuel supply.

We must remember that a resolution will come and while looking at the whole resolution of that situation, we must be reminded that as of today, an important factor is that the cost per litre of petrol in our neighbouring countries is- West and Central Africa is three, four times of what it is here.

That is a direct transfer of the wealth of Nigeria; of foreign exchange of Nigeria to our neighbours. Done illegally, illicitly and for the gain of a few people. That is what we need to reflect on as we look at the situation in the downstream sector of the oil industry.

FAAC transfer to LGs impediment

Mr. Edun disclosed that there were impediments to the implementation of the recent Supreme Court judgment on direct payment federation allocations to the Local Government Councils.

He, however, assured that the impediments were being addressed, saying that President Tinubu believed in Fiscal Federalism and would ensure the implementation of the ruling.

His words, “As far as the Supreme Court ruling is concerned, Mr. President is a democrat. He believes in federalism. He believes in Fiscal Federalism. What has come to pass now is a new fiscal regime where through the State/Local Governments Joint Account funding goes directly to the local governments.

There is a committee of the Attorney-General and representatives of states and local governments within the conference of the Federation Account Allocation Committee that is looking at the practicality of moving to what the Supreme Court has said.

“There are practical impediments to the implementation and the governors have moved immediately to hold local government elections because the funds have to be released to elected governments. But also in practical terms, there was a FAAC meeting just last week, but it could not yet implement the judgement because the actual proceedings had not yet been handed down. It was not in the hands of the Attorney-General for him to start implementing.

“What is going to happen is that under a presidency that believes in the Rule of Law, the judgement on the Local Government is going to be faithfully implemented.”

$500 m Bond

According to Mr. Edun, the federal government would, in the next four weeks, float a $500 million Bond to attract Diaspora Nigerians and to enable Nigerians who have funds abroad to bring their funds home for investment.

The minister said, “We need to attract those savings. And indeed, we need to attract the savings of Nigerians that keep their money abroad. We have an open exchange rate system.

“It’s not illegal. And so we have issuance of a dollar-denominated security, not depending on the financial architecture of the Western world, not depending on the kind of architecture that you use to raise Euro Bonds. We’re using the Nigerian financial system, the Securities and Exchange Commission, the banking system, the investment bankers to issue $500 million. In the first instance, that will be available and will attract foreign currency held by Nigerians abroad and anybody else who buys into the macroeconomic reform efforts of President Bola Ahmed Tinubu.

“That issue is a challenge to the best and the brightest in financial markets. It is due to open in the next three to four weeks, maximum.”

Good revenue performance

The minister said that with the reforms put in place, the federal government has surpassed its Half Year revenue target by 30 percent and was on its way to recording a budget deficit of about 4 percent in the 2024 Fiscal Year.

Cash Transfers resume

Reacting to the concerns about the hardship in the country, he admitted that the effects of the reform policies could have created immediate difficulties for the people but that Nigerians would be better for it when the expected outcomes of the reforms became manifest.

He disclosed that the president was very concerned about the welfare of ordinary Nigerians and that after overcoming the transparency challenges of the Cash Transfer Programme of the Social Investment initiative, the Cash Transfers had resumed with about 600, 000 beneficiaries having been recently covered.

Mr. Edun said, “I’d like to continue by emphasizing that in terms of the strategic initiatives, in terms of the counter measures to cope with high cost of living, which as we had said earlier, is one of the early costs. The spike in inflation is a natural and expected reaction to changes that needed to be made. And that was decades ago, not to talk of the fact that they needed to meet now.

“So the direct transfers are geared towards providing 15 million households, that’s 75 million people with direct monetary support, because that allows them to decide what they want to buy with it, whether it is food, whether it is medicine, they decide and the world all over, this has been proved to be an effective way of intervening to help people with their cost of living. We started and had to reconfigure in the interest of transparency and accountability, the direct payments program had to be reconfigured. And now we have a gold standard in providing direct payments to individuals and therefore to their households.

“We biometrically identify them uniquely through a name or a voter’s card number. And then we digitally pay them through a BVM, which means they have a bank account or through a mobile wallet. And the improvements that have now been made in that system meant that just a day or two ago, 600,000 payments were made.” (Vanguard)